The Role of Singapore in the Growth of Intra-Southeast Asian Trade, c.1820s–1852

Atsushi Kobayashi*

*小林篤史, Graduate School of Asian and African Area Studies, Kyoto University, 46 Shimoadchi-cho, Yoshida Sakyo-ku, Kyoto 606-8501, Japan

e-mail: greysh-black.zg14[at]hotmail.co.jp

DOI: doi.org/10.20495/seas.2.3_443

This paper argues that the expansion of Southeast Asian trade in the first half of the nineteenth century was based partly on the growth of intra-regional trade. Singapore played a significant role as a British free port in the connection between Western long-distance trade and intra-regional trade.

According to my estimates, intra-regional trade centered on the British and Dutch colonies grew from the 1820s to 1852, with the focus shifting from Java to Singapore. As background to this growth, attention is drawn to the relaxation of Dutch protectionist tariffs imposed on British cotton goods imported via Singapore. Prompted by British diplomatic protests, tariff levels were reduced, and Singapore increased its exports of European cotton goods across the region. The importance of the distribution system for regional products in the rise of trade in Singapore is also discussed. As Southeast Asian products exported to the Asian market were traded through Singapore, local merchants such as the Chinese and Bugis often conducted transactions of those regional products in exchange for European cotton goods. Thus, the distribution system for regional products facilitated the influx of European cotton goods into the region via Singapore.

Keywords: Southeast Asian trade, intra-regional trade, Singapore, European cotton goods, Southeast Asian products, Asian merchants

Introduction

In a new commercial wave during the first half of the nineteenth century, the expansion of British trade surged over Southeast Asia. The establishment of Singapore as a British free port in 1819 by Thomas Stamford Raffles of the East India Company contributed to the British advance on China (Greenberg 1951) and the increase of British influence in Southeast Asian trade (SarDesai 1977) during the nineteenth century. The purpose of this paper is to examine the patterns connecting regional trade with Western long-distance trade in Southeast Asia during the second quarter of the century, focusing on the role of Singapore in the growth of intra-Southeast Asian trade.

Challenging the traditional historiography, recent studies have shown a resurgence in Asia’s long-distance trade and intra-Asian trade in the first half of the nineteenth century. Kaoru Sugihara (2009) criticizes traditional historiography for emphasizing the central importance of the opium triangle, and statistically demonstrates the existence of multilateral trading networks within Asia, not confined to the opium triangle. Moreover, intra-Asian trade composed mostly of necessities grew during this period. As background to this growth, Sugihara argues that local Asian merchants could take advantage of the new commercial opportunities that emerged as a result of the deregulation of trade by the British and Dutch East India Companies and the Chinese Qing government after the late eighteenth century.

Anthony Reid (1997) confronts the tendency to assume that commerce had been stagnant during the era between the end of the “age of commerce” in the second half of the seventeenth century and the growth of export economies under colonial rule in the late nineteenth century. Through an analysis of trade data of Southeast Asian exports from the 1760s to the 1840s, he finds that exports of major commodities from Southeast Asia enjoyed high growth rates during the late eighteenth century and the first half of the nineteenth century rather than during the high colonial period. Furthermore, as background to the expansion of commerce in this period, Reid (Reid and Fernando 1996) remarks that Asian traders, such as the Malays and Chinese, activated local trade in the face of the collapse of the monopoly of the Dutch East India Company and the lifting of maritime bans by the Chinese Qing government.

The studies by Sugihara and Reid serve to justify a reconsideration of the integration of Asian countries into the world economy in the nineteenth century. They criticize the fact that traditional historiography has placed emphasis on the impact of Western influence in Asia, and suggest that we inquire into the possible ways in which the reorganization of market institutions, the revitalization of merchants’ activities, and changes in the mode of production in Asia from the late eighteenth century to the first half of the nineteenth century facilitated the expansion of Western long-distance trade in Asia. From both studies emerges a new perspective that the patterns of regional response to Western trade in Asia during this period may have influenced the course of integration of Asian regions into the world economy after the second half of the nineteenth century, with a further progress of international division of labor.

Previous studies discussing the integration of Southeast Asia into the world economy in the nineteenth century, as Reid points out, have shown a tendency to assume that Southeast Asian trade was stagnant before 1850. In general, those studies before the early 1990s use statistics published by the colonial authorities in the late nineteenth century and examine the increase in primary product exports from individual countries under colonial rule (Cowan 1964; Maddison and Prince 1989; Booth 1991). Therefore, they assume, without a serious examination, that economic life in most parts of the region during the era when Western colonialism had not penetrated thoroughly and few statistical accounts are available, was based on agricultural activities as the chief means of subsistence (Thee 1989, 134–135; Booth 1991, 20). In contrast to this prevailing view, studies came out after the 1990s that discuss the boost in Southeast Asian trade in the first half of the nineteenth century from a new point of view (Reid 1997; Lindblad 2002; Li 2004a). Those studies place importance on the role of British free ports—Singapore and Penang—in connecting the region with Western long-distance trade, by highlighting the lively regional trade between these hubs and surrounding regions. In other words, it is suggested that the perspective of “intra-regional trade” across the framework of Western colonialism is effective in considering the expansion of Southeast Asian trade during this period. However, no study has discussed comprehensively the role of intra-regional trade in the expansion of Southeast Asian trade.

In light of these studies, this paper statistically demonstrates that intra-regional trade centered on British and Dutch colonies grew from the 1820s to the early 1850s. We see that the growth of intra-regional trade was partly affected by the Dutch protectionist tariff policy against British cotton goods based on the regional division of the Anglo-Dutch Treaty of 1824. In addition, we find that multilateral trade relationships were formed in Singapore, in which Chinese middlemen played a central role through the reorganization of the distribution system of regional products, facilitating the distribution of European cotton across the region. In conclusion, it is argued that the combination of the new Western commercial wave and traditional trade flows brought about the growth of intra-regional trade and was the leading factor in the expansion of Southeast Asian trade in the first half of the nineteenth century.

The next section reviews what previous studies have said about Southeast Asian trade, focusing on local (intra-regional) trade, the inflow of European cotton goods, and the distribution of “Asian market-oriented” regional products. The third section defines the concept of intra-regional trade based on trade statistics and demonstrates the growth of intra-regional trade centered on the British and Dutch colonies from the 1820s. In the fourth section, we discuss the institutional basis for the growth of intra-regional trade by examining the development of British and Dutch tariff policies. In the latter part of this paper, we focus on Singaporean trade and shed light on the composition of commodities and merchants’ activities, revealing not only the importance of European cotton goods but also the role of various regional products in the growth of Singapore’s intra-regional trade.

Review of Literature

This section reviews previous studies dealing with the early-modern Southeast Asian trade in terms of local (intra-regional) trade, the influx of European cotton goods, and traditional circulations of regional products, in order to clarify the points of discussion in the following sections.

Some previous studies have examined the significance of trade within Southeast Asia, which is called “intra-regional trade” in this paper, in the first half of the nineteenth century. It is well recognized that the establishment of Singapore influenced the reorganization of regional trade structures. There is an important study by Wong Lin Ken (1960) that discusses comprehensively the trade of Singapore from 1819 to 1869. Relying on this work, Thomas Lindblad (2002) points out that we need to pay attention to the role of trade in Singapore in order to examine trade of the Outer Islands, which include the Malay Archipelago under Dutch influence apart from Java and Madura. He observes that the Outer Islands had close trade relationships with Singapore after the 1820s, and that such regional trade was conducted by traditional commercial networks such as those of the Bugis, Chinese, Minangkabau, and so on. In addition, some scholars discuss the connection of mainland Southeast Asia, especially the Gulf of Siam area, with Singapore. In the second half of the eighteenth century, the lower Mekong region became the commercial frontier. Chinese immigrants and merchants flowed into the area, largely influenced by the economic growth of China (Cooke and Li 2004). The regional trade route and system formed during that period were partly reorganized by connecting Singapore with the expansion of the distribution of Western-influenced products, such as opium and British cotton goods, in the region (Reid 2004, 30–32; Li 2004b, 78–79). Accordingly, these previous studies suggest that “intra-regional trade centered on Singapore” was one of the important ways for the whole region to connect with Western trade in this era. Therefore, first we need to investigate the volume and trend of this regional trade through a statistical analysis, in order to figure out its precise significance for the boost in Southeast Asian trade. In a statistical analysis of intra-regional trade, we use trade statistics not only for Singapore but also for other British colonial ports and Dutch Java, because we assume that those colonial ports provided the region with a connection to Western long-distance trade as well as Singapore. Through the combined use of colonial trade statistics in this way, we can understand the quantitative importance of intra-regional trade for the expansion of Southeast Asian trade for the first time.

Second, there are studies (Wright 1961; Reid 2009) considering the influx of European cotton goods as a new commodity into the region from the second decade of the nineteenth century. In those studies, it is mentioned that European cotton goods replaced Indian cotton, which had been a staple since the sixteenth century. Above all, it is worth paying attention to the argument over the Dutch protectionist tariff policies againstBritish cotton goods in Dutch Java. Alfons van der Kraan (1998) describes how the Netherlands attempted to drive out British cotton goods from Java to corner the market for the domestic cotton industry. According to his argument, the Netherlands levied high tariffs on imports of British cotton into the Dutch possessions. Further discriminatory tariffs were imposed on imports of British cotton via Singapore, because of Singapore’s entrepôt function of distributing British cotton goods across the region. As a result, Dutch cotton goods, backed by industrialization at home, took a commanding share in the market for cotton textiles in Java. Studies such as the above suggest that parts of Southeast Asia were exposed to the competition among European states after the Napoleonic Wars, and that the resurgence of Southeast Asian trade during this period was due partly to the impact of Western industrialization. Nevertheless, the influence of the high Dutch tariff on intra-regional trade—particularly trade between Singapore and islands under Dutch influence, other than Java and Madura—has not been discussed in detail. We can therefore neither evaluate the function of Singapore in the influx of European cotton goods nor figure out comprehensively the impact of cotton-manufactured goods on the expansion of Southeast Asian trade. The fourth section attempts to fill this gap.

In addition to cotton goods, we pay attention to the role of the distribution of regional products in the growth of intra-regional trade. Eric Tagliacozzo (2004) pays attention to exports of Southeast Asian marine goods to China during 1780–1860 and discusses the role of Singapore as an entrepôt for such products imported from surrounding islands and exported to China. In Penang and Singapore, Western traders took advantage of the distribution of regional products to access the Chinese market and obtained tea and silk for the West. Jennifer Cushman (1993) studies Siamese trade in the late eighteenth and early nineteenth centuries and shows that exports from Siam were composed mostly of various bulky (low value per unit of weight) goods, especially for the Chinese market. She observes how some of those exports went to Singapore in exchange for British and Indian cotton piece goods, indicating the involvement of Singapore in traditional commodity flows. These arguments show the role that the British colonial port of Singapore played in the flow of regional products in Asian markets, suggesting that a combination of traditional circulation and Western advance boosted Southeast Asian trade during this period. How, specifically, did these regional products and European cotton goods representing the Western advance relate to each other? Without clarifying this point, we cannot sufficiently figure out the role of the distribution of regional products in the Western advance. The fifth section demonstrates that the distribution of Asian market-oriented products in Singapore facilitated the influx of European cotton goods into the region.

The Growth of Intra-regional Trade from the 1820s to 1852

Statistical Approach to Southeast Asian Trade

This section defines the concept of Southeast Asian trade on the basis of the trade statistics of Western colonies. As far as Southeast Asia is concerned, the trade statistics of Dutch Java and the British Straits Settlements (Penang, Malacca, and Singapore) are the most important available sources, and these four colonies seem to have occupied the largest part of Western long-distance trade in Southeast Asia during this period.1) Therefore, we focus on the trade of British and Dutch colonies and define “intra-regional trade centered on British and Dutch colonies” from trade statistics. First, we look at the coverage of trade statistics and trade structures for British and Dutch colonies from the 1820s to 1852.

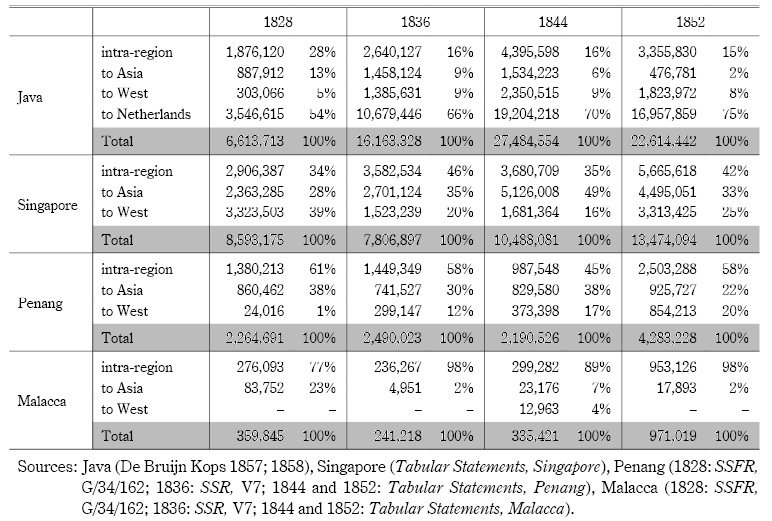

Table 1 shows exports from British and Dutch colonies to each regional division, classified as intra-regional (exports to “Southeast Asia” as today’s geographical unit), to Asia (exports to Asia other than Southeast Asia), and to the West (exports to Europe and America) from 1828 to 1852. In those days, the most common currency in Southeast Asia was the Spanish dollar, a silver coin from the American continent, so other units of account have been converted to this denomination throughout the paper.2) As for the period for which trade statistics are available, we can use the data for exports from Singapore to individual places from 1823, and those for Java from 1825, while the first years for Penang and Malacca are 1828 and 1836 respectively. After 1843, trade statistics for all four ports are available. The year 1852 is chosen as the final year in this table because the trade of Java and the Straits Settlements increased drastically afterward. It follows that 1852 is the final year showing the tendency and structure of trade in the first half of the nineteenth century. The year 1844 is set as the middle year between 1836 and 1852. In the following statistical analysis, the four years 1828, 1836, 1844, and 1852 are referred to as benchmark years. In addition, because the trade statistics of Penang and Malacca before 1843 do not distinguish between merchandise and treasure (bullion and coin) in trade value, the trade of the four colonies is shown as a combined value that includes both.

From Table 1, we can see the trade structure of each colony. First, Dutch Java was occupied by Britain in 1811 in the midst of the disorder arising from the Napoleonic Wars. After five years of British rule, Dutch rule resumed in 1816, and the entire island became a Dutch possession after the Java War (1825–30). The trade statistics for Dutch Java (De Bruijn Kops 1857; 1858) used in this paper are the aggregation of trade of all Dutch ports located in Java and Madura. Trade within Java and Madura is excluded from these statistics. According to Table 1, exports from Java to the Netherlands shows the volume to have been of substantial size, due to the increase in exports of coffee and sugar by the Dutch-controlled Cultivation System in Java from the early 1830s. Nevertheless, intra-regional exports maintained a constant share, above 15 percent, during this period.

Next, trade statistics for Singapore (Tabular Statements, Singapore) were published by the missionary press and the Bengal colonial government.3) In the trade structure of Singapore, exports to Western countries had the largest share, nearly 40 percent in 1828; but after that date, intra-regional exports and exports to Asia became greater. Intra-regional exports stayed at 30–40 percent, and their absolute value increased steadily during this period.

Founded in 1786 by the British on islands along the west coast of the Malay Peninsula, Penang soon became the hub of the “country trade.” The year 1826 saw the establishment of the Straits Settlements, headquartered in Penang. The Bengal colonial government published the trade statistics for Penang (Tabular Statements, Penang) after 1843. From Table 1, we see that exports from Penang increased in the second half of the 1840s, and more often than not, Penang’s intra-regional exports constituted nearly 60 percent.

Malacca became a British port under the Anglo-Dutch Treaty of 1824, and it was integrated into the Straits Settlements in 1826. The Bengal administration officially published trade statistics for Malacca (Tabular Statements, Malacca) from 1843. According to Table 1, the volume of Malaccan trade was small compared to the trade of other colonies, and the destinations of Malaccan exports were mostly intra-regional.

An important caveat on the combined use of trade statistics of British and Dutch colonies is that there is a difference of four months in the coverage of annual returns between them: Javanese annual trade statistics adopt the calendar year (January to December), whereas the statistics of the Straits Settlements adopt the official year (May to April). Although this makes it difficult to compare numerical values in detail or to analyze the seasonality of trade, it is still possible to examine the rough structure and general trends of trade by a combined use of trade statistics for the four colonies. In the following, the four sets of trade statistics are aggregated as they are for the quantitative analysis of Southeast Asian trade.

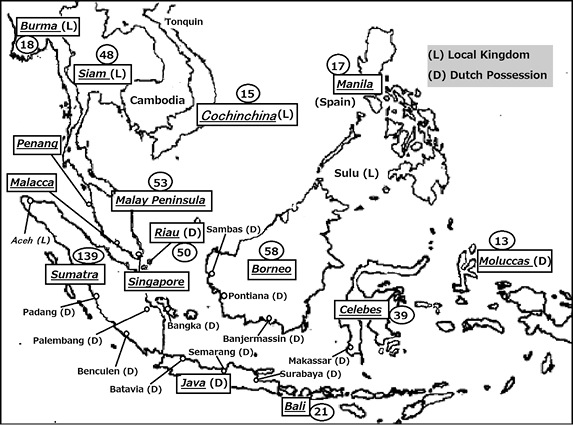

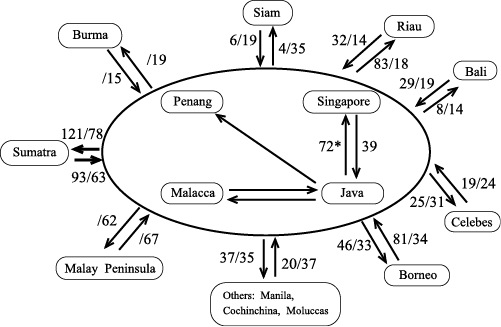

Fig. 1 shows the participants in Southeast Asian trade in the British and Dutch colonies, as well as the size of trade in each location. The trade values (imports and exports), which are circled in the figure, are an aggregate of the values of the four benchmark years in Table 1. Places that are difficult to identify consistently and which show relatively small trade values are excluded from the figure.4) We can see that the main participants in trade were Burma, Siam, and Cochinchina on the mainland, and Manila, the Malay Peninsula, Riau, Borneo, Sumatra, Celebes, the Moluccas, and Bali in insular Southeast Asia.

Fig. 1 Southeast Asia in the First Half of the Nineteenth Century (100,000 Spanish Dollars)

Sources: This map was made by the author on the basis of the map in Moor (1837). The trade data were taken from Table 1.

Note: Burma Konbaung Dynasty has ceded Arracan and Tenasserim provinces to Britain in 1826.

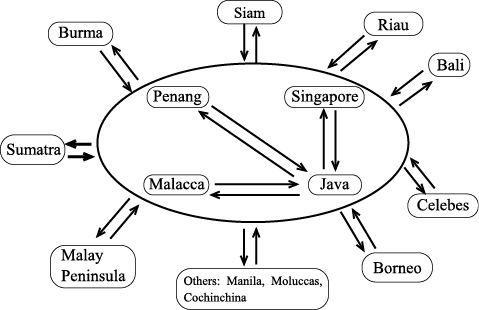

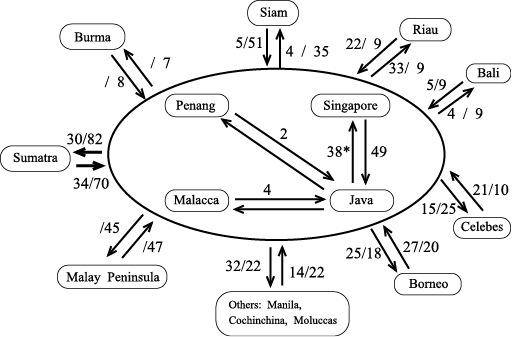

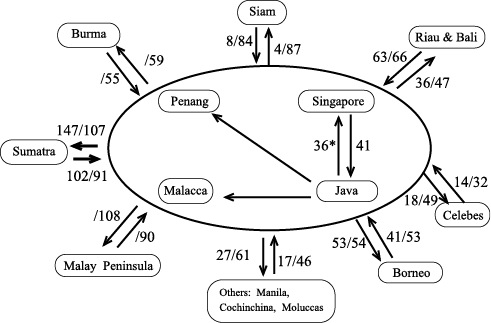

Fig. 2 is a conceptual diagram of intra-regional trade centered on British and Dutch colonies, designed to show the ways in which the volume of intra-regional trade was calculated. In this figure, trade relations among the four Western colonies are placed in the center, and the trade relationships with places appearing in Fig. 1 are indicated with arrows. Manila, the Moluccas, and Cochinchina, which show small trade values and little change, are grouped together as “Others.” In this diagram, the position of each place does not indicate the geographical location as indicated in Fig. 1. All arrows appearing in this figure indicate intra-regional trade. In other words, this diagram does not include such regional trade as trade between islands (for instance, Borneo and Celebes), the coastal trade of each location, or trade between port and hinterland via river. Thus, the coverage of intra-regional trade centered on British and Dutch colonies is limited to seaborne trade between the four Western colonies and the principal Southeast Asian locations.

In Fig. 2, trade among the Straits Settlements is excluded to avoid a double counting of major commodities contributing to the growth of intra-regional trade. As is discussed later, the growth in intra-regional trade was based in part on opium and cotton piece goods, and those commodities accounted for a large part of the trade among the Straits Settlements. If we were to include trade among the Straits Settlements, trade in one article would be counted twice because this trade was composed mostly of entrepôt trade. For instance, cotton piece goods imported from Britain to Singapore were (1) exported to Penang and then (2) reexported from Penang to Sumatra. It follows that there is a double counting in the export and reexport of cotton piece goods in intra-regional trade. Although there would have been commodities consumed in the Straits Settlements, it can be assumed that a double counting of those major commodities would prevent the accurate estimation of intra-regional trade. Therefore, trade among the Straits Settlements has not been included in this conceptual diagram.

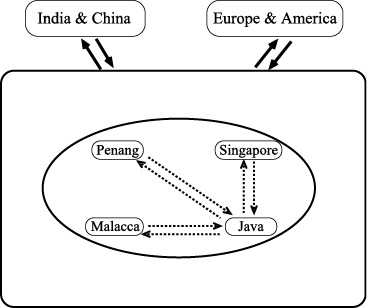

Fig. 3 is a conceptual diagram of trade with Asia and with the West centered on British and Dutch colonies. The left arrows with solid lines show the trade of British and Dutch colonies with India and China, representing “trade with Asia.”5) Likewise, the right arrows with solid lines represent “trade with the West” (Europe and America) centered on British and Dutch colonies. These do not represent the entire Southeast Asian trade with Asia and the West but only the trade of British and Dutch colonies with these regions. Accordingly, in Fig. 3, four colonies are set inside the box representing Southeast Asia.

Fig. 3 Conceptual Diagram of Trade with Asia and with the West Centered on British and Dutch Colonies

Estimation of Southeast Asian Trade from 1828 to 1852

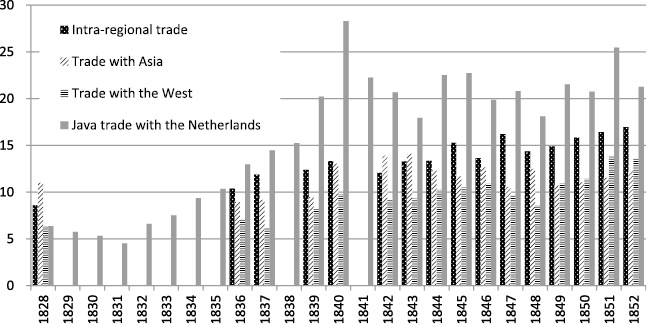

Let us now calculate the value of intra-regional trade, trade with Asia, and trade with the West as defined above. In order to obtain the sum of intra-regional trade, while we use only export figures to calculate the trade between the four colonies and their Southeast Asian trade counterparts, we need to use both export and import figures. Thus, we need to convert import values to an export-price basis by deflating 7 percent from import values, as an approximate percentage, representing the difference between F.O.B. (Free on Board) and C.I.F. (Cost, Insurance, and Freight) values (see Sugihara 2009, 144). For trade with Asia and trade with the West, we take both export and import figures from the trade statistics for the British and Dutch colonies. Fig. 4 shows the calculated results.

Fig. 4 Intra-regional Trade, Trade with Asia, Trade with the West, and Java Trade with the Netherlands (Million Spanish Dollars)

Sources: See Table 1, and Penang (1837: SSR, V7; 1839 and 1840: SSR, V8; after 1842: Tabular Statements, Penang), Malacca (1837: SSR, V7; 1839 and 1840: SSR, V8; after 1842: Tabular Statements, Malacca).

In Fig. 4, trade with the West is calculated, separating Java’s trade with the Netherlands as an independent branch of trade because its value was too large to aggregate. Java’s trade with the Netherlands soared from approximately 5 million dollars in 1828 to above 20 million dollars in 1852. In addition, trade with the West increased gradually from about 5 million to 10 million dollars. In contrast, trade with Asia fluctuated but remained at around 10 million dollars during this period. Intra-regional trade increased from approximately 8 million to 16 million dollars during this period. It follows that there was a growth in intra-regional trade from the 1820s to 1852 because there were no remarkable price rises or any significant inflation in the region at the time (Lindblad 2002, 92). Furthermore, from Fig. 4 we can see that intra-regional trade maintained a larger volume than trade with the West and exceeded trade with Asia during this period. Although it is worth noting the rapid increase in Java’s trade with the Netherlands under the Dutch-controlled Cultivation System, intra-regional trade also showed remarkable growth. It may be assumed that Western merchants found it more difficult to join in intra-regional trade than trade with Asia and the West, because it must have been difficult for them to obtain competitive knowledge about commercial customs, navigation routes, and vernaculars. Thus, the growth in intra-regional trade seems to have been based largely on the activities of local merchants.

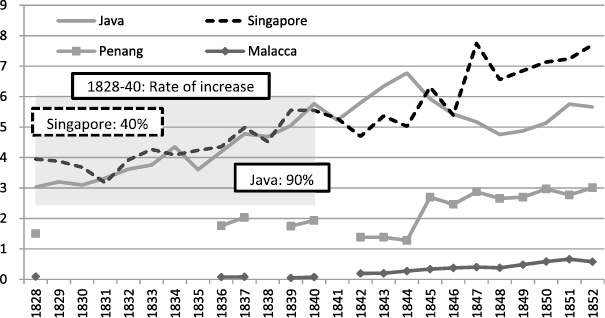

From Fig. 5, showing the intra-regional trade of individual colonies, we can see that the trade values of Java and Singapore were considerably larger than those of Penang and Malacca, and that these trade values increased on a similar scale from 1828 to 1840. During this period, Singapore’s intra-regional trade increased 40 percent and Java’s 90 percent. After 1840, while Singapore appeared to be stagnant from 1839 to 1846, Java’s intra-regional trade increased until 1844. Java then saw a decline in its intra-regional trade after 1844, whereas trade of the Straits Settlements increased. From 1828 to 1844, Java was vitally important for the growth of intra-regional trade, although Singapore increased its trade as well. The Straits Settlements, particularly Singapore, played a central role in the growth of intra-regional trade from 1845 to 1852.

Fig. 5 Intra-regional Trade of British and Dutch Colonies (Million Spanish Dollars)

Source: See Fig. 4.

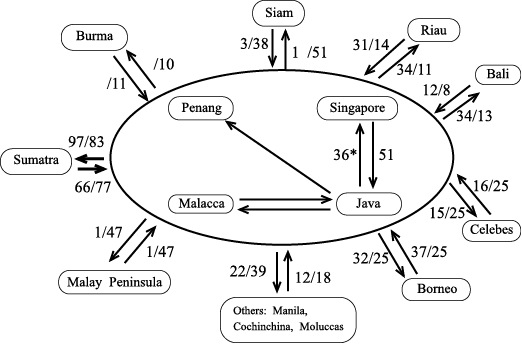

Let us now look at changes in the regional structure of intra-regional trade to see the changes in trade relationships. Figs. 6 to 9 show the trade values of each place in intra-regional trade for 1828, 1836, 1844, and 1852. First, we can see that the trade values between Dutch Java and the Straits Settlements in the central circle did not show any tendency to increase throughout these years, although there was a temporary increase in 1844. Therefore, the growth of intra-regional trade during this period is not attributable to the expansion of trade between British and Dutch colonies. According to Figs. 6 and 7, Dutch Java increased its trade with Sumatra, Borneo, and Bali from 1828 to 1836, while the change in the volume of trade was small for the Straits Settlements during this period. A comparison between Figs. 7 and 8 suggests that Dutch Java boosted trade with Sumatra and Borneo from 1836 to 1844 and that exports to Riau increased as well. The Straits Settlements could not expand trade with places in the archipelago, although its trade with Burma and the Malay Peninsula increased slightly during this period. When comparing Figs. 8 and 9, we see an increase in the Straits Settlements’ trade from 1844 to 1852, and that the geographical expansion of its trade reached the whole of Southeast Asia. Specifically, trade with Siam and Burma on the mainland increased rapidly, as did trade with the neighboring Malay Peninsula and Sumatra and the eastern islands of Celebes and Borneo. In other words, from 1828 to 1844 Dutch Java expanded its intra-regional trade with the archipelago under Dutch influence; and afterward the Straits Settlements, with Singapore at the head, extended trade relationships to the whole region, including the Dutch sphere of influence. This resulted in the growth of intra-regional trade, with a shift in focus from Java to Singapore.

Fig. 6 Intra-regional Trade in 1828 (10,000 Spanish Dollars)

Source: See Table 1.

Notes: Import and export values of each region outside the large central circle are shown in two figures, distinguishing trade with Java and trade with the Straits Settlements wherever possible. Thus Sumatra’s imports, for example, are shown as 30/82, indicating that it imported 300,000 dollars from Java and 820,000 dollars from the Straits Settlements, while exports are shown as 34/70, similarly indicating values for two destinations.

* Exports from Java to Singapore include exports to Penang and Malacca.

Fig. 9 Intra-regional Trade 1852 (10,000 Spanish Dollars)

Source: See Table 1.

Note: See Fig. 6. After 1847, trade with Riau and Bali cannot be distinguished in trade statistics of Singapore; therefore, they are together in this figure.

The Development of British and Dutch Tariff Policies

This section discusses the development of British and Dutch tariff policies in order to comprehend the background of the growth of intra-regional trade. The Anglo-Dutch Treaty, concluded in March 1824, fixed British and Dutch spheres of influence in Southeast Asia, with a powerful influence on intra-regional trade.

The United Kingdom, possessing a sphere of influence north of the Malacca Straits, increased its political and economic influence in Southeast Asia through the establishment of the Straits Settlements—Penang, Malacca, and Singapore—as the basis of its activities (Webster 1998, Chapter 4). Its main driving force was the interests of British industry and commerce, vitalized by the Industrial Revolution, particularly the cotton industry. With the adoption of free trade policies, the Straits Settlements prospered as hubs for Asian traders who imported regional products and exported cotton goods to surrounding ports. Straits Settlements merchants, who earned profits from the distribution of cotton goods, were eager to support the policy of free trade (Webster 2011).

Meanwhile, the Netherlands, possessing a sphere of influence south of the Malacca Straits, had been pursuing the colonization of Java since 1816 and constructing a modern nation at home with the enormous wealth drawn from its colony. After the Napoleonic Wars, the addition of Flanders to the new nation of the United Kingdom of the Netherlands was approved by the Vienna Protocol in 1816. The Netherlands adopted protectionist policies in its colonies to guarantee the interests of the flourishing domestic Flemish cotton industry (Van der Kraan 1998, 18–21), while adopting free trade policies at home to accommodate the interests of the entrepôt trade of Amsterdam (Wright 1955, 154–155). This tariff policy imposed over the area of Dutch influence became a barrier against the inflow of British cotton goods.

The starting point for Dutch cotton tariffs was the Textile Ordinance decreed by the Netherlands government in February 1824, setting a high tariff rate against British cotton goods (BPP 1840, 13). The Javanese cloth market had been overwhelmed by British cotton goods until the return of Java to the Dutch in 1816. Afterward, in order to maintain the market for the Flemish cotton industry, the Netherlands imposed an import duty of 25 percent on foreign European cotton goods, especially targeting British goods shipped directly from Britain, and 35 percent if they came via an Asian port—the latter was generally the case because British cotton goods were usually imported via Calcutta or Singapore. This high tariff had the desired effect: the influx of British cotton goods into Java diminished, while imports of Belgian goods, which bore no duty, increased in their share of cotton goods imported into Java—from 2.5 percent in 1823 to 70 percent in 1829 (Muller 1857, 84–91; Posthumus 1921, 90–93).

The British government made diplomatic protests against this Dutch protectionism on the basis of Article 2 of the Anglo-Dutch Treaty of 1824 (BPP 1840, 2–3). According to this treaty, the two nations had agreed to the following: the vessels of one nation entering a port in the Eastern Seas belonging to the other nation would not pay more than double the duty on the vessels of the nation that controlled the port, and if no duty was imposed on the vessels of that nation, the charge on the vessels of the other nation would not exceed 6 percent. In other words, the imposition of high tariffs of 25 percent and 35 percent on British cotton goods was in complete violation of the treaty, because there were no duties on Dutch cotton goods in any Dutch colony. In response to Britain’s protests, the Netherlands insisted that the Anglo-Dutch Treaty was concerned with the nationality of ships and did not make stipulations regarding the origin of products (Posthumus 1921, 262–263, 448), and generally, high tariffs were maintained throughout the 1820s.

The British government’s protests were in the interests of two parties: British merchants who exported cotton goods directly from Britain to Southeast Asia and whose main target was Java, and local British merchants based in the Straits Settlements who could benefit from the reexport of British cotton goods to surrounding regions. Since British diplomatic protests were made in defense of different interests, we will deal with each development in turn.

The first group that was served by British protests was British merchants at home. In Java, British cotton goods began to circulate under British rule and maintained a dominant share among total imports of cotton goods until 1823 (Van der Kraan 1998, 11). The high tariff set by the Textile Ordinance of 1824 reduced the imports of British cotton goods and helped to increase imports of Belgian cotton goods into Java. However, as a result of the secession of Belgium from the Netherlands in 1830, the Netherlands lost the Flemish cotton industry and could no longer export domestic cotton goods to Java; British merchants immediately took advantage of this to increase their exports of cotton goods to Java. For a time, the share of British cotton goods among total imports of cotton goods into Java was above 90 percent (Muller 1857, 84–91; Van der Kraan 1998, 24–25), which led to an optimistic view among British merchants even in the face of the Dutch protectionist policy. As the Dutch government began to nurture the domestic cotton industry in the 1830s, however, the British sensed the urgency of the situation, and protests against Dutch tariffs strengthened after 1833 (BPP 1840, 66–73). In May 1836, the Dutch government gave in and raised the tariff rate on Dutch cotton goods from zero to 12.5 percent, while maintaining the tariff rate of 25 percent on British cotton goods, following Article 2 of the Anglo-Dutch Treaty.6)

In addition, in October 1837 the Dutch government reduced the tariff rate of 35 percent on British cotton goods imported via Asian ports to 25 percent, the same as direct imports from Britain (ibid., 187; Posthumus 1921, 485). Nevertheless, these alterations in Dutch tariff policy during the 1830s did not improve the institutional base of intra-regional trade, as we shall see below.

Second, we take up the development of tariff policies based on the interests of British merchants in the Straits Settlements. The British diplomatic protests during the 1830s did not explicitly mention the high tariff of 35 percent imposed on the Straits Settlements because the Netherlands charged the tariff even on Dutch ships importing European cotton goods through the Straits Settlements (BPP 1840, 63). For instance, if a Dutch ship brought Dutch cotton goods from Singapore to a Dutch-ruled port, the ship had to pay a tariff of 35 percent, following Article 2 of the Anglo-Dutch Treaty. In fact, however, there was no need for Dutch cotton goods to go through Singapore.

The commerce of British merchants based in the Straits Settlements who earned profits from reexporting British cotton goods to surrounding areas was severely affected by the Dutch discriminatory tariff, levied not only on Java but also on Dutch-ruled ports located on the west coast of Sumatra, Borneo, and Celebes (Moor 1837, 173–174). Singaporean merchants were eager to plead their case with the home government, publishing protests in newspapers in the 1830s, but in vain (SC, May 12, 1825; BPP 1840, 63, 161–162).

To make matters worse for merchants in the Straits Settlements, in 1834 the Dutch government implemented a prohibitive tariff of 70 percent on imports of European cotton goods via the Straits Settlements as a wartime decree during the Belgian Revolution (BPP 1842, 15). Although the Netherlands insisted that this new tariff policy was aimed at driving out Belgian cotton goods from Dutch possessions, in reality imports of British cotton goods into Dutch possessions were levied the prohibitive tariff (ibid., 53–54). Furthermore, in 1834 port regulation was also decreed by the Batavian government, declaring that foreign European cotton goods would not be permitted to enter the Dutch possessions unless they were first imported into the principal ports of Java, limited to Batavia, Semarang, and Surabaya (BPP 1840, 74–75). In other words, exports of cotton goods from Singapore to Dutch possessions in Sumatra, Borneo, and Celebes were completely banned, and this severely damaged the entrepôt function of Singapore. As a result, the amount of British cotton goods imported from the Straits Settlements to the Dutch territory was considerably reduced. The British home government could not judge accurately whether the regulations implemented by the Netherlands for trade in the Dutch possessions were a violation of the Anglo-Dutch Treaty or not, because those decrees were not published in Europe (ibid., 71).

This discriminatory Dutch tariff spurred further complaints from local British merchants, bringing the problem to the top of the British diplomatic priority list in the early 1840s (SFP, April 5, 1838; June 20, 1839; July 18, 1839; September 26, 1839; BPP 1842, 2–3, 21, 54). In 1841, Lord Palmerston, the British foreign minister, officially lodged a protest with the Dutch government concerning the discriminatory tariff and the port regulation of 1834; the Dutch government responded immediately, declaring officially that the prohibitively high tariff and the port regulation as a wartime decree had been abolished in October 1839. Thus, by reducing the tariff to 25 percent, per the terms of the Anglo-Dutch Treaty (BPP 1842, 40–43), the institutional basis for trade between the Straits Settlements and Dutch possessions was eventually set right.

Combination of the New Wave and Traditional Circulations

Commodity Compositions of the Intra-regional Trade of Singapore

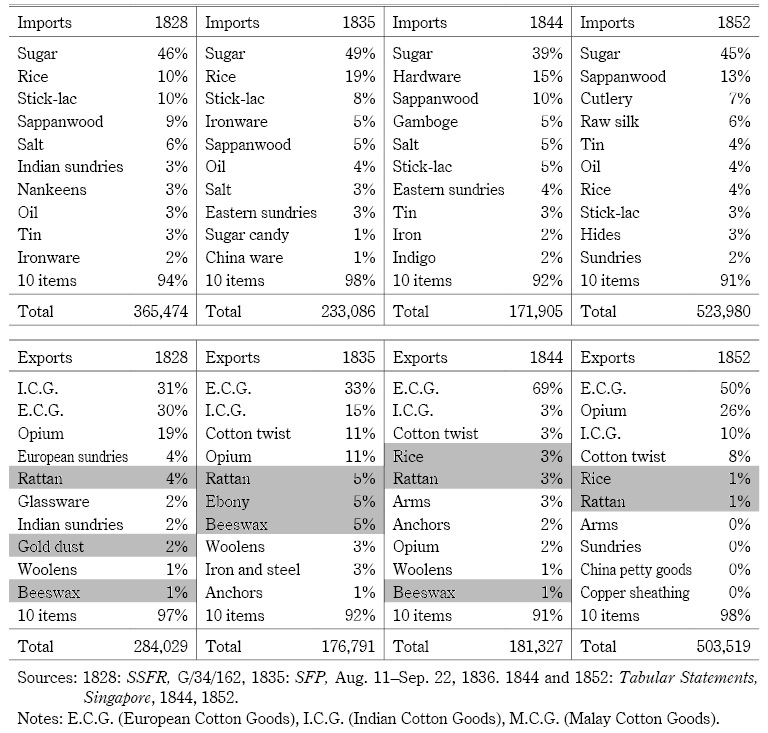

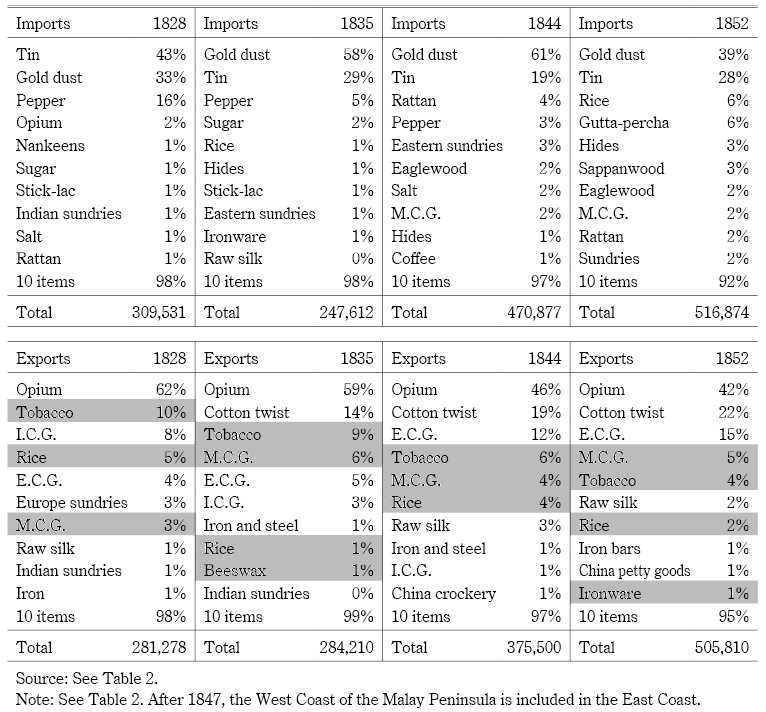

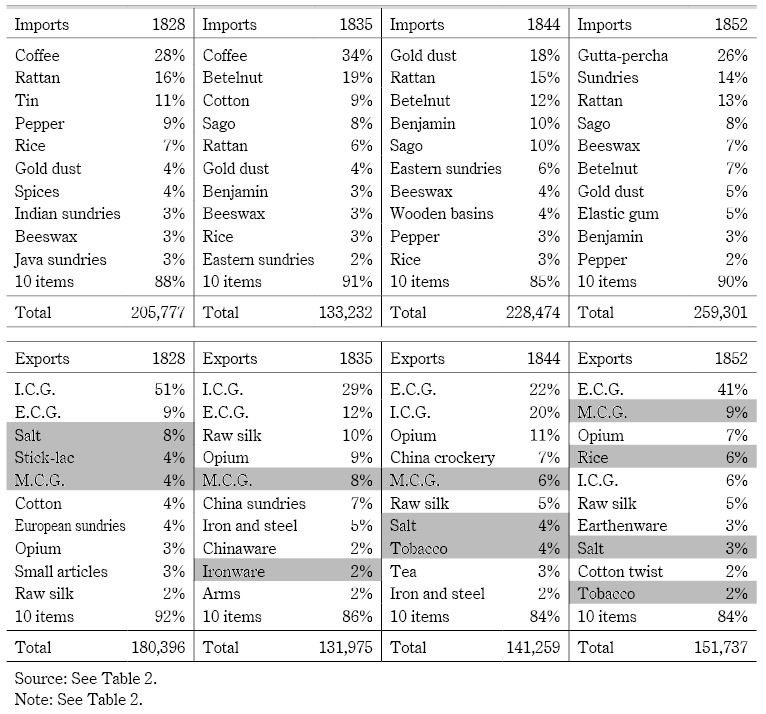

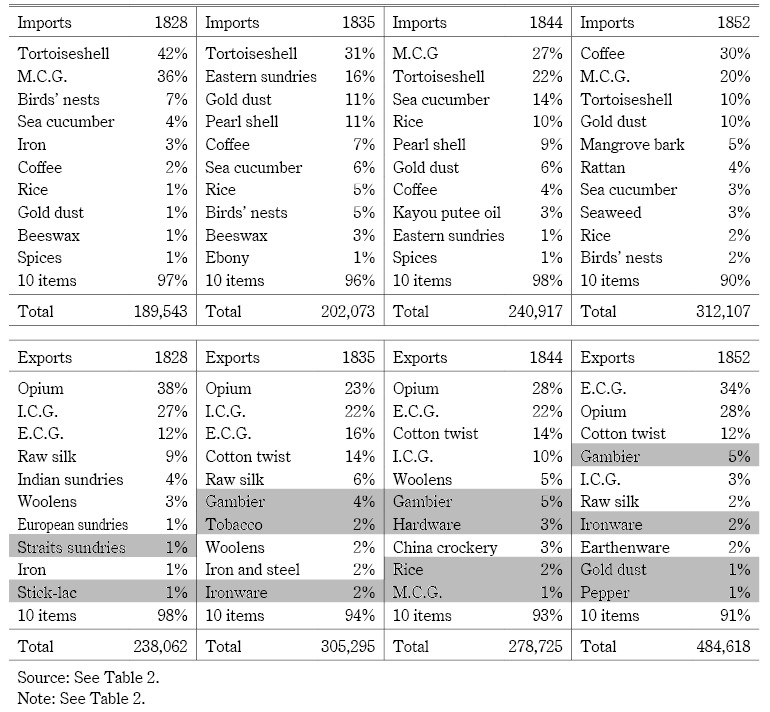

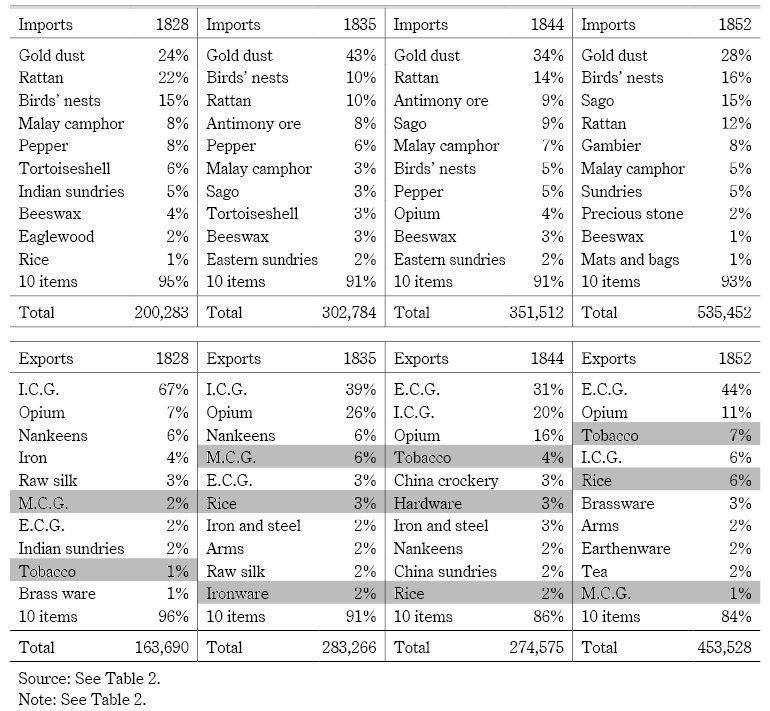

In this section we focus on the trade of Singapore, because this colonial port played a leading role in the growth of intra-regional trade centered on British and Dutch colonies; this study will shed some light on commodity compositions to reveal the main driving force for the growth of Singapore’s intra-regional trade. Tables 2 to 6 show the commodity compositions of the imports and exports of Singapore with its main intra-regional trade counterparts—Siam, the east coast of the Malay Peninsula, Sumatra, Celebes, and Borneo—which accounted for approximately 60–70 percent of the intra-regional trade of Singapore. In these tables, the top 10 items are listed in the four benchmark years listed earlier (1835 has been substituted for 1836 due to a lack of sources).

Table 3 Imports and Exports of Singapore with the East Coast of the Malay Peninsula (Spanish Dollars)

First, let us look at the commodity composition of imports to see what kind of regional products were brought into Singapore. Generally, each location had a few leading items that took a significant share of the imports into Singapore, such as sugar from Siam; tin or gold dust from the east coast of the Malay Peninsula; coffee or gutta-percha (a sort of resin) from Sumatra; tortoiseshell, Malay cotton goods, or coffee from Celebes; and gold dust from Borneo. Although products demanded in Europe—such as sugar, coffee, and tin—stand out on this list, it is worth noting that some of the leading items were traded for Asian markets. For instance, marine goods such as tortoiseshell, sea cucumber, and pearl shells from Celebes were exported to China via Singapore (Tagliacozzo 2004, 31). After the leading items, various regional products are listed in the tables; they were an important component of imports as a whole. They were primarily preferred by Asian consumers rather than meeting European demand. Presumably, trade in these Asian market-oriented products had been nurtured before the nineteenth century,7) which suggests that the growth in Singapore trade was not only brought about by European demand but was also based on traditional Asian trade.

According to the commodity composition of exports in the tables, cotton goods and opium were the leading items of export from Singapore to the main Southeast Asian locations. Opium took a large share among the exports to the east coast of the Malay Peninsula and Celebes, but less so in exports to Siam, Sumatra, and Borneo. When it comes to the export of cotton goods, the general trend was that European cotton goods replaced Indian cotton during this period, but there was a difference between areas. When it came to exports to the Gulf of Siam (Siam and the east coast of the Malay Peninsula), European cotton goods surpassed Indian cotton by 1835, although the export value of Malay cotton goods was larger than that of European cotton goods to the east coast. On the other hand, the archipelago (Sumatra, Celebes, and Borneo) maintained a constant volume of Indian cotton goods until the middle of the 1840s; European cotton goods overwhelmed Indian cotton in the late 1840s. Presumably, these geographical differences can be partly explained by the influence of high Dutch tariffs on imports of British cotton goods into the Dutch-ruled ports of Sumatra, Celebes, and Borneo. Exports of European cotton goods from Singapore to areas under Dutch influence could not expand readily due to the high tariffs. This allowed Indian cotton goods to maintain their dominance in the region, which had endured since the sixteenth century.8) Consequently, the exports of European cotton goods from Singapore to the archipelago expanded after the lifting of high Dutch tariffs against Singapore in the early 1840s.

In addition, as we can see from the gray-highlighted cells indicating the export of regional products, commodities imported from Southeast Asian locations were reexported to intra-regional locations via Singapore. In the case of Siam, forest products, such as rattan and beeswax, produced mainly in tropical forests on islands (Crawfurd 1820, 423, 438), were supplied through Singapore constantly, which means that there was a regional market based on supply and demand in forest goods within the region. Likewise, gambier exported to Celebes was used as a gum for chewing betel, a favorite item among locals, and tobacco produced mainly in Java was consumed across insular Southeast Asia (ibid., 416–417). Ironware (including hardware and cutlery) imported from Siam—the iron industry in northern Siam flourished to meet regional demand in the early nineteenth century (Li 2004b, 78)—was reexported from Singapore throughout insular Southeast Asia. When it comes to the constant export of salt to Sumatra, because the Dutch colonial authorities implemented the monopoly system for salt across the west coast of Sumatra after the 1820s, the Minangkabau, the people of the hinterland, preferred Siamese salt, imported from the east coast of Sumatra via Singapore, to high-priced Java salt (Dobbin 1983, 100–101). In any case, although the trade value of each regional product was tiny compared to the value of cotton piece goods and opium brought from outside the area, the circulation of regional products within the region through Singapore was closely related to the ordinary lives of locals. Presumably, as exports of European cotton goods from Singapore increased, imports of regional products in exchange for them also increased, including reexports not just to the West but also to Asia. Thus, exports of European cotton goods boosted intra-regional trade not only by connecting with Western long-distance trade directly through providing regional products for European demand, but also by promoting the internal distribution of Asian market-oriented products via Singapore.

The Role of Chinese Middlemen in Singapore

This section explores the role of Chinese middlemen in Singapore who intermediated the trade in cotton piece goods between Western merchants and local traders, for the growth of intra-regional trade.

In Singapore, European agency houses were the main importers of cotton goods, and their number increased from 14 in 1827 to 36 in 1855 (Wong 1960, 167). These firms sold European cotton goods as agents of Western firms and exported regional products to the West in return (Lee 1978, 14–15). Agency houses were required to sell European cotton goods to local Asian traders gathering in Singapore and to buy from them regional products for European markets. To undertake this business, European agency houses needed the cooperation of middlemen.

In Singapore, Western—especially British—merchants were unfamiliar with the local Asian way of doing business. Similarly, local traders, such as Malays and Bugis, had less experience in communicating with Western merchants, so Chinese middlemen played an important role as intermediaries between them. Overall, Malacca Chinese, or Baba, who were locally born and capable of speaking English as well as the vernacular, acted as middlemen (Earl 1837, 415).

In those days, although barter trade was common in the Singapore market owing to the scarcity of specie, European agency houses could dispose of cotton goods on a large scale by credit sale and generally issued promissory notes for a two-month credit period to Chinese middlemen who delivered in return not money but regional products (Wong 1960, 163). Credit sale imposed high risks on Western merchants, however, because the merchants loaned their capital to middlemen in advance. In those days, practice did not conform strictly to rules. Promissory notes were taken as payable, nominally, in two to three months’ time, but in many instances when the middlemen could not pay back within the credit period, the credit was actually extended to six months (SC, May 22, 1828; Phipps 1835, 269; Wong 1960, 163). For European firms, the collection of capital was unstable, and in the meantime they were exposed to the risk of failure to collect. According to the commercial newspaper in Singapore, Chinese merchants often went back to China without repaying their debts to Western merchants (SC, August 13, 1829). Furthermore, the law courts did not work well in preventing debtors from defaulting, although there were trials regarding credit sales (ibid., May 22, 1828; August 12, 1830). In 1827 a law court opened in the Straits Settlements, headquartered in Penang, but only one judge was appointed to court and he was stationed in Penang almost all year long; his trips to Singapore were not regular (Turnbull 1972, 56–57). Under the circumstances, trials in Singapore did not proceed smoothly, and debtors recognized that confiscation of property was not executed properly even if the debt was overdue (Buckley 1902, 239). It is presumed that formal institutions such as a judicial system were inadequate to protect the business of European firms in Singapore. As a result, Chinese merchants serving in administrative positions and possessing property in Singapore were selected as trustworthy middlemen by Western merchants. In this way, Chinese middlemen succeeded in their business in Singapore.

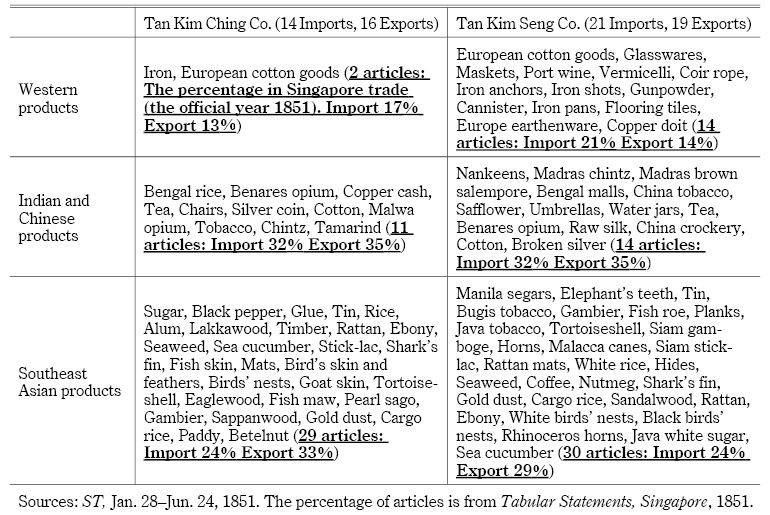

Chinese middlemen in Singapore did not specialize in the intermediary business for European agency houses but dealt in various kinds of products on their own account to meet the demand of local Asian traders. Table 7 shows the commodities handled by Tan Kim Ching and Tan Kim Seng, extracted from the Straits Times, which published the lists of merchandise imported and exported by European ships (square-rigged vessels) in Singapore from January to June of 1851. They were famous and wealthy Fujian Chinese of Malaccan background residing in Singapore who performed the role of middlemen for Western merchants (Song 1902, 46, 62, 66, 91–92; Yen 1986, 183–184). From Table 7 we learn that both merchants handled a variety of Southeast Asian products. In addition, the table shows the percentage (by value) of Western products, Indian and Chinese products, and Southeast Asian products handled by each merchant among the imports and exports in Singapore in 1851, calculated from trade statistics of Singapore, adjusting for consistency of products’ names. Southeast Asian products listed in Tan Kim Ching’s merchandise took up 24 percent of imports and 33 percent of exports in Singapore; those of Tan Kim Seng were 24 percent and 29 percent. These figures are comparable to the shares taken up by Western products and Indian and Chinese products respectively in the trade conducted by both merchants. Presumably, both merchants purchased those regional products from local traders coming to Singapore, as part of their intermediary business. There were, however, articles not only for European markets, such as sugar, tin, and coffee, but also goods for China, such as birds’ nest and sea cucumber, and for local markets, such as tobacco, betel nut, and rice. In other words, Chinese middlemen did not merely conduct the intermediary business of cotton goods for Western merchants but also intermediated between various local traders gathering in Singapore by handling a variety of products, including Asian market-oriented products. Thus, the intermediary business of Chinese middlemen functioned to integrate various parts of the Singapore trade, such as trade with the West, trade with Asia, and intra-regional trade. The business of middlemen could multilaterally connect trading entities centered on Singapore.

The Function of Multilateral Trade Relationships in Singapore

This section discusses the function of those multilateral trade relationships for the growth of Singapore’s intra-regional trade. First, we examine the business relationships between Chinese middlemen and local traders through the case of transactions between Chinese merchants and Bugis traders in the Singapore market.

In the first half of the nineteenth century, local Bugis traders engaged in trade between Singapore and the eastern islands, such as Borneo, Celebes, and Bali (SC, December 16, 1830; Moor 1837, 13; Davidson 1846, 56–57). Previous studies (Lineton 1975; Andaya 1995) discuss the fact that Bugis immigrants were scattered all over the archipelago, and they have revealed the extensive trading activities based on their diasporas in the eighteenth century. Until the early 1860s, the arrival of Bugis traders in the September-to-November period was a crucial influence on the market conditions of Singapore.9) Presumably, Bugis traders mastered the market in the eastern islands, so it could have been efficient for Chinese middlemen in Singapore to depend on the activities of Bugis in order to distribute cotton goods and obtain regional products. A European traveler wrote this description (Davidson 1846, 56–57) of a transaction between Chinese merchants and Bugis traders at the bazaar in Singapore in the 1840s:

On the arrival of a boat, her nakoda (or commander) lands with nearly every man on board; and he may be seen walking all over the place for a few days before making any bargain. . . . They [Bugis] are, however, always received with a hearty welcome by the Chinese of the Island [Singapore], who, inviting them to be seated, immediately hand round the siri-box (betel-nut, arica leaf, &c.) among them; and over this universal luxury, they will sit and talk on business matters for hours, during which time it may be fairly calculated that both host and guests tell a lie per minute, without betraying by their countenances the slightest consciousness of having been thus engaged. This strange sort of preliminary negotiation goes on, probably, for a week; at the end of which the passer-by [Bugis] may see the contents of the different Bugis boats entering the Chinese shops or stores, as the case may be.

From this description, first, we see that interaction with Bugis traders required experience and expertise with local commerce and a knowledge of the vernacular; this resulted in a situation in which Chinese middlemen who possessed these abilities engaged in transactions with local Bugis traders. Through this transaction with Bugis in the market, Chinese merchants could complete their intermediary business in European cotton goods.

The transaction in European cotton goods between Chinese middlemen and Bugis traders was closely related to the multilateral trade relationships in Singapore. The transactions were based on an exchange of cotton goods for regional products imported by Bugis traders, and as the commodity compositions of imports from Celebes in Table 5 show, most of the imports were Asian market-oriented products. Therefore, they could not strike a bargain in regional products without the export routes to Asian markets, and as a result European cotton goods were not exported as well.

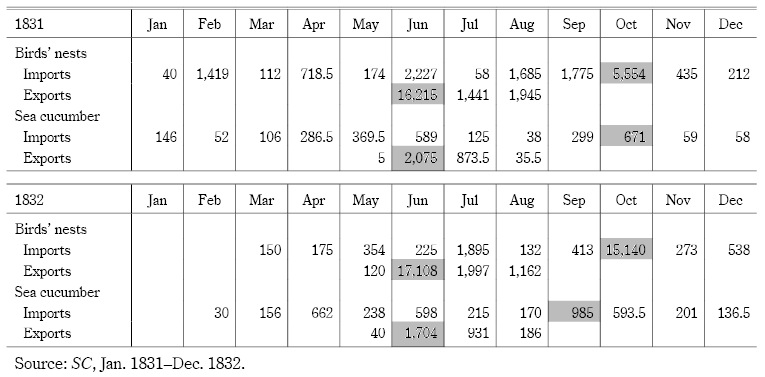

Let us now look at this circuit of regional products for Asian markets in Singapore in the case of the trade in birds’ nests and sea cucumber, imported from the eastern islands and mostly exported to China. Table 8 shows the quantities of monthly imports and exports of birds’ nests and sea cucumber for Singapore from 1831 to 1832. As can be seen from the gray-highlighted cells indicating the largest quantity of imports and exports in each year, a large amount of both articles were imported in September and October, which was the high season for the arrival of Bugis traders from the remote eastern islands with the southwest monsoon. However, according to the table, exports of both articles concentrated on the season from May to August. In the first half of the nineteenth century, Chinese junks arrived at Singapore in January with the northeast monsoon, and they purchased various articles, including regional products, from the Chinese merchants in Singapore. They then rode on the southwest monsoon in May and June to return to Chinese ports with their purchases (SC, April 23, 1829; April 28, 1831; Earl 1837, 365–367). Thus, there was a seasonal gap between imports and exports in birds’ nests and sea cucumber; a large amount of imports in October was exported in June of the next year. We assume that Chinese merchants in Singapore connected the imports of articles by Bugis with the exports by Chinese junks, storing them in their own warehouses. Thus, the multilateral trade relationships formed by Chinese middlemen supported the distribution of regional products for Chinese markets via Singapore.

Table 8 Quantities of Monthly Imports and Exports of Birds’ Nests and Sea Cucumbers in Singapore, 1831–32

Unit: Birds’ nests (Catty, 100 catties=1 picul), Sea cucumbers (Picul)

In the above case, we looked at the flow of commodities imported from within the region and exported externally, namely to China, but the function of the multilateral trade relationships is applicable to the internal circulation of regional products as well. For instance, Singapore’s intra-regional trade relationships seemed to function to facilitate the export of rattan collected in tropical forests in Sumatra to Siam and the export of Siamese salt to Sumatra through connections with both areas. The distribution system of regional products was reorganized through the multilateral trade relationships in Singapore, and the influx of European cotton goods, as the new wave from the external region, joined this flow via Singapore. Furthermore, we assume that traditional circulations could strengthen connections with Western trade through the confluence of European cotton and could respond to European demand more readily. In Table 4, for example, in 1852 the largest imports from Sumatra were of gutta-percha, a resin recognized for its utility as a gum in the 1840s and thus suddenly in demand in Europe. In other words, although one of the driving forces for the growth of Singapore’s intra-regional trade was certainly European cotton goods, the dynamic behind the new impetus to the growth of trade was a combination of a new wave of European cotton and the traditional circulations of regional products in Singapore.

Conclusion

This paper discussed the growth of intra-regional trade centered on British and Dutch colonies through a statistical analysis. In the first part, it showed that intra-regional trade increased with the shift in focus from Java to Singapore from the 1820s, and the intra-regional trade of Singapore grew with the extension of its trade relationships throughout Southeast Asia. This growth was attributed partly to the relaxation of high Dutch tariffs on British cotton goods imported via the Straits Settlements. The Dutch protectionist tariff policy, ignoring the Anglo-Dutch Treaty, considerably disrupted Singapore’s intra-regional trade with areas under Dutch influence. However, after the 1840s, with restrictions relaxed as a result of British diplomatic protests serving the interests of the Straits Settlements’ merchants, the institutional basis for intra-regional trade was set out in accordance with the Anglo-Dutch Treaty.

In the latter part, we analyzed the growth of Singapore’s intra-regional trade, examining in particular the function of multilateral trade relationships centered on middlemen. Chinese middlemen in Singapore dealt in various kinds of articles to intermediate between merchants coming to Singapore; they bought regional products from local traders in exchange for European cotton goods and not only delivered regional products to Western merchants but also sold them to Asian merchants. The expansion of the intra-regional export of European cotton goods from Singapore was conducted through multilateral trade relationships based on traditional commodity flows in Asia.

In the first half of the nineteenth century, the expansion in Southeast Asian trade occurred under the advance of Western countries. The establishment of Singapore and the influx of European cotton goods were crucial factors in that expansion. However, the expansion of Singaporean trade occurred not only due to that external impact but also due to the activities of local merchants who responded to the new commercial opportunities and the reorganization of the distribution system of regional products there. This combination of Western influence and local response culminated in the development of intra-regional trade during this period, and this was one of the patterns of regional response to Western long-distance trade.

Accepted: August 19, 2013

References

Primary Sources

British Parliamentary Papers (BPP). 1842. No. 352, Papers Relative to the Execution of the Treaty of 1824, by the Netherland Authorities in the East Indies.

―. 1840. No. 284, Papers Relative to the Execution of the Treaty of 1824, by the Netherlands Authorities in the East Indies.

Singapore Chronicle (SC). 1824–37.

Singapore Free Press (SFP). 1835–65.

The Straits Times and Singapore Journal of Commerce (ST). 1845–53.

Statistics

De Bruijn Kops, G. F. 1857; 1858. Statistiek van den handel en de scheepvaart op Java en Madura sedert 1825 [Statistics of the trade and navigation on Java and Madura since 1825], 2 vols. Batavia: Lange et Co.

Dutch Java

Straits Settlements

Straits Settlements Factory Record (SSFR). G/34/162. London. British Library.

Straits Settlements Records (SSR). V7, V8. Singapore. National Archives.

Tabular Statements of the Commerce and Shipping of Malacca. Calcutta: Military Orphan Press.

Tabular Statements of the Commerce and Shipping of Prince of Wales Island (Penang). Calcutta: Military Orphan Press.

Tabular Statements of the Commerce and Shipping of Singapore. Calcutta: Military Orphan Press.

Books and Articles

Andaya, Leonard Y. 1995. The Bugis-Makassar Diasporas. Journal of the Malayan Branch of the Royal Asiatic Society (JMBRAS) 68(1): 119–138.

Blussé, Leonard. 1991. In Praise of Commodities: An Essay on the Cross-cultural Trade in Edible Bird’s-Nests. In Emporia, Commodities and Entrepreneurs in Asian Maritime Trade, c.1400–1750, edited by Roderich Ptak and Dietmar Rothermund, pp. 317–335. Stuttgart: Franz Steiner Verlag.

Booth, Anne. 1991. The Economic Development of Southeast Asia: 1870–1985. In Exploring Southeast Asia’s Economic Past, edited by G. D. Snooks, Anthony Reid, and J. J. Pincus, pp. 20–52. Melbourne: Impact Printing.

Buckley, Charles Burton. 1902. An Anecdotal History of Old Times in Singapore. Singapore: Fraser & Neave.

Cooke, Nola; and Li, Tana, eds. 2004. Water Frontier: Commerce and the Chinese in the Lower Mekong Region, 1750–1880. Singapore: Rowman & Littlefield.

Cowan, C. D., ed. 1964. The Economic Development of Southeast Asia: Studies in Economic History and Political Economy. New York: Frederick A. Praeger.

―, ed. 1950. Early Penang and the Rise of Singapore. JMBRAS 23(2): 1–211.

Crawfurd, John. 1820. History of the Indian Archipelago, Vol. 3. Edinburgh: Archibald Constable.

Cushman, Jennifer Wayne. 1993. Fields from the Sea: Chinese Junk Trade with Siam during the Late Eighteenth and Early Nineteenth Centuries. Ithaca: Southeast Asia Program, Cornell University.

Davidson, G. F. 1846. Trade and Travel in the Far East. London: Madden and Malcolm.

Dobbin, Christine. 1983. Islamic Revivalism in a Changing Peasant Economy: Central Sumatra, 1784–1847. London: Curzon Press.

Earl, George Windsor. 1837. The Eastern Seas. London: Wm. H. Allen Co.

Greenberg, Michael. 1951. British Trade and the Opening of China 1800–42. Cambridge: Cambridge University Press.

Lee, Poh Ping. 1978. Chinese Society in Nineteenth Century Singapore. Kuala Lumpur: Oxford University Press.

Li, Tana. 2004a. The Water Frontier: An Introduction. In Water Frontier: Commerce and the Chinese in the Lower Mekong Region, 1750–1880, edited by Nola Cooke and Li Tana, pp. 1–17. Singapore: Rowman & Littlefield.

―. 2004b. The Late-Eighteenth- and Early-Nineteenth-Century Mekong Delta in the Regional Trade System. In Water Frontier: Commerce and the Chinese in the Lower Mekong Region, 1750–1880, edited by Nola Cooke and Li Tana, pp. 71–84. Singapore: Rowman & Littlefield.

Lindblad, J. Thomas. 2002. The Outer Islands in the 19th Century: Contest for the Periphery. In The Emergence of a National Economy: An Economic History of Indonesia, 1800–2000, edited by Howard Dick et al., pp. 82–110. Honolulu: Allen & Unwin.

Lineton, Jacqueline. 1975. Pasompe Ugi: Bugis Migrants and Wanderers. Archipel 10: 173–201.

Maddison, Angus; and Prince, Gé, eds. 1989. Economic Growth in Indonesia, 1820–1940. Dordrecht: Foris Publications.

Moor, J. H. 1837. Notice of the Indian Archipelago, and Adjacent Countries. Singapore: Singapore Free Press.

Muller, Hendrik. 1857. De Nederlandsche katoennijverheid en het stelsel van bescherming in Nederlandsch-indie [The Dutch cotton industry and the system of protection in the Netherlands Indies]. Rotterdam: Kramer.

Phipps, John. 1835. A Practical Treatise on the China and Eastern Trade: Comprising the Commerce of Great Britain and India, Particularly Bengal and Singapore, with China and the Eastern Islands. London: W. H. Allen.

Posthumus, N. W. 1921. Dokumenten betreffende de buitenlandsche handelspolitiek van Nederland in de negentiende eeuw, deel 2, onderhandelingen met Engeland over de koloniale handelspolitiek: 1814–1838 [Documents concerning the foreign trade policy of the Netherlands in the nineteenth century, Part 2, Negotiations with England about colonial trade policy: 1814–1838]. ’s-Gravenhage: M. Nijhoff.

Ptak, Roderich. 1991. China and the Trade in Tortoise-shell (Sung to Ming Periods). In Emporia, Commodities and Entrepreneurs in Asian Maritime Trade, c.1400–1750, edited by Roderich Ptak and Dietmar Rothermund, pp. 195–229. Stuttgart: Franz Steiner Verlag.

Reid, Anthony. 2009. Southeast Asian Consumption of Indian and British Cotton Cloth, 1600–1850. In How India Clothed the World: The World of South Asian Textiles, 1500–1850, edited by Giorgio Riello and Tirthankar Roy, pp. 31–51. Leiden: Brill.

―. 2004. Chinese Trade and Southeast Asian Economic Expansion in the Late Eighteenth and Early Nineteenth Centuries: An Overview. In Water Frontier: Commerce and the Chinese in the Lower Mekong Region, 1750–1880, edited by Nola Cooke and Li Tana, pp. 21–34. Singapore: NUS Press; London: Rowman & Littlefield.

―. 1997. A New Phase of Commercial Expansion in Southeast Asia, 1760–1850. In The Last Stand of Asian Autonomies: Responses to Modernity in the Diverse States of Southeast Asia and Korea, 1750–1900, edited by Anthony Reid, pp. 57–81. New York: St Martin’s Press.

Reid, Anthony; and Fernando, Radin. 1996. Shipping on Melaka and Singapore as an Index of Growth, 1760–1840. In “Asia and Europe: Commerce, Colonialism and Cultures,” edited by M. N. Pearson and I. B. Watson. Special Issue, South Asia: Journal of South Asian Studies 19(1): 59–84.

SarDesai, D. R. 1977. British Trade and Expansion in Southeast Asia 1830–1914. New Delhi: Allied.

Song, Ong Siang. 1902. One Hundred Year’s History of the Chinese in Singapore. London: Murray.

Sugihara, Kaoru. 2009. The Resurgence of Intra-Asian Trade, 1800–1850. In How India Clothed the World: The World of South Asian Textiles, 1500–1850, edited by Giorgio Riello and Tirthankar Roy (with collaboration of Om Prakash and Kaoru Sugihara), pp. 139–169. Leiden: Brill.

Tagliacozzo, Eric. 2004. A Necklace of Fins: Marine Goods Trading in Maritime Southeast Asia, 1780–1860. International Journal of Asian Studies 1(1): 23–48.

Thee, Kian Wie. 1989. The Development of Sumatra, 1820–1940. In Economic Growth in Indonesia, 1820–1940, edited by Angus Maddison and Gé Prince, pp. 133–158. Dordrecht: Foris Publications.

Turnbull, C. M. 1972. The Straits Settlements 1826–67: Indian Presidency to Crown Colony. London: Athlone Press.

Van der Kraan, Alfons. 1998. Contest for the Java Cotton Trade, 1811–40: An Episode in Anglo-Dutch Rivalry. Occasional Paper No. 32. Center for South-East Asian Studies, University of Hull.

Webster, Anthony. 2011. The Development of British Commercial and Political Networks in the Straits Settlements 1800 to 1868: The Rise of a Colonial and Regional Economic Identity? Modern Asian Studies 45(4): 899–929.

―. 1998. Gentlemen Capitalists: British Imperialism in Southeast Asia 1770–1890. New York: Tauris.

Wong, Lin Ken. 1960. The Trade of Singapore 1819–69. JMBRAS 33(4): 1–315.

Wright, H. R. C. 1961. East-Indian Economic Problems of the Age of Cornwallis & Raffles. London: Luzac and Company.

―. 1955. Free Trade and Protection in the Netherlands 1816–1830: A Study of the First Benelux. Cambridge: Cambridge University Press.

Yen, Ching-hwang. 1986. A Social History of the Chinese in Singapore and Malaya, 1800–1911. Singapore: Oxford University Press.

1) There are other statistical sources available: for Java’s coastal trade, see Ryuto Shimada’s paper; and for the trade of the Dutch Outer Islands, see Atsushi Ota’s paper—both in this focus.

2) Exchange rates are 1 Spanish dollar=2.1085 sicca rupees (1820s), 2.245 company rupees (1830–50s), 2.65 Dutch East Indies guilders (1820s), 2.55 guilders (1830–50s) (Cowan 1950, 21; Wong 1960, 8).

3) The government of the Straits Settlements was downgraded from a presidency, one administrative unit of the British East India Company, to a residency under the Bengal Presidency in 1830.

4) Places excluded are “Neighbouring islands” in the trade statistics of the Straits Settlements, and “Biliton,” “Kokos-Eilanden” (Cocos Islands), “Sandelhout Eiland en Flores” (Sumba Island and Flores), “Timor Delie” (Timor Dili), and “Timor Koepang” (Timor Kupang) in the trade statistics of Dutch Java.

5) For trade with Asia, we can consult the trade statistics of British India for the trade of Burma, Sumatra, and Manila with Indian ports (Bengal, Madras, and Bombay). Even if we add those trade values to “trade with Asia,” however, the share of the British and Dutch colonies of the total value turns out to be over 80 percent. Thus, the share of the British and Dutch colonies in “trade with Asia” is of central importance for the statistical analysis of Southeast Asia’s trade with other parts of Asia.

6) In fact, the Netherlands government entered the Secret Textile Contract with the Netherlands Trading Society, importing most Dutch cotton into Java, in which the full amount of 12.5 percent duty was to be refunded in the Netherlands to subsidize the Dutch textile industry (Van der Kraan 1998, 52).

7) Previous studies have discussed trade in marine and forest products, such as tortoiseshell (Ptak 1991) and birds’ nests (Blussé 1991) in Southeast Asia before the nineteenth century.

8) The tariff rate on imports of Indian cotton goods in Dutch possessions was 12.5 percent until 1837; afterward, it increased to 25 percent (BPP 1840, 78, 187).

9) See SFP, Report on the Market, November 29, 1852; September 30, 1853; October 20, 1857; October 5, 1859; November 21, 1861; September 19, 1862; November 21, 1864.