Contents>> Vol. 3, Supplementary Issue

Introduction:

Savings Groups in Laos from a Comparative Perspective

Ohno Akihiko* and Fujita Koichi**

*大野昭彦, School of International Politics, Economic and Communication, Aoyama Gakuin University, 4-4-25 Shibuya Shibuya-ku, Tokyo 150-8366, Japan

Corresponding author’s e-mail: acharya7ohno[at]yahoo.co.jp

**藤田幸一, Center for Southeast Asian Studies, Kyoto University, 46 Shimoadachi-cho, Yoshida Sakyo-ku, Kyoto 606-8501, Japan

DOI: doi.org/10.20495/seas.3.SupplementaryIssue_3

Poverty-lending Approach vs Financial Systems Approach

Delivering financial services to the rural poor in developing countries is believed to be a costly business. This is because it entails high transaction costs and a perceived high risk due to various reasons that range from the relatively high demand for small loans to precarious livelihoods and the paucity of financial institutions in these areas, which makes for low deposit capability. In addition, formal laws are insufficient in terms of the protection of property rights of privately held collateral. These circumstances compel formal financial institutions to hesitate to provide sufficient services to the rural poor.

Micro-finance Institutions (MFIs) are thought to be the best alternatives to extending loans to the rural poor who are living under the above-mentioned circumstances. A large part of the literature on MFIs has centered on their effectiveness with respect to poverty alleviation from the perspective of the poverty-lending or credit-led approach. Bangladesh’s Grameen Bank is the most notable MFI along this line.

The poverty-lending approach, however, has invited a twofold criticism: financial unviability and limited MFI outreach. First, in what Vogel (1984) referred to as the forgotten half of rural finance, MFIs generally do not provide services for savings primarily due to the misconceived belief that the rural poor are unable to save because of their poverty, and thus, do not respond to savings products. This absence of savings services jeopardizes the financial viability and sustainability of MFIs. Further to this point, most MFI programs incur large loan losses and require frequent capital injections from external organizations. The extensive presence of rotating savings and credit associations (ROSCAs) in the rural areas of developing countries, however, suggests that the low-income people are capable of savings.1) As Rutherford (2000) claims, the rural poor in developing countries have a monetary surplus albeit a limited one. Second, targeting the rural poor and placing a heavy reliance on external organizations for loan funds leads to the problem of poor outreach in terms of the narrow segment of the social strata that is serviced and the limited areas in which these services are provided.

This signifies the need for financial systems or a savings-led approach that emphasizes a commercial financial intermediary between cash-surplus and cash-deficit households through the provision of savings services (Rhyne 2001). Robinson (2001) referred to the shift from the poverty-lending approach to the financial systems approach as being a micro-finance revolution. She claims that “large-scale sustainable micro-finance can be achieved only with a financial systems approach” ( ibid. , 2).

Savings groups (hereafter SGs) epitomize this revolution. SGs have numerous similar forms under different names in different places, such as credit unions, credit cooperatives, savings and loans cooperatives, accumulating savings and credit associations, self-help groups, village banks, self-reliance village banks. Though they have distinct features, taking a blanket interpretation, we define the SG as a member-owned-and-governed financial institution whose funds are contributed almost solely through the internal mobilization of members’ savings under the principle of savings-before-credit. Thus, the SG performs as a financial intermediary among the members within a village community. SGs and credit unions are customarily differentiated in Thailand and Laos in that the former are officially registered savings groups. Thus, SGs are often regarded as semi-formal financial institutions. Though we follow this definition, the two terms are used interchangeably.

MFIs in developing countries are mostly operated under the principle of the poverty-lending approach, whereas there are only a handful of MFIs that employ the financial systems approach. In addition, so far only a few research attempts have been made on the ongoing SGs in developing countries. This special issue attempts to provide empirical evidence on how the SGs of the Lao People’s Democratic Republic (hereafter Laos) serve the needs of rural people and the factors that facilitate or hinder the growth of these groups.

Savings Group Movement in Laos

Laos is primarily an agricultural economy with over three quarters of the total population currently living in rural areas. Since becoming liberalized under the New Economic Mechanism in 1986, the Lao economy has shifted from a socialist economy toward a market-based one. Creating rural financial markets is one of the central mechanisms of policy interventions aimed at moving the economy through a process of becoming a market-based economy. In 1993, the Lao government established the Agricultural Promo tion Bank (APB) as a state-owned bank tasked with extending financial services to rural households by offering subsidized loans for agriculture. However, the APB branch network has remained extremely poor. It also reportedly suffers from high non-performing loans (ADB 2006). To compensate for the insufficient outreach of the APB, the MFIs have taken an active role in rural areas in Laos.

Among the various MFIs in Laos, the SGs initiated by the Foundation for Integrated Agricultural and Environmental Management (FIAM: a Thai NGO) hold a unique position in rural finance. A joint project of the FIAM and Lao Women’s Union (LWU) to form SGs marked the first organized movement of this kind. It took place under the auspices of the Small Rural Development Project for Women (SRDPW). In 2002, another SG movement commenced under the Women and Community Empowerment Project (WCEP) in cooperation with the LWU and the Community Organizations Development Institute of Thailand (CODI: a Thai Government Agency). As the director of the WCEP is an ex-director of the SRDPW, the WCEP organized SGs using the same method as the SRDPW. The SGs have accumulated their loan funds almost solely from members’savings. Though FIAM and CODI delivered technical assistance, including the training of accountants, they did not provide lines of credit, especially after the initial stage of their development.2)

These two projects established the largest SGs in Laos in terms of the number of SGs and their members. Though the SG movement was implemented in cooperation with a government body (LWU), the SGs remain outside the regulation and supervision of the central bank (Bank of Lao).3) Thus, they are regarded as semi-formal financial institutions.

The SG programs were first implemented in the nine districts of Vientiane Municipality by compartmentalizing the districts between the two projects.4) Their services were extended to the other provinces of Luang Prabang, Bolikhamxai, Champasak, and so forth. In the Vientiane Municipality, at the time of our survey, the SGs were servicing more than 90% of the villages and approximately half of the households, realizing greater outreach than the MFIs, based on the poverty-lending approach.

SG membership is self-selected and members are mostly women. As a rule, only women are entitled to obtain loans from the groups. Managing committee members are selected by suffrage from among group members. SGs mobilize savings and extend short-term loans (normally for three- or six-month terms) to members on an individual basis. Though there is no direct link between the loan amount and the extent of a member’s savings, a ceiling on borrowing is set at five times the borrower’s savings amount. Thus, collateral is required. The members determine the group rules, such as the interest rates (normally 3% per month), terms of loans, and the penalty for delinquency.5) Though no interest is paid on savings, members receive dividends from the group’s profits, which is directly proportional to the amount of savings each member has contributed to the group.

The SG is an autonomous financial institution in that it solely relies on the savings mobilized from its own members. Monthly meetings are held to collect savings and disburse loans. Members are required to attend these meetings and to make a deposit every month. Negligence of this duty (generally, three months in a row) results in membership cancelation. To assure high autonomous control of the SG, members have to reside in a sufficiently cohesive area. In other words, the SG is community-based and utilizes community pressure for contract enforcement. Despite its high autonomy, the SG cannot be managed without the supporting institutions (mostly international NGOs) and its donors, particularly in terms of accounting training for poorly educated villagers, who are elected as committee members, as well as monitoring.

Diversified Growth Path

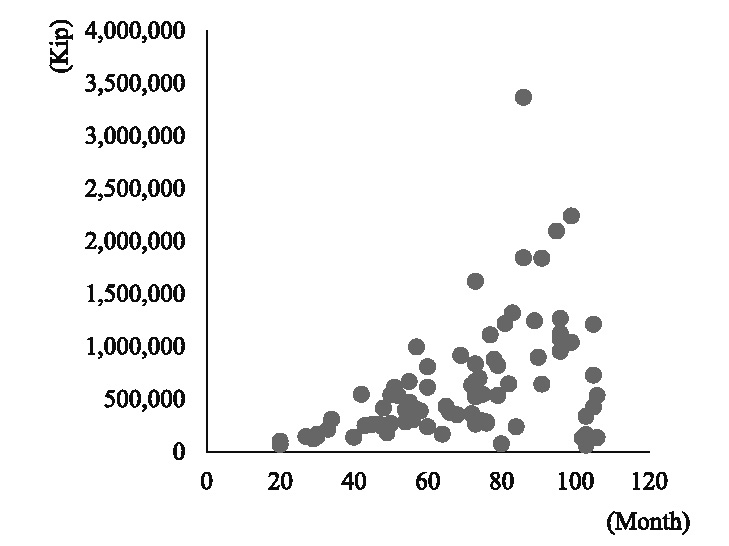

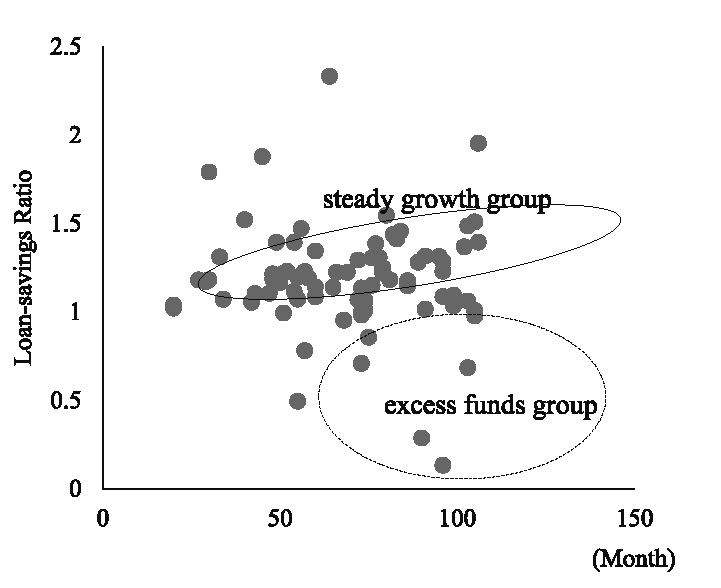

Figs. 1 and 2 demonstrate the diversified growth paths of the SGs in Naxaythong and Pakngum districts of Vientiane Municipality (N=83 surveyed in 2008). While some groups have achieved reasonable growth in terms of average savings per member, others demonstrate only modest growth.

The loans-to-savings (LTS) ratio, a ratio between the total amount of loans and savings (including reserves) of the SGs, is mostly in a range of 1 to 1.5. As a stipulated proportion of the group’s interest profits (generally 10–20%) are accumulated in the group’s loan funds as reserves, in the course of time the LTS ratio will be greater than 1.6) Some groups have an LTS ratio greater than 1.5. This cannot be attained through the normal accumulation of reserves. These SGs are supposed to obtain external funds, called project money, from international NGOs. On the other hand, there are some SGs with an LTS ratio of less than 1. This implies that the total amount of savings exceeds the total amount of loan demands, thus causing an excess- or idle-funds issue. One of the primary aims of this special issue is to identify the factors behind the diversified growth paths of the SGs in Laos.

Different Initial Conditions

The emergence of the SGs/credit unions dates back to the nineteenth-century Germany. This movement diffused throughout the world and has had a prolonged history in many developed countries, such as Japan. The experiences of these countries offer lessons for the SGs in developing countries. However, initial socio-economic conditions differ among countries. To provide a better understanding of Lao SGs, we show the initial conditions that characterize the SG movements in Laos, Japan, and Thailand.

Differences in agrarian structures are likely to affect the performance of SGs. The agrarian societies of Laos and Thailand, during this time, can be said to have been egalitarian, whereas that of pre-war Japan, when the credit union movement was in full swing, was landlord dominated. In Japan, it was the landlord class that exercised initiative in the wide sphere of village politics, including the foundation and management of credit unions. The landlord class constituted a major net saver in the credit unions, while the tenant class was a major net borrower. As a great number of landlords held a stake in regional banks, they drew on credit unions so as to mobilize savings at a lower cost. In addition, purchasing chemical fertilizers was a main reason for borrowing from credit unions. Increasing the use of chemical fertilizers could have stabilized the tenants’ livelihood, and secured land rent for the landlords. Thus, keeping the loan interest rates low was compatible both for the landlord and the tenant classes.

The landlords’ active commitment to credit unions in Japan facilitated their sound management, especially in mobilizing savings (see the first article of this special issue by Ohno). In Laos and Thailand, on the other hand, agriculture was dominated by peasant proprietors. There existed no particular class of households that could be net savers for the SGs. Thus, the savings mobilization required an interest rate or a dividend that was higher than the interest rate of the formal banks.

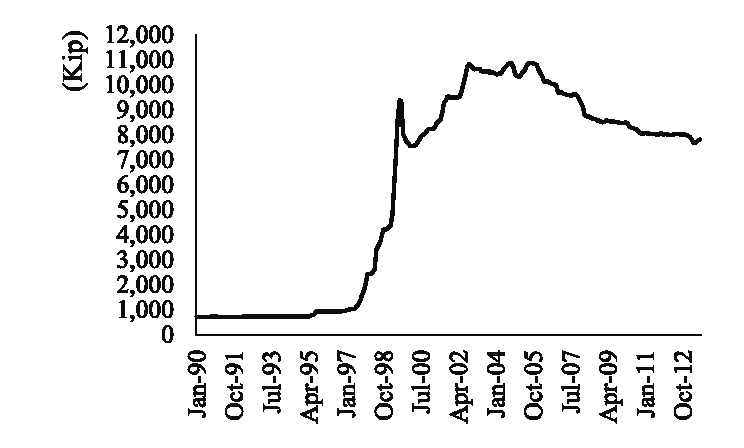

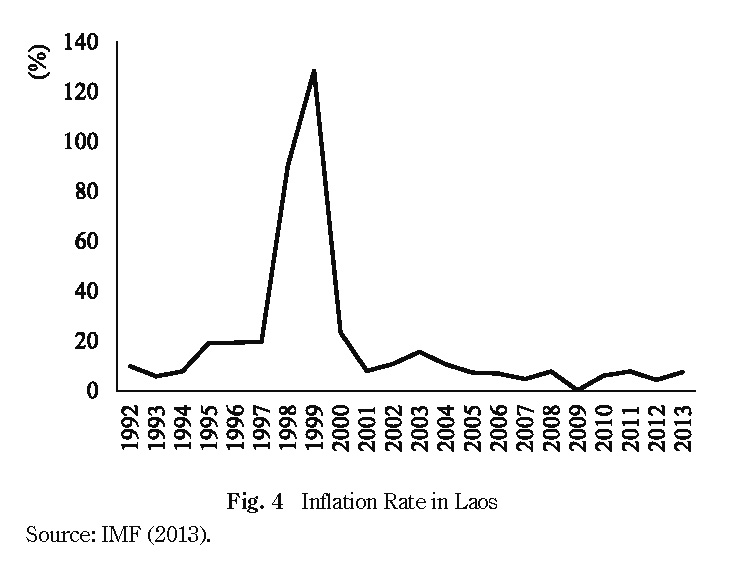

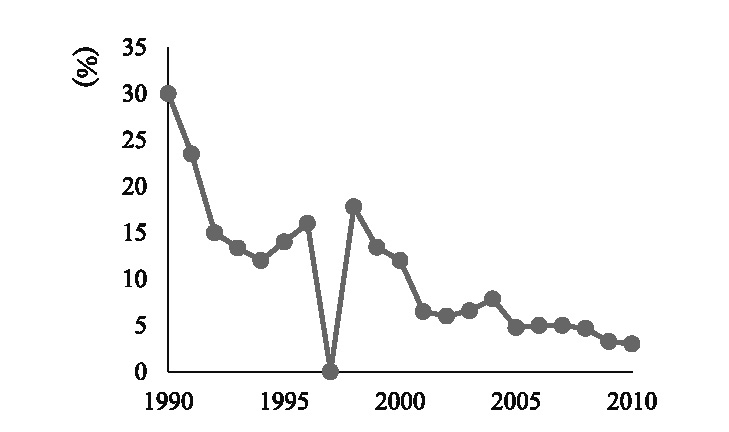

Another notable initial condition is that the Lao economy was incurring economic turbulence when the SG movement had only just begun in the second half of the 1990s. The Lao currency faced a critical loss of confidence in the markets. The Asian financial crisis of 1997 and the mismanagement of the economy by the Lao government resulted in a drastic depreciation of the Kip and a subsequent spiraling of inflation as is shown in Figs. 3 and 4. To secure reasonable dividends, the lending interest rate of the SGs had to be maintained at rates as high as 4–5% per month.

Inflation started to level off at around the turn of the century. Since 2005, the rate has been as low as a single digit. Correspondingly, the annual deposit interest rate of the formal banks (Fig. 5) decreased to below 10%. In 2010, it decreased to below 5%. The Lao SGs started to lower the lending interest rate, but it still remains in a range of 2–3% per month. As 70% of interest revenues are allocated to dividends, the annual dividend is equivalent to 16.8–25.7% of the interest rate on deposits. This is mainly because net savers of these SGs are opposed to lowering the lending interest rate due to a fear of reducing the dividend. This phenomenon was also observed in a Thai SG (see the first article of this issue by Ohno). A low LTS ratio is a serious sign for SGs, as this creates excess funds and, hence, lowers profits and dividends.

Coping with Excess Funds

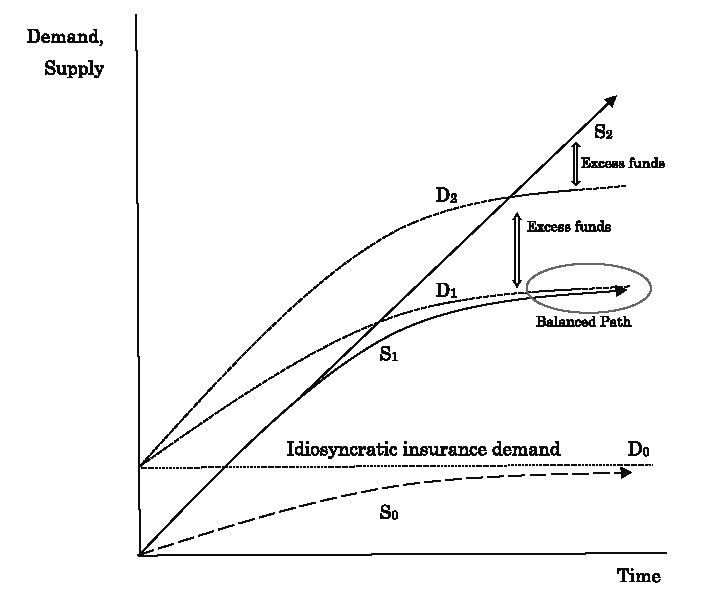

Three possible ways to deal with the excess-funds issue are: (1) lowering the lending interest rate; (2) increasing the demand for loans; and (3) linking excess funds with loan demands outside the SG in a creditable way. These countermeasures against excess funds are represented in Fig. 6. Needless to say, lending the excess funds to non-members who reside outside the village is the worst option, as will be discussed in the sixth article by Fujita in this special issue.

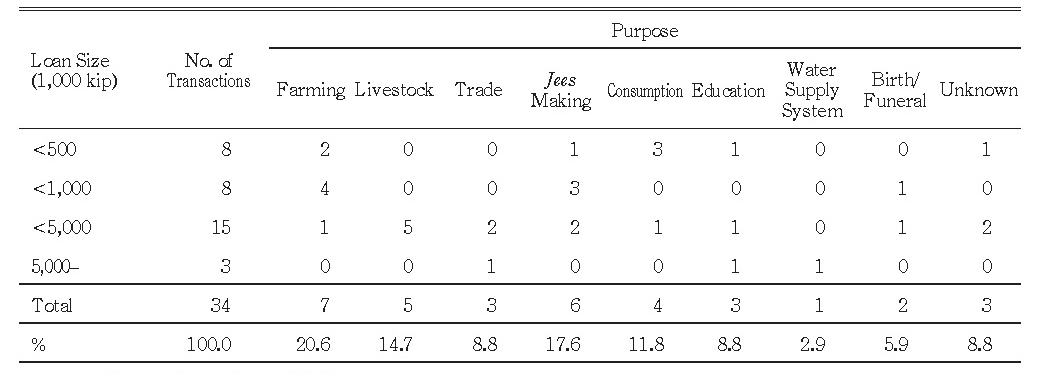

Loans can be classified into those for insurance purposes and those for production. Loan demands for insurance take place idiosyncratically and thus will be more or less constant over time (D 0) as long as generic natural disasters do not hit the village economy. As the fifth article of this issue, by Chansathith, Ohno, Fujita, and Mieno reveals the major purposes of borrowing are for medical treatment and daily consumption. These loans are supposed to deal with shocks and smooth consumption, and are, thus, idiosyncratic in nature. Loans for production purposes constitute the second largest reason for borrowing. Expenditures for planting and harvesting are for agricultural workers’ wages. Purchasing chemical fertilizers accounts for a negligible portion of expenditures. This finding reveals a stark contrast with Japanese credit unions that disbursed loans mainly for the purchase of chemical fertilizers.7)

When loan demands for production purposes are negligible, we cannot expect savings accumulation to occur right from the start. These types of SGs are seen in the backward areas of Luang Prabang Province, as is discussed in the second article of this issue by Fujita, Ohno, and Chansathith. As savings accumulation cannot be expected to grow steadily under such circumstances, SGs will be sluggish, as S 0depicts.

As a village economy develops, total loan demand (D 1) increases. When production methods remain indigenous and excess funds emerge, however, demand easily reaches a plateau. In Japan, an increasing use of chemical fertilizers in the Meiji era shifted the loan demand upward to D2 . In Laos, in contrast, the use of chemical fertilizers was not yet common. Thus, loan demand remained stagnant at D1.

Though shifting loan demand upward leads to a favorable growth of SGs, this does not necessarily deter the emergence of excess funds for long as accumulated savings constantly increased, as indicated by S2. As long as a balanced growth (S1 =D1) cannot be maintained, excess funds emerge by any means. As the loan interest rate was reasonably low in Japan, the Japanese credit unions had to resort to the third measure of linking excess funds to external demand. According to the Industrial Cooperative Law of 1900, the Japanese credit unions were equipped with systematic mechanisms to transfer such funds to other savings-deficient credit unions and even to formal financial markets (banks), including the government bond market. However, the Lao and Thai SGs were totally devoid of such mechanisms.

As mentioned above, the Lao SGs decreased their loan interest rate to achieve a balanced growth path by shifting loan demand upwards and by reducing the growth rate of savings. However, lowering the lending interest rate is difficult for the Lao SGs because members fear a reduction in dividends. Thus, some SGs in the Vientiane Municipality failed to deter the emergence of excess funds. To address this issue, FIAM and CODI established service networks, among the SGs in the Vientiane Municipality, to transfer excess funds to the under-resourced SGs, but with very limited effect.

Let us now introduce the papers to follow. The first paper, entitled “Savings Groups and Rural Financial Markets: Japanese and Thai Experiences,” by Ohno, discusses the SG movements that took distinct growth paths in Japan and Thailand. Historically speaking, the new paradigm of micro-finance, referred to as a revolution by Robinson, is not a recent phenomenon. The first credit union movement in German countryside is known as Raiffeisen’s credit unions (Guinnane 2001).8) The Raiffeisen model was widely trans-planted to other countries, including Japan. In Thailand, a nation-wide SG movement began in 1974. This paper discusses how the rural financial markets created by the SGs/ credit unions were integrated into nation-wide financial markets in Japan and why this integration process did not take place in Thailand. The results offer practical viewpoints for policy interventions aimed to integrate individual SGs with wider financial markets in Laos.

The second and third papers deal with rural financial markets in Luang Prabang Province. The second paper, entitled “Performance of Savings Groups in Mountainous Laos under Shifting Cultivation Stabilization Policy,” by Fujita, Ohno, and Chansathith, examines the SGs in remote and poor villages in the Luang Prabang Province, where market economies are less developed. Though it has been emphasized that low-income people do have savings capacity, in the mountainous villages in Laos SGs show poor savings accumulation. A probit analysis on what facilitates the households’ participation in an SG revealed that the households that secured a constant flow of income tended to join SGs, and those that could obtain cash income in an emergency were more likely to not join an SG. And even though member households obtain loans from SGs to cope with emergency cash expenditures associated with illness, such shock experiences do not affect an intention to join an SG. This seems to be because emergency expenditures have opposite forces. While having experienced an emergency might encourage households to join an SG, the experience may make it difficult for these households to save every month. The surveyed villages had just ceased shifting cultivation, but yet were without sufficiently stable cash income sources. It was also found that medical expenses accounted for 7–28% of total household cash expenditures, depending on the village. These factors hamper the growth of SGs. Our conclusion demonstrates that the SGs are required to deal with emergency expenditures, and that policy interventions that aim to realize a constant flow of income are highly required for the growth of SGs.

The third paper, entitled “Informal Network Finance as a Risk Coping Device in Mountainous Laos,” by Ohno and Chansathith, discusses the importance of the informal network in coping with idiosyncratic shocks. However, they also suggest that the poor have less access to the informal network because the range of the finance network is subject to blood relationships and geographical proximity. Thus, the raison d’etre of the SGs in the remote, backward areas rests on providing micro-insurance to the poor.

The fourth to sixth papers deal with the SGs in the Vientiane Municipality. The fourth paper, by Kongpasa and Mieno, uses the same methodology developed by Coleman (1999) to examine whether SGs enhance the welfare of rural people. Coleman claims that the impact of SGs to the welfare of rural households is insignificant in Northeast Thailand. However, Kongpasa and Mieno found a positive impact of SGs in the Vientiane Municipality.

The fifth paper, by Chansathith, Ohno, Fujita, and Mieno, explores how the SGs function in the four sample villages in the Vientiane Municipality. They examine the borrowing behaviors of rural households, by comparing loans from different lenders: SGs, a formal bank, and informal lenders. These three types of lenders have their own particular features, and thus distinct borrowing functions were obtained among the three types of lenders. A formal bank extends loans for production purposes, while informal lenders do so for risk-coping purposes. SGs fall between the two. Another important finding is that though the rich class participates in SGs more than the poor class does, the latter obtains loans from SGs more than the rich class. Thus, the SG is supposed to function as a financial intermediary between the cash-surplus rich households and the cash- deficient poor households. Also important is the finding that the SGs in the villages with a higher loan demand for production purposes show favorable performance and rapid growth. This will explain the diversified growth paths of SGs in Laos.

The final paper, by Fujita, examines an SG that is facing a serious problem of excess funds. To maintain a high dividend rate, the Don Neua SG extended loans to entrepreneurs outside the village, thus violating the SG’s rules. This eventuated in a problem of non-performing loans. The Don Neua SG in Vientiane Municipality is not exceptional. Integration of independent village financial markets created by the SGs are highly sought after to cope with the excess-funds problem.

We can draw three major policy conclusions from these findings: (1) The management of the SGs is deeply embedded in the social relations of agrarian societies. In Japan, it was the landlord class that exercised the critical initiative in the foundation and management of credit unions. As long as such a social class is nearly non-existent in Laos, support from a third-party body such as an NGO or a government agency is very much required for managing and monitoring SGs. (2) The purposes of loan demand vary from insurance against idiosyncratic risks, primarily in the poor areas, to investment for agriculture, primarily in the irrigated areas. It follows that distinct devices are installed within SGs to deal with the different loan demands in different areas. Special emphasis should be placed on an insurance mechanism for SGs in economically disadvantaged or backward areas. (3) An external institution should be established in Laos to coordinate excess funds, otherwise an excess-funds issue could jeopardize SGs. This is because the SG that is a within-a-village institution is not equipped with an inter-group coordination mechanism.

Accepted: December 22, 2014

Acknowledgments

On behalf of all the authors in this focus group, we would like to thank anonymous referees for their extremely insightful comments, from which we have greatly benefitted. We would also like to acknowledge the financial support from Grants-in-Aid for Scientific Research (No. 20176960).

References

Asian Development Bank. 2006. Rural Finance in the Lao People’s Democratic Republic: Demand, Supply, and Sustainability.

Bank of the Lao P.D.R. Retrieved January 15, 2015 from http://www.bol.gov.la/english/exchrate.html.

Coleman, Brett E. 1999. The Impact of Group Lending in Northeast Thailand. Journal of Development Economics 60(1): 105–141.

Guinnane, Timothy W. 2001. Cooperatives as Information Machines: German Rural Credit Unions, 1883–1914. Journal of Economic History 61(2): 366–389.

International Monetary Fund. 2013. World Economic Outlook Database, 2013. Retrieved January 15, 2015 from http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/index.aspx.

Rhyne, Elisabeth. 2001. Mainstreaming Microfinance: How Lending to the Poor Began, Grew, and Came of Age in Bolivia. Bloomfield, CT: Kumarian Press Inc.

Robinson, Marguerite. 2001. The Microfinance Revolution: Sustainable Finance for the Poor. World Bank.

Rutherford, Stuart. 2000. The Poor and Their Money. Delhi: Oxford University Press.

Vogel, Robert C. 1984. Savings Mobilization: The Forgotten Half of Rural Finance. Undermining Rural Development with Cheap Credit, edited by Dale W. Adams, Douglas H. Graham, and J. D. von Pischke, pp. 248–65. Boulder, Colorado: Westview Press.

1) In Laos, ROSCAs called “houei” can be widely observed in rural areas.

2) Some SGs in the Vientiane Municipality and most SGs in Luang Prabang Province receive seed money, named project funding, at the time of foundation, to a maximum of 10,000,000 kip (US$ 1,000).

3) This hampers the integration of the rural financial markets created by the SGs with the formal financial markets.

4) Note that the Vientiane Municipality split from Vientiane Province in 1989, and the capital of Laos is located there. In 2009, the Vientiane Municipality had 491 villages and 453 SGs.

5) In the initial stage when loan demands exceed savings, interest rate tends to be as high as 4%.

6) Reserves are, as a rule, for loan losses. However, as loan losses are negligible for most of the SGs in Laos, reserves are treated as loan funds.

7) That loans are extended for non-production and production purposes in Laos would make it difficult to estimate the borrowing function (the fifth article of this issue). Furthermore, multiple loan purposes would diversify the growth path of the SGs in Laos.

8) Chronologically, the Schulze-Delitzsch model is the vanguard of credit unions. However, while the model targeted urban areas, the Raiffeisen model was intended for rural areas.