Contents>> Vol. 7, No. 3

Rents, Accumulation, and Conflict in Malaysia

Jeff Tan*

*Institute for the Study of Muslim Civilisations, Aga Khan University, The Aga Khan Centre, 10 Handyside Street, London, N1C, United Kingdom

e-mail: jeff.tan[at]aku.edu

DOI: 10.20495/seas.7.3_309

This paper examines conflict in Malaysia through an analysis of rents and the relationship between the economic imperative for growth and political imperative for stability. It links episodes of conflict and political instability to the social forces that drive the allocation of rents and the impact of these rents on the pattern of accumulation. It examines how the emergence and expansion of the Malay intermediate classes increased contestation and conflict over the allocation of rents that compromised the state’s ability to balance the political imperative for stability with the economic imperative for growth. It traces Malaysia’s long-term economic slowdown associated with premature deindustrialization to the state prioritizing rents for accommodation (redistribution) over rents for learning and accumulation.

Keywords: rents, accumulation, conflict, growth, stability, deindustrialization, Malaysia

I Introduction

Malaysia’s political economy is usually analyzed in terms of policy swings between state intervention and economic liberalization. The former is seen as a response to political pressures for redistribution and the latter as a response to the growth imperative. The withdrawal of the state through economic liberalization is thus considered desirable by reducing rent seeking and corruption associated with state intervention. The implicit assumption here is that state intervention is intrinsically inefficient (because politicians pursue their own interests) and is an invitation to rent-seeking behavior. This draws from public choice theory (see, e.g., Krueger 1974; 1990; Buchanan 1980; Boycko et al. 1996) and is consistent with the elite-centered approach where state intervention is analyzed in terms of political capture of the state by individual politicians who then redistribute public resources to secure political support (see, e.g., Jesudason 1989; Bowie 1991; Gomez 2002).

Several problems can be identified with the elite-centered explanation. First, the public choice critique of state intervention and rents fails to distinguish between different types of rents and ignores the role of some types of rents in the development process historically. Second, the discussion of rent seeking largely excludes discussion of rent seekers, that is, the social forces that pursue rents and influence the allocation of rents. Instead, elite-centered explanations focus on the role of individual political leaders, with analysis of the state and state intervention similarly removed from social forces that the state is invariably connected to. Third, conflict tends to be examined in terms of interethnic rivalries that are seen as the cause of political instability rather than the outcome of pressure from social forces seeking rents.

This paper provides an alternative approach to the issue of conflict in Malaysia through an analysis of rents in order to provide a broad overview of the relationship between the economic imperative for growth and political imperative for stability since independence. It develops a framework to link episodes of conflict and political instability to the allocation of rents and pattern of accumulation in Malaysia. It does this by distinguishing between the different types of rents needed in the development process, the social forces that drive the allocation of these rents, and the impact of the allocation of rents on growth and stability (section II). The paper then applies this framework to Malaysia (section III) and argues that the emergence and expansion of social forces, specifically the Malay intermediate classes, increased contestation and conflict over the allocation of rents. This compromised the state’s ability to balance the political imperative for stability with the economic imperative for growth because of the nature of the state’s relationship with these classes. Malaysia’s long-term economic slowdown can be traced to the state prioritizing rents for accommodation (and hence stability) over rents for learning and accumulation. This corresponds with premature deindustrialization and the increasing frequency and intensity of conflict.

II Rents, Accumulation, and Conflict

The development process entails the transfer of resources from less to more productive sectors and classes. Historically this redistribution has been associated with the process of industrialization and occurred through the allocation of rents for learning (to promote manufacturing) and accumulation (to support the emergence of an industrial capitalist class). As any form of economic redistribution is invariably contested, rents associated with economic growth will usually need to be supplemented with rents for accommodation to secure political stability, usually by buying off dissent or purchasing support during a period of socioeconomic transformation. The allocation of rents in the development process will thus be informed by the imperatives for growth and stability.

Conflict can be understood as an outcome of the contestation over rents (or rent seeking) that affects the allocation of rents for growth and stability. As contestation involves social forces, the analysis of rents needs to be supplemented with an analysis of the social forces that drive (or oppose) the allocation of rents. At the same time, the analysis of accumulation helps explain growth outcomes based on the types of rents prioritized. The remainder of this section elaborates on the relationship between rents, growth, and stability (section II-1); the role of social forces in shaping how rents are allocated (section II-2); and how contestation and conflict are driven by rent seeking and triggered or exacerbated by economic slowdown (section II-3).

II-1 Rents and Patterns of Accumulation

The development process is typically characterized by two competing requirements—the economic imperative for growth and the political imperative for stability. Political stability is both a condition for accumulation and hence economic growth, and also contingent on economic growth because economic prosperity provides the basis for, and the resources to, secure political legitimacy and hence stability. The purchase of political support for stability thus depends on sustainable patterns of accumulation and growth. Declining growth rates can lead to instability by reducing the state’s ability to distribute rents and hence dispense patronage necessary for stability. This is also why instability and conflict often coincide with economic slowdown or crises.

Accumulation can broadly refer to the process of wealth creation through productive or unproductive investments in productive or unproductive sectors. Growth associated with productive accumulation in productive sectors tends to be more sustainable than growth from unproductive accumulation in unproductive sectors. The pattern of accumulation describes the prevailing or dominant types of productive or unproductive investment and sectors that characterize an economy, and can be illustrated through the sectoral shares of GDP. Both growth and stability involve the allocation of different types of rents, and the relationship between growth and stability is mediated through these rents. Rents are typically defined in (neoclassical) economics as “excess incomes” higher than the minimum next-best opportunity (Milgrom and Roberts 1992, 269) that should not exist in efficient markets. However, rents have been a central feature of late industrialization as illustrated by the experiences of Japan, South Korea, and Taiwan (see Amsden 1989; Wade 1990; Chang 1994) because new technology needs to be produced and learned and new property rights created (Khan 2000b).

Late industrialization entails the allocation of rents to promote learning for technological adaptation by providing incentives for emerging industries (ibid.; Bhide 2005; Gries and Naude 2008), particularly as new technology is often only acquired through the process of learning-by-doing (Arrow 1962). These rents include “conditional subsidies” (Amsden 1989) and “performance-indexed rewards” (World Bank 1993) that are “conditional on the achievement of learning over a specified time-frame” (Khan 2000b, 22). Rents for learning are thus potentially productive as they can contribute to technological acquisition and industrial upgrading, even if this entails initial costs and deadweight losses (Khan 2000a).

At the same time, rents for accumulation are needed to create new property rights because developing countries typically lack a domestic capitalist class able to participate in the industrialization process. These rents function to promote accumulation (or wealth creation) and include subsidies (e.g., soft loans) and “transfers . . . which convert public property into private property” (e.g., privatization and land grabs) (Khan 2000b, 36, 38) akin to the process of “primitive accumulation” of the Enclosures Act in England (Marx 1867). As with rents for learning, rents for accumulation are also potentially productive provided they lead to investment in productive sectors. In the context of late industrialization, productive sectors would necessarily center on manufacturing.

The allocation of rents for learning and accumulation will usually need to be supplemented with rents for accommodation to maintain political stability (Khan 1998a). This is because the redistributive features of rents, in particular the creation of new property rights, will invariably be contested, particularly by groups or classes that have been excluded, as was the case in Pakistan in the 1950s and 1960s (Khan 1999). Rents for accommodation can be viewed as side payments to particular groups or classes that potentially threaten political stability and/or whose support the state depends on for legitimacy (Khan 1998a; 1998b; North et al. 2007). These can take the form of the “limited access order” (LAO) that restricts access to valuable resources or activities (North et al. 2007) or politically motivated redistributive policies that form the basis for a stable “elite bargain” (Di John and Putzel 2009; Varkkey 2014, 189) or that serve to consolidate political control and stability (Dunning 2005). LAOs are often also related to primitive accumulation centered on natural resource extraction that may be productive and form the basis for sustainable growth, for example where timber concessions help create a wood furniture industry. In this case, rents for accommodation also function to promote accumulation. Politically motivated redistribution can range from handouts in the form of small or medium state contracts and public employment, to large-scale cash transfers (Varkkey 2014) and are generally unproductive.

The allocation of both sets of rents thus affects accumulation in different ways. Rents for learning and accumulation associated with industrialization are potentially growth enhancing (depending on how these are allocated and managed) and are thus more likely to lead to sustainable patterns of accumulation. Rents for accommodation may result in accumulation but are generally unproductive and growth reducing because they are allocated primarily for political expediency and can result in unsustainable patterns of accumulation, even if productive accumulation may sometimes occur as an unintended outcome. They are nonetheless often necessary as political stability is a precondition for accumulation and hence growth.

The sustainability of patterns of accumulation refers to the ability of different types of investments and sectors to sustain long-term growth, and is a reflection of the net effect of productive and unproductive rents. Sustainable patterns of accumulation suggest a positive net effect of rents, where the benefits of rents to promote growth outweigh the costs of rents to maintain stability. Unsustainable patterns of accumulation suggest a negative net effect of rents, where the benefits of rents to promote growth are outweighed by the costs of rents to maintain stability. As it would be difficult to quantify the actual costs and benefits of different rents (see Khan 2000b), determining the net effect can be based on evidence in the literature of the success of rents for learning and accumulation, and changes in the allocation of rents for accommodation.

II-2 Social Forces and Rent Seeking

Social forces are central in the discussion of rents because they are both an outcome and driver of rent allocations. Insofar as rents are connected to social transformations associated with the capitalist transition, these will lead to the emergence of new social classes that include both (emerging) capitalist and non-capitalist classes. The former are often the outcome of rents aimed at promoting late industrialization, and the latter typically comprise economically inactive or uncompetitive classes seeking political accommodation. These social classes constitute social forces where they exert political pressure over subsequent allocations of rents.

Rents are typically allocated through informal patron-client networks as part of “traditional” forms of relationships between rulers and the ruled (ibid.). Patron-client exchanges are “repeated exchanges between patrons and clients” that survive in early capitalist societies because

personalised and specific payoffs from patrons to clients provide a very efficient mechanism of purchasing political support by allowing the accommodation and incorporation of key groups of clients . . . where the state is not strong enough to enforce order by force. (Khan 1998b, 115)

Patron-client networks “organise payoffs to the most vociferous opponents of the system” and are thus “an effective if costly way of maintaining political stability where there is a lack of support for emerging capitalism and capitalists” (ibid.).

This suggests that the impact of social forces on the allocation of rents will depend on: (a) the composition and preferences of new social classes; (b) their connection to the state; and (c) the balance of power between these social forces and the state. Economically active classes include emerging capitalists who are more likely to favor productive rents and sectors. Economically inactive classes include traditional (feudal) pre-capitalist classes and emerging intermediate classes that comprise the petty bourgeoisie, salaried and professional employees, and low-level public officials (Hodges 1961; Khan 2005; 2010). The latter classes are more likely to favor unproductive rents and sectors. These could include rents for accommodation such as (public) employment opportunities and rents for accommodation through accumulation in protected and/or non-tradable sectors.

The influence of these classes will depend on their connection with the state and the balance of power between them and the state. The economic imperative means that the state will tend to prioritize growth when it is connected to economically active classes as the interests of the state and these classes are likely to coincide, and as growth also provides revenue to secure political legitimacy. This is especially so where the balance of power is in favor of the state, enabling it to enforce performance conditionalities associated with learning rents that are necessary for technology upgrading and efficiency gains in dynamic sectors related to manufacturing (Khan 2004).

Where the balance of power is not in favor of the state, even potentially productive rents for learning and accumulation may lead to inefficient outcomes. This is because intense competition between developing countries to move up manufacturing global value chains within global production networks (GPNs), and the high risks with only modest returns in the short term, act as major disincentives for manufacturing (Razmi and Blecker 2008; Whittaker et al. 2010). At the same time financialization creates perverse incentives for the pursuit of unsustainable accumulation in finance, insurance, real estate, and other non-tradable, protected, and unproductive sectors (see Brenner 2002; Duménil and Lévy 2004; Stockhammer 2004; 2005; 2008; Krippner 2005). In the absence of sufficient disciplinary capacity, the state will be unable to sanction non-performance by removing rents from underperforming firms or ensure that rents for accumulation lead to investments in productive sectors (Khan 2000b).

The state is more likely to prioritize the political imperative for stability where it is connected to economically inactive classes and where the balance of power is unfavorable. As the domestic capitalist class (where this exists) in developing countries tends to be small and politically weak, the state is more often connected with traditional (feudal) pre-capitalist classes and emerging intermediate classes. Some segments of the intermediate classes may be economically active (e.g., small traders and shopkeepers), but in general these classes tend to be those left behind because they are unable to compete in the modern economy.

The intermediate classes are, however, often “collectively the most powerful political group in most developing countries” (Khan 2005, 718) and “provided a significant proportion of the political entrepreneurs of recent history” (Khan 2010, 62), thus constituting a major social force seeking rents in many developing countries (Fine 1997; Khan 2000a; North et al. 2007). The state’s connection to the intermediate classes is thus usually one based on political support for ruling political parties or the threat of political instability associated with the withdrawal of this support. This “tension between the redistributive demands coming from factional politics and the imperative of ensuring economic growth largely through the capitalist sector can result in sharp shifts in state policy” ranging from politically motivated redistribution to specific patron-client factions and “dramatically pro-capitalist policies” (Khan 2010, 62).

II-3 Rent Seeking, Contestation, and Conflict

Conflict arises from contestation by social forces over the allocation of resources in general and rents more specifically. The frequency and intensity of conflict depend on the degree of contestation. The degree of contestation is in turn shaped by the composition of social forces and changes in the balance of power. The propensity toward conflict also corresponds with economic slowdown or crises and is related to the state’s inability to allocate further rents for accommodation because unsustainable patterns of accumulation cannot deliver sufficient growth for redistribution. Patterns of accumulation that are unsustainable, for example where rents are allocated in protected or non-tradable sectors, are thus more prone to conflict, especially during economic crises.

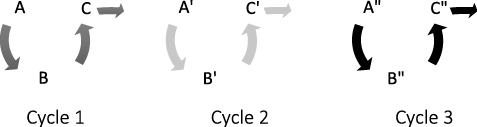

The relationship between rent seeking and conflict can be illustrated in terms of cycles of accumulation and conflict (Fig. 1) . The allocation of rents shapes the pattern of accumulation (A) that brings about social transformations and the emergence of new social forces (B). These new social forces contest the subsequent allocation of rents, which in turn fuels conflict and culminates in an episode of conflict (C). The outcome of this conflict depends on the state’s connections with society, the nature of this relationship, and the balance of power between the state and segments of society it is connected to. The types of rents related to accumulation and accommodation then create a new pattern of accumulation (A′) that brings about further social transformations and leads to new emerging social forces (B′) through the allocation of rents, setting off a new cycle of contestation and episode of conflict (C′) and eventually another new cycle of accumulation and conflict (A″/B″/C″).

Fig. 1 Cycles of Accumulation and Conflict

Notes: A/A′/A″ (pattern of accumulation); B/B′/B″ (social forces); C/C′/C″ (episode of conflict).

III Cycles of Accumulation and Conflict in Malaysia

The framework of cycles of accumulation and conflict can help explain the relationship between accumulation and conflict in Malaysia based on the analysis of rents and social forces. The allocation of rents illustrates the tension between growth and stability that has been a central feature of Malaysia’s political economy across four phases of development: Phase 1 (1957–69), Phase 2 (1970–85), Phase 3 (1986–99), Phase 4 (2000–16). Each phase of development broadly corresponds with a cycle of accumulation and conflict that is characterized by a specific pattern of accumulation and episode(s) of conflict. The discussion below is by no means comprehensive but instead tries to provide a historical overview of how social forces influence economic outcomes (patterns of accumulation) and the impact of this on political stability. Patterns of accumulation are assessed in terms of changing sectoral shares of GDP. Indicators of political instability and conflict draw loosely from the idea of “elite fractiousness” that is typically reflected in leadership contests, cabinet changes and dismissals, and party splits (see, e.g., Case 2014).

Section III-1 examines the three types of rents allocated in Malaysia across the four phases of development, and the impact of these rents on the pattern and sustainability of accumulation. Section III-2 looks at the two-way relationship between rent allocation and emerging social forces, where the Malay intermediate classes emerged as a result of early rents for accommodation, and where the subsequent push for an expansion of these rents led to the rapid growth of these classes and specific patterns of accumulation. Section III-3 examines how increasing contestation and conflict over rent allocation are driven by social forces and correspond with economic slowdown related to unsustainable patterns of domestic accumulation.

III-1 Rents and Patterns of Accumulation in Malaysia

Rents for Learning

Early rents to promote import-substitution industrialization (ISI) in Phase 1 (1957–69) sought to modernize and diversify the economy through tax exemptions (the 1958 Pioneer Industry Ordinance) and high tariffs after 1966, mainly in the packaging and assembly of imported components for the protected domestic market (Jomo and Edwards 1993; Lim 2011; Rasiah 2011). Rents were also allocated to promote Malay participation in manufacturing through the Rural Industrial Development Authority and by stipulating a 10 percent reservation of share capital for Malays in pioneer industries (Lim 1985, 42). The inherent limitations of ISI in a small domestic market and the failure of import-substitution industries to move beyond basic manufacturing and assembly activities (see Jomo and Edwards 1993) were mirrored in the pattern of accumulation by the end of Phase 1 that was dominated by agriculture (33.1 percent of GDP compared to 13.1 percent for manufacturing) and reflected in a modest average growth rate over this phase of 6.5 percent (Lim 2011). (Unless indicated, data in this section is taken from the World Bank’s World Development Indicators.)

Rents for ISI were supplemented with rents to promote export-oriented industrialization (EOI) in Phase 2 (1970–85) through the 1968 Investment Incentives Act and 1971 Free Trade Zones Act. These offered tax holidays, tax and tariff exemptions, investment credits, and infrastructural facilities to attract foreign direct investment (FDI) that “translated into substantial rents” for export-oriented (foreign) manufacturing firms (Rasiah 2011). This coincided with the increase globally of FDI, the emergence of GPNs, and Malaysia’s position within the region as a node of, and intersection for, the Japanese and US electronics industry production chains (Tanaka and Kenney 1996). This was reflected in changes in the pattern of accumulation, with the manufacturing share of GDP increasing from 13.1 percent to 19.7 percent by 1985, and in higher average growth rates over this phase at 6.9 percent.

Rents for a second round of ISI in domestic heavy industries in Phase 3 (1986–99) were a response to the limitations of FDI-led industrialization and

an emerging industrial dualism between the foreign domination of a high-technology, dynamic export sector and almost all internationally competitive non-resource based industrial capability, and a domestic manufacturing sector restricted to small and medium domestic firms mainly in assembly and subcontracting and disconnected from high-technology production and heavy industries. (Tan 2014, 158)

These rents were introduced at the end of Phase 2 to support the Heavy Industries Corporation of Malaysia (HICOM), which included Proton—the national car company—through high protection rates and a Vendor Development Programme to guarantee contracts for local companies as part of local content requirements.

Rents were also allocated for EOI in Phase 3 through the 1986 Promotion of Investment Act and 1986 Industrial Master Plan and included incentives for local sourcing, export credit refinancing, tax relief, tax deductions, and support for export promotions (Rasiah 2011). Rents for learning also targeted high-technology industries as part of wider economic policies to develop human capital and a knowledge economy (Lim 2011). EOI benefited from a second round of (mainly Japanese and Taiwanese) FDI that led to the rapid growth of manufactured exports (from 27.2 percent at the end of Phase 2 in 1985 to 80 percent by 1999) and increased manufacturing growth (from an average of 9.6 percent in Phase 2 to 11.3 percent in Phase 3, in spite of a 13.4 percent contraction in 1998 following the Asian financial crisis). This pattern of accumulation was reflected in the industry and manufacturing shares of GDP (46.5 percent and 30.9 percent respectively), and average growth rate of 7 percent (in spite of a 9.6 percent contraction in 1998).

Rents in Phase 4 (2000–16) focused on industrial upgrading in line with the Second Industrial Master Plan (1996–2005) and the Eighth and Ninth Malaysia Plans (2001–5 and 2006–10). However, the New Economic Model in 2010 marked a shift toward higher value-added activities in resource-based industries, particularly petrochemical, pharmaceutical, and food product industries, through R&D, FDI, and “dynamic industry clusters,” along with greater private partnerships with government-linked companies (GLCs) and a reduction of direct state involvement. This was reflected in the pattern of accumulation where export-led growth in manufacturing continued to rely on FDI while domestic accumulation was largely driven by GLCs and in non-manufacturing sectors, including resource-based industries. This corresponded with a fall in the industry share of GDP from 46.5 percent to 38.3 percent, and manufacturing from 30.9 percent to 22.2 percent, while services increased from 42.7 percent to 53 percent. The growth of the service sector was dominated by the state or by labor-intensive, low-technology services (wholesale and retail trade, hotels, restaurants) with limited scope for productivity increases, and a decline in modern services that are synonymous with support for the manufacturing sector (OECD 2016) that is consistent with premature deindustrialization.

Rents for Accumulation

While rents for learning would normally be complemented with rents for accumulation to promote the emergence of a domestic (industrial) capitalist class, this was not the immediate case in Malaysia because of the nature of social forces. Early rents for learning were not necessarily in manufacturing because of the economic dominance of foreign (mainly British) capital in plantations and mining, the political weakness of a domestic (ethnic Chinese) capitalist class, and preferences of emerging Malay capitalists and intermediate classes (discussed further in section III-2). Instead, rents for accumulation were closely tied with the political accommodation of economically inactive or uncompetitive classes and were already widespread in Phase 1.

Article 153 of the Federal Constitution amounted to “the first legal action to create a Malay bourgeoisie” (Lim 1985, 40) by preserving the “special position” of Malays and natives of Sabah and Sarawak through affirmative action. Malay businesses were offered protection through quotas for transport licenses (in 1958), timber licenses (1964), and government contracts (1964) (ibid.). Assistance was provided in the form of credit, the creation of Bank Bumiputera, and training for small businessmen and Malay professionals. The initial process of increasing Malay corporate ownership centered on the 1968 Capital Issues Committee, which set share prices, usually below market value, for Malay individuals and state-owned enterprises (SOEs), with 10 percent of shares of public limited corporations reserved for Malays (ibid.; Jesudason 1989). Large government expenditure on infrastructure as part of (rural) socioeconomic policies in the first three development plans provided enormous rents for Malay contractors (Lim 1985, 41).

In the absence of a Malay capitalist class, the state led the accumulation process in Phase 2 under the New Economic Policy (NEP). This centered on the acquisition of shares that provided quick control of well-managed, profitable companies, particularly in the “commanding heights of the economy” (e.g., British plantations and tin mines) (Jesudason 1989). Rents for accumulation were facilitated by regulations and laws to increase Malay equity and access to capital. The Industrial Coordination Act (1975) required companies to set aside 30 percent of shares issued for Malay equity.

Banking guidelines directed lending to priority sectors and categories of borrowers, with the designation of Malays as a “priority group” requiring a minimum of 20 percent of new loans allocated to Malay individuals or Malay-controlled companies (Searle 1999). This was supported by increasing state control and ownership of the banking sector, which influenced lending patterns and ensured compliance with lending targets for Malays (Chin and Jomo 2000). The Credit Guarantee Corporation (1972) provided credit to small and later medium enterprises in agriculture, commerce, and industry. The establishment of Bank Bumiputera in 1965 (as a direct response to Malay demands at the first Bumiputera Economic Congress) and takeovers of Malayan Banking in 1969 and United Malayan Banking Corporation in 1976 provided the state with ownership of the three largest commercial banks. This led to low interest rates, easy credit, and preferential lending for Malay businesses, often with risky forms of collateral and the acquisition of shares without the cash payment of capital but with the future earnings of allotted shares (Tan 1982). The easy access to finance was supported by even larger public funds from the state despite the poor track record of Malay businesses (Jesudason 1989).

Rents for accumulation in Phase 3 centered on privatization and the stock market. Privatization can be seen as a response to the distributional constraints and inefficiencies of the NEP by prioritizing growth over redistribution (Felker 1998). It centralized policy making and rent allocation more narrowly among a smaller group of businessmen through the management of key government-linked projects, and sought to institutionalize direct, high-level, state-business networks to foster private-public cooperation and consultation for industrial upgrading (Lall 1995; Felker 1998). It also represented an acceleration of the accumulation process through the direct sale of public assets at discounted prices, and tendering of (large) public infrastructure concessions (Tan 2008) that benefited a smaller group of (mainly) Malay capitalists close to the leadership of UMNO (United Malays National Organisation, the ruling Malay party), sometimes as proxies for the party itself (see Gomez 1991). The state promotion, and rapid growth, of the stock market allowed for the capture of rents through higher share prices and access to relatively cheap funds (Chin and Jomo 2001). Investment in equities was encouraged through changes in government lending guidelines in 1992 that authorized banks and non-monetary financial institutions to hold stocks in privatized SOEs, effectively increasing the share prices of these companies.

Rents for domestic accumulation in Phase 4 centered on a new round of state-led accumulation mainly in protected or non-tradable sectors through the investment activities of government-linked investment companies (GLICs) and GLCs. These public corporations represented a return to state-led accumulation following the failure of privatization and bailouts of large (Malay) conglomerates, including some of the largest beneficiaries of privatization (Tan 2008). GLCs received rents through their domination of key economic sectors (most notably banking) and also allocated rents for learning and accumulation through procurement policies and wider entrepreneurship support schemes.

Procurement policies included government (privatization) contracts allocated to large Malay companies for the purposes of accumulation, while small contracts allocated to individual Bumiputera contractors functioned as rents for accommodation. Both types of contracts constituted rents for accommodation in unproductive sectors associated with construction. These rents were also institutionalized within individual state departments and government ministries as quotas for Malay contractors. For example, in 2008 the Ministry of Works introduced a 10 percent “Distribution Policy” to small Class F Malay contractors for projects worth RM10 million and above that was extended in 2010 to larger Class E Bumiputera contractors (Malaysia 2009).

The Bumiputera Empowerment Programme required Malay participation in major infrastructure projects as part of ongoing state privatization contracts for Malay companies (see Tan 2015). RM10.6 billion, or 50 percent of total work packages under Line 1 of the Mass Rapid Transit project, for example, was allocated to Malay contractors (TERAJU 2017). Similarly, Skim Permulaan Usahawan Bumiputera (SUPERB, Bumiputera Entrepreneurs Start Up Scheme) allocated RM100 million to 200 new start-up companies between 2014 and 2017 (ibid.). These functioned as rents for both learning and accumulation.

Rents for Accommodation

Rents for accommodation were related to the political imperative for stability and crises of legitimacy, and were needed to secure political support at each phase of development. These rents also often intersected with rents for accumulation. Early state intervention in Phase 1 to improve the poor socioeconomic position of Malays was necessary to secure UMNO’s political support (Lim 1985; Jomo 1990) and a reflection of the state’s connection with the Malay rural populace that formed its core constituency. These rents included the creation of public enterprises with redistributional objectives to promote new economic activities, rural development and infrastructure projects discussed previously, and expanded education and public employment opportunities (Salleh and Meyanathan 1993).

Rents for accommodation were greatly expanded in Phase 2 under the NEP, especially through education and employment opportunities, as a direct response to UMNO’s electoral losses in 1969 and demands of the Malay intermediate classes, most notably through the youth wing of UMNO. This led to significant increases in government expenditure on education and a university quota system that greatly increased Malay enrollment at university from 1,038 (28.8 percent of total enrollment) in 1967–68 to 17,692 (70.6 percent) by 1980 (Malaysia 1971; 1976; 1981). Greater access to education through a quota system (first introduced by the British for its Malay Administrative Service) also facilitated Malay employment in the public sector, which expanded rapidly as a result. The bureaucracy grew fourfold to 521,818 employees by 1983, public sector expenditure increased over tenfold to RM35.4 billion in 1982, and the number of SOEs increased from 109 to 656 by 1980 (Khoo 1995).

These rents for accommodation were maintained into Phases 3 and 4 and were supplemented with the increased allocation of various privatization contracts for segments of the Malay intermediate classes that had expanded significantly as a result of rents for accommodation and accumulation in Phase 2. Ongoing and increasing allocations of rents for accommodation were related to increasing pressure from low-level UMNO members who constituted part of the Malay intermediate classes, including over 28,000 small (Class F and G1) Bumiputera contractors. Large-scale cash transfers to secure votes were introduced in Phase 4 through Bantuan Rakyat 1Malaysia (BR1M, 1Malaysia People’s Assistance) as a response to a loss of political legitimacy after the ruling Barisan Nasional (National Front) coalition lost the popular vote in 2008 and 2013. BR1M disbursed RM5.4 billion to 7.3 million recipients between 2012 and 2016 (Anand 2016). This paralleled earlier rural (infrastructure) development expenditure.

The Failure of Rents for Learning and Accommodation

The literature on Malaysia suggests that rents for learning and domestic accumulation did not promote industrial upgrading and successful accumulation in manufacturing. The failure of learning rents was evident in each phase of development. Phase 1 was characterized by the inability of import-substitution industries to move beyond basic manufacturing and assembly activities. In Phase 2 domestic manufacturing remained restricted to “small and medium domestic firms mainly in assembly and subcontracting [that was] disconnected from high-technology production and heavy industries” (Tan 2014, 159) with low local content and limited linkages and technology transfer between multinational corporations (MNCs) and domestic firms outside the FTZs (Warr 1989; Jomo and Edwards 1993; Ali 1994; Ariff 1994). Phase 3 suffered from “ongoing structural weaknesses related to low aggregate technology levels, minimal technology spillovers and weak supply chains, with a heavy dependence on imported components” (Tan 2014, 161). The failure of learning and industrial upgrading was reflected in the inability and/or unwillingness of domestic companies to move into higher-technology sectors in the face of increasing competition, and ultimately in the shift away from manufacturing that characterized premature deindustrialization in Phase 4.

Similarly, rents for accumulation were unsuccessful in promoting accumulation, let alone accumulation in manufacturing across all four phases, with the historic failure of numerous high-profile Malay entrepreneurs (Lim 1985; Lim 2000). Early attempts to transfer wealth to Malays in Phase 1, through Amanah Saham Nasional (ASN, National Unit Trust Scheme), for example, reached only a small number of Malays, with many subsequently divesting rather than accumulating. Phase 2 was characterized by Ali-Baba relationships (where politically connected but economically inactive Malays known as “Ali” partnered with economically active ethnic Chinese capitalists referred to as “Baba”) or the divestment of government contracts or concessions for a quick profit. As a result, the NEP did not produce a class of dynamic Malay entrepreneurs (Gale 1981; Jesudason 1989; Salih 1989; Bowie 1991; Khoo 1995; Crouch 1996; Gomez and Jomo 1997).

The failure of rents for accumulation in Phase 3 was reflected in renationalizations and/or the state bailout of numerous prominent Malay capitalists and large Malay conglomerates associated with privatization, including some of the largest privatization projects (Tan 2008). This failure was epitomized by the inability and unwillingness of Proton’s private owner DRB to continue financing substantial R&D costs in the face of global competition and mounting debts, and its subsequent move into largely protected, non-tradable sectors following the renationalization of its subsidiary Proton (ibid.; Tan 2014). The failure of HICOM was largely connected to the failure of Proton and highlights the underlying tension between the imperatives for growth (accumulation) and redistribution (accommodation). Proton’s competitiveness depended not only on technological acquisition to produce a Malaysian car that was competitive, but also on the efficiency of the Malay vendors from which Proton was obliged to source 80 percent of its components. Proton’s inability to acquire and develop its own technology, compounded by ongoing high costs associated with local content requirements, meant that it remained uncompetitive in terms of technology and pricing. This was emblematic of the wider failure of industrial upgrading and the state’s inability to ensure learning rents translated into efficiency gains.

The Sustainability of Patterns of Accumulation

The overall failure of potentially productive rents associated with learning and accumulation, and increasing unproductive rents for accommodation suggests a negative net effect of rents. However, this is not reflected in economic growth rates, particularly in Phases 2 and 3. One explanation is that accumulation was largely driven by MNC-led manufacturing exports that occurred outside of the allocation of these rents, with early rents for accommodation, particularly in Phase 2, also financed by natural resource rents associated with high oil and commodity prices (Felker 2014).

Nonetheless, the reliance on MNC-led industrialization and growth had implications for domestic technological and manufacturing capabilities, particularly given the failure of rents for learning and accumulation. This was reflected in the dual industrial structure that emerged in Phase 2, and the shift away from manufacturing associated with premature deindustrialization in Phase 4. The corresponding economic slowdown in Phase 4 reduced available resources for rent allocation in the face of increasing demands for redistribution from social forces, particularly the Malay intermediate classes.

This was illustrated in the increasing demands for more government projects from low-level UMNO members who constituted part of the Malay intermediate classes, which compelled the government to allocate increasing amounts of rents for unproductive and unsustainable forms of accumulation. This included RM600 million in small contracts in 2006 allocated to all 191 UMNO divisions (Ong 2006), “more small-scale infrastructure projects in rural areas throughout the country . . . to cater to the needs of the 28,000-strong Bumiputera class F contractors” in 2014, and continued government assistance (UMNO 2014). Alongside these rents for accommodation were rents for unproductive accumulation in construction, with RM4.4 billion allocated between 2001 and 2005 to 27 Bumiputera contractors (Malaysia 2006, 228).

III-2 Social Forces and Rent Seeking in Malaysia

Social forces are central in the discussion of rents in Malaysia and can be seen as drivers and by-products of rent allocations across all four phases of development. The emergence of the Malay intermediate classes was the direct outcome of rents for accommodation in Phase 1 that were institutionalized as part of Malay “special rights.” These rents were aimed mainly at UMNO’s rural constituency by promoting socioeconomic development through infrastructure development, education, and public employment opportunities. The Malay intermediate classes included businessmen, white-collar professionals, civil servants, and middle-income groups (Jomo 1999). The growth of these classes in Phase 1 was reflected in the increase in “middle” social status Malay legislators from 10 percent (1955) to 42 percent (1964) (Neuman 1971). This increase was accounted for by Malay teachers (with 80 percent of the Federation of Malay Teachers Association being UMNO members), Malay businessmen, and junior civil servants (who registered a fourfold increase) (Clarke 1964, cited in Neuman 1971, 229).

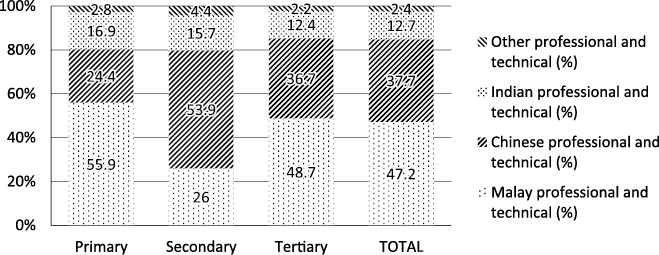

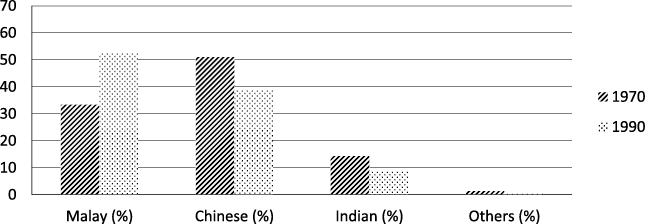

This early evidence can be supported by examining official data on the employment shares of ethnic groups in middle class jobs. A breakdown by occupation and sector shows that Malays already dominated “professional and technical” occupations (47.2 percent) compared to Chinese (37.7 percent) and Indians (12.7 percent) in 1970, particularly in the primary and tertiary sectors, where Malays accounted for 55.9 percent and 48.7 percent of employment respectively (Fig. 2.1).

Fig. 2.1Employment Shares by Ethnic Group and Professional and Technical Category, 1970

Source: Malaysia (1976).

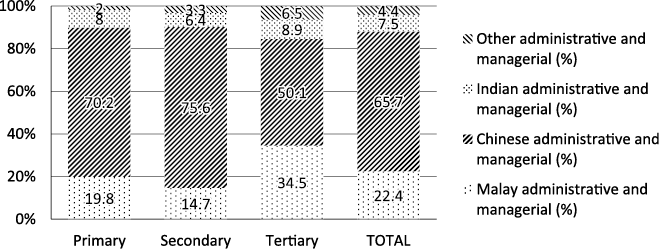

Malay representation was slightly less for total “clerical” positions (33.4 percent) compared with Chinese (51 percent) (Fig. 2.2), but this is far from being poorly represented as is often argued. Only in “administrative and managerial” positions was Malay participation significantly lower (22.4 percent) overall compared with Chinese (65.7 percent) (Fig. 2.3). Even then, the share of Malay administrators and managers in the tertiary sector (34.5 percent) was far from poor and not surprising given that this sector included public administration.

Fig. 2.3 Employment Shares by Ethnic Group and Administrative and Managerial Category, 1970

Source: Malaysia (1976).

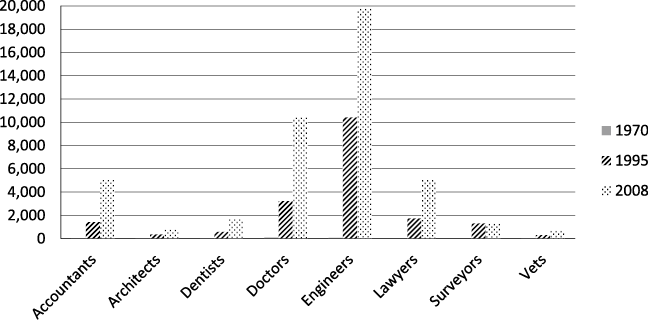

Similarly, there was already a reasonably large number of registered Malay (Bumiputera) professionals, contrary to official NEP figures provided in the various Malaysia Plans. The discrepancy appears to be based on the number of Malay professionals actually registered with their respective professional/trade bodies (architects, accountants, dentists, doctors, engineers, lawyers, surveyors, and veterinary surgeons) rather than the total numbers of people engaged in these professions. As a result, official figures show that there were only 40 Malay accountants, 12 architects, 20 dentists, 79 doctors, 66 engineers, no lawyers or surveyors, and 8 veterinarians in 1970 (Malaysia 1976), which seems rather implausible.

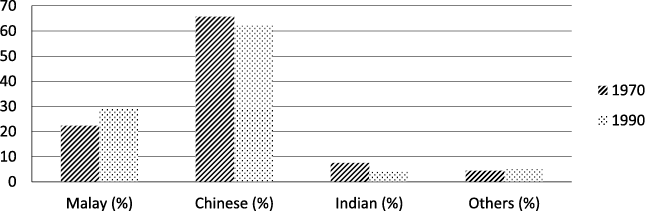

The 1967–68 Department of Statistics household survey (Choudhry 1970, cited in Hirschman 1975) provides more insight into the size of this segment of the Malay intermediate classes, even if the classification is slightly different (Fig. 3). This shows that in 1967 Malay professionals were overrepresented as “teachers” (62 percent) and “scientists” (60 percent), well represented in “other medical” (36 percent), and underrepresented only as “architects and engineers” (18 percent) and “physicians and dentists” (16 percent). Again, the actual number of Malay registered professionals (in absolute terms and as a share of each occupational category) is not insignificant, particularly the 28,379 teachers who also constituted UMNO’s membership and support base.

Fig. 3 Professional and Technical Occupations by Ethnic Community (males), Peninsular Malaysia, 1967 (%)

Source: Choudhry (1970), cited in Hirschman (1975).

The presence of these intermediate classes before 1970 thus constituted the main social forces that were also connected to the state through UMNO and who needed to be accommodated. Heightened expectations and aspirations, along with the inability of the civil service to continue absorbing emerging university graduates, contributed to the impatience of the Malay middle class and demands for greater government intervention in favor of economic redistribution (Tan 1982; Jomo 1990; Gomez and Jomo 1997). Demands made at the first and second Bumiputera Economic Congress in 1965 and 1968 subsequently formed the basis of the NEP in Phase 2.

The NEP greatly increased rents for accommodation and contributed to the significant growth of the Malay intermediate classes. The new Malay middle class grew from 12.9 percent (1970) to 27 percent (1990) (Crouch 1993) and, by one estimate, more than tenfold between 1970 and 1998 (see Jomo 1999). This was mirrored in the expansion of the Malay intermediate classes in terms of “professional and technical,” “administrative and managerial,” and “clerical” occupation categories between 1970 and 1990, where the Malay share of employees increased from 47.2 percent to 60.5 percent, 22.4 percent to 28.9 percent, and 33.4 percent to 52.4 percent respectively (Figs. 4.1– 4.3). The increased share of Malays in these occupational categories was mirrored by a corresponding decline in the share of other ethnic groups.

Fig. 4.1 Employment by Ethnic Group and Professional and Technical Category, Peninsular Malaysia, 1970 (%)

Sources: Malaysia (1976; 1996).

Fig. 4.2 Employment by Ethnic Group and Administrative and Managerial Category, Peninsular Malaysia, 1970 (%)

Sources: Malaysia (1976; 1996).

Fig. 4.3 Employment by Ethnic Group and Clerical Category, Peninsular Malaysia, 1970 (%)

Sources: Malaysia (1976; 1996).

The most revealing indicator of the growth of the Malay intermediate classes was in the number of registered Bumiputera professionals in the eight prized professions as prioritized by the government, with the most significant increase being in the number of engineers from 66 (1970) to 7,018 (1990) (Malaysia 1976; 1996). This coincided with an increase in the percentage of Bumiputera contractors registered with the Ministry of Works from under 30 percent (1970) to 63 percent (1980) (Lim 1985) and the longer-term increase in Class F (sole proprietor) Bumiputera contractors, supported by the increase in construction-related privatization contracts (see Tan 2015).

State-led accumulation through the control of publicly listed companies by state agencies also created a small but powerful “bureaucratic-capitalist elite” able to resist government attempts to impose budgetary discipline (Jomo 1986; Mehmet 1988; Bowie 1991; Bruton 1992; Jomo and Tan 1999). A powerful group of professional and trustee Malay executive directors increasingly active in business, former state managers, and Malay millionaires also began to appear in the late 1970s (Lim 1985; Jesudason 1989; Searle 1999). This emerging class of Malay businessmen has been variously described as Malay trustees, figurehead capitalists, executive-professional directors, executive-trustee directors, functional capitalists, bureaucrats-turned-businessmen, and state-managers-turned-owners (Khoo 2005, 28). Also included were politicians-turned-businessmen, UMNO proxy capitalists-turned-businessmen, and UMNO proxy capitalists-turned-corporate captains.

The emergence of these social forces was mirrored in changes in the occupational background and outlook of UMNO leaders and grassroots members, with schoolteachers and other local leaders replaced by businessmen and university-educated professionals produced by the NEP (Crouch 1993; Searle 1999). These classes were directly connected to the state through their membership of UMNO and were able to influence the allocation of rents by providing support for leadership contests, where growing elite fractiousness tilted the balance of power from patrons to clients. “Middle class elements” were able to completely take over UMNO by the early 1980s, and by the time privatization was introduced there was already a large Malay middle class, including younger, more professionally trained managers whose support was important and who had to be accommodated (Jomo 1999; Milne and Mauzy 1999).

The shift from the NEP in Phase 2 to privatization in Phase 3 was in part driven by these social forces, including economically active segments of the Malay intermediate classes and Malay big businessmen who stood to benefit most. Privatization, along with the state promotion of the stock market, accelerated the allocation of rents for accumulation and led to the expansion of Malay large capitalists who were also closely associated with key UMNO leaders (patrons), even acting as proxies for the party or individual leaders and thus deeply entrenched in competing patron-client networks (see, e.g., Gomez 1991; 2002). Smaller privatization contracts also led to the growth of segments of the Malay intermediate classes, most notably Malay contractors.

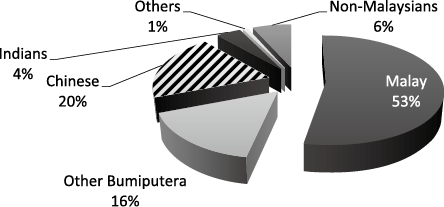

This accounted for the very high numbers and share of Malay contractors in Phase 4 that was a legacy of early construction-related rents associated with (rural) infrastructure projects in Phase 1. Employment data for “status by ethnic group” in 2013 provides some supporting evidence, with Malays making up only 38 percent of employers (compared to 48 percent for Chinese) but 53 percent of own account workers (20 percent Chinese) (Fig. 5). Own account workers are self-employed, and this corresponds with the rapid growth of Bumiputera professional engineers (Fig. 6) and very large numbers of Class F (sole proprietor) Malay contractors dependent on government (construction-related) contracts (Tan 2015) that constituted emerging social forces in Phase 4.

Fig. 5 Employed Persons by Status in Employment and Ethnic Group: Own Account Workers, 2013

Source: Malaysia (2013).

Fig. 6 Registered Bumiputera Professionals, 1970, 1995, 2008, Total

Sources: Malaysia (1971; 1996; 2011).

III-3 Rent Seeking, Contestation, and Conflict in Malaysia

Much of the political conflict and instability over Malaysia’s four phases of development can be traced to the growing contestation over the allocation of rents. This contestation can be observed in key episodes of conflict reflected in elite fractiousness that often diverts attention from the role of social forces driving changes in rent allocation. The emerging Malay intermediate classes in Phase 1 increased demands for greater government intervention in favor of economic redistribution (Tan 1982; Jomo 1990; Gomez and Jomo 1997). Pressure was exerted through UMNO and Malay business associations that largely represented medium-scale enterprises dependent upon bureaucratic patronage (e.g., the Associated Malay Chambers of Commerce, Selangor Malay Chambers of Commerce, and Kuala Lumpur Petty Traders Association) (Lim 1985; Ho 1988; Jesudason 1989; Felker 1999). Demands and threats made at the first and second Bumiputera Economic Congress (itself created in response to Malay business demands) in 1965 and 1968 culminated in “race riots” on May 13, 1969 that were orchestrated by segments of UMNO (Cham 1975; Kua 2007; Raja Petra 2009). The manifestation of violence as “race riots” tends to obscure the underlying conflict over rent allocation within UMNO between rival factions that resulted in the removal of Tunku Abdul Rahman as prime minister and suspension of parliament.

Increased conflict in Phase 2 was the direct result of contestation for rents by the greatly expanded Malay intermediate classes and economic imperatives related to the unsustainable expansion of the public sector. The changing composition of the Malay middle class reshaped the internal politics within UMNO local branches. Increasing economic patronage changed the nature of patron-client relationships, transforming local UMNO representatives into political patrons. Elected Members of Parliament who were previously political patrons (providing political support in return for economic benefits) greatly increased their control of the district development machinery, which enabled MPs to distribute development benefits and purchase continued support (Shamsul 1986).

Malay businessmen became an important force in the internal politics of UMNO, increasing factional struggles for nomination and outbreaks of violence at UMNO branch and division meetings after 1984 (ibid.; Khoo 1992; Crouch 1993; Aziz 1997). Increasing contestation in Phase 2 culminated in the UMNO leadership challenge by “Team B” (led by Finance Minister Razaleigh Hamzah and Deputy Prime Minister Musa Hitam) in 1987 (Khoo 1992; Crouch 1993). Prime Minister Mahathir Mohamad’s narrow victory led to the removal of Team B cabinet ministers, the departure of Team B UMNO members, and the creation of a rival Malay political party, Semangat 47. Mahathir’s “Team A” received support from an NEP class of Malay businessmen who benefited from the subsequent introduction of privatization in Phase 3.

Increasing fragmentation of patron-client networks and factionalization within UMNO also made it harder for the political leadership to discipline Malay businessmen whose political support it depended on (see Tan 2008). The constraints on the state’s disciplinary capacity, along with preferences of the Malay intermediate classes for protected, non-tradable, and unproductive sectors of the economy, affected the types of rents and patterns of accumulation. As a result, rents for accumulation shifted away from manufacturing (where domestic firms generally remained uncompetitive) and into construction, real estate, and finance (Tan 2014).

Conflict at the end of Phase 3 related to the sacking of Deputy Prime Minister Anwar Ibrahim in 1997, which was the outcome of growing contestation and factionalization within UMNO over increasingly personalized patronage networks that centered on individual political leaders (Gomez 2002). The narrowing channels of rent allocation to a small circle of Malay capitalists closely associated with the prime minister, “together with the rapid and visible rise of a few selected Bumiputera businessmen under Mahathir’s leadership . . . led to increasing discontent” and “dissatisfaction over the allocations of government contracts, government funded projects, and the perceived beneficiaries of privatized projects and licenses” (Zainal and Bhattasali 2008, 28).

Phase 4 featured two key episodes of conflict. The first was the removal of Abdullah Badawi as prime minister in 2009 following UMNO’s poor performance in the 2008 general election, highlighting the importance of political legitimacy. The second centered on the dismissal of Muhyiddin Yassin as deputy prime minister in 2015 over questions about the financial scandal at 1MDB. The creation of 1MDB itself was part of state strategies for accumulation by distributing patronage to segments of the Malay intermediate classes, such as Class F contractors. In this case, the negative net effect of rents meant that the pattern of accumulation was increasingly unsustainable, thereby increasing the likelihood of conflict.

Episodes of conflict in each phase of development related to the economic imperative for growth and corresponded with economic slowdown or crises that occurred as a result of external shocks and/or internal factors. Conflict at the end of Phase 1 occurred against a backdrop of high unemployment and poverty that was accentuated along ethnic lines. Low levels of job creation lagged behind population growth, contributing to an increase in unemployment from 6 percent (1960) to 8 percent (1970), while poverty was estimated at 49.3 percent (74 percent for Malay households) (Abdul Rahman 1996).

Conflict in Phase 2 was related to the fiscal burden of a large, financially draining public sector associated with the NEP, which became unsustainable with the global recession in the 1980s when GDP growth fell from 7.8 percent (1984) to −1.1 percent (1985). Government expenditure was further constrained by falling oil prices (1982–86), the collapse of the tin market (1985), and declining prices of other major exports (after 1984) (Gomez and Jomo 1997) that substantially increased the budget deficit from RM120 million (1981) to RM3.5 billion (1987). The fall in oil prices in 1982 coincided with declining natural resource rents from 29 percent of GDP to 20 percent, leading to a reduction in government expenditure from 18 percent to 14.5 percent between 1982 and 1984 (World Bank), which constrained the state’s ability to redistribute.

Conflict in Phase 3 occurred during the 1997–98 Asian financial crisis when GDP growth fell from 10 percent (1996) to −7.4 percent (1998). Again, the very sharp decline in natural resource rents as a share of GDP from 37.6 percent (1979) to 8.1 percent (1999) further curtailed government expenditure, which declined from 16.7 percent (1986) to 9.8 percent (1998) as a share of GDP. Conflict in Phase 4 corresponded with a long-term economic slowdown associated with premature deindustrialization from 2000 that was exacerbated by the global financial crisis in 2008. Average economic growth was the lowest, at 5.1 percent, in Phase 4; and growth was even lower, at 4.6 percent, after Najib Razak’s appointment as prime minister in 2009. Lower economic growth made it increasingly difficult to finance and distribute patronage, leading to the prime minister’s increased centralization of control of GLICs and GLCs (Gomez et al. 2018) and short-term, risky, and blatant forms of accumulation, most notably through 1MDB.

IV Conclusion

This paper has sought to explain conflict in Malaysia in terms of the tension between economic growth and political stability. These imperatives have necessitated the analysis of different types of rent to promote growth and maintain stability, and the influence of social forces in their allocation. Stability depends on sustainable growth for the continued transfer of rents for accommodation. Sustainable growth in turn depends on sustainable patterns of accumulation that require a positive net effect of rents, where the benefits of rents to promote learning and accumulation outweigh the costs of rents for accommodation.

The state’s capacity to promote productive accumulation, manage learning rents, and limit rents for accommodation was constrained by its connections, through UMNO, with the Malay intermediate classes, and the threat these classes posed as UMNO’s core membership and constituency. These classes increased pressure for redistribution, initially through rents for accommodation that were disconnected from the drivers of economic growth in the manufactured exports sector. Domestic patterns of accumulation that accompanied the growth of the Malay intermediate classes, and the transition of segments of these into businessmen, were often short term and unsustainable, centered on the pursuit of quick profits such as through the sale of shares and contracts allocated to Bumiputera. This required continued state support in the form of protection and increasing rents for accumulation in unproductive sectors.

Despite what would appear to be a negative net effect of rents across the four development phases, the state was able to promote (non-domestic) accumulation and hence growth through MNC-led industrialization. However, the long-term consequence of the disconnect between domestic accumulation and manufacturing was the lack of domestic technological and manufacturing capabilities to compete globally, a subsequent shift in the pattern of domestic accumulation away from manufacturing, and the long-term economic slowdown after 2000 associated with premature deindustrialization, with growth no longer driven by manufacturing.

Conflicts in each phase of accumulation were related to unsustainable patterns of accumulation arising from the allocation of rents for accumulation in sectors outside of manufacturing, and the state’s inability to ensure that learning rents led to technological and industrial upgrading. Conflict across all four phases of development was the logical outcome of increasing contestation in the context of the greatly expanded Malay intermediate classes and economic slowdown and/or crisis. This heightened contestation and conflict over rent allocation led to an increasingly factionalized UMNO and fragmented patron-client networks, shifted the balance of power, and compromised the state’s ability to balance economic and political imperatives because political patrons were increasingly reliant on the political support of clients in UMNO elections. This made it more difficult for the state to withdraw rents or enforce discipline and performance targets because the balance of power was not in its favor.

In the absence of a successful Malay capitalist class, the state once again took the lead in the accumulation process through GLICs and GLCs in Phase 4. GLCs were thus an economic and political response to the failure of Malay capital. However, accumulation preferences under GLCs further reinforced Malaysia’s shift away from manufacturing and toward unsustainable patterns of accumulation. Political contestation increased pressure on patrons (politicians) to allocate rents for accommodation that increasingly also included rents for accumulation. Hence, where rents for accumulation were previously kept separate and enabled the state to promote accumulation in productive sectors such as manufacturing, the allocation of rents for accumulation for the purposes of accommodation led instead to increasingly unproductive forms of accumulation in unproductive sectors.

Several implications arise from these observations. First, the political influence of the Malay intermediate classes has been largely understudied and underestimated. The creation of these classes was important for achieving interethnic parity and hence maintaining stability, but their expansion fueled further conflict and political instability. Contrary to the elite-centered focus in the literature on conflict in Malaysia, the analysis of rents and patron-client networks suggests that elite fractiousness is largely a manifestation of underlying political pressure from clients, particularly the Malay intermediate classes, through their connections with various political factions within UMNO.

Second, the idea that the Malay middle classes emerged and expanded as a result of conscious planning by a “developmentalist state” (Abdul Rahman 1996) is based on an elite-centered analysis of the state that is disconnected from society and social forces. The incorporation of the demands of the Malay intermediate classes into the NEP suggests that these classes were already present and exerted political influence. State interventions and motivations thus need to be anchored in an analysis of social forces and their connections with the state.

Third, premature deindustrialization is itself related to the state prioritizing unproductive over productive rents and foreign-led over domestic manufacturing. This potentially increases the future likelihood of increasing contestation and conflict in the absence of alternative sources of sustainable growth.

Accepted: June 29, 2018

References

Abdul Rahman Embong. 1996. Social Transformation, the State and the Middle Classes in Post-Independence Malaysia. Southeast Asian Studies 34(3): 56–79.

Alavi, R. 1998. Management of Protection Policy: Lessons from Malaysian Experience. In Malaysian Industrialisation: Governance and the Technical Change, edited by I. Yussof and A. G. Ismail, pp. 254–265. Bangi: Penerbit Universiti Kebangsaan Malaysia.

―. 1996. Industrialisation in Malaysia: Import Substitution and Infant Industry Performance. London: Routledge.

Ali, A. 1994. Technology Transfer. In Malaysia’s Economy in the Nineties, edited by Jomo K. S., pp. 171–193. Petaling Jaya: Pelanduk Publications.

―. 1993. Technology Transfer in the Malaysian Manufacturing Sector. In Industrializing Malaysia: Policy, Performance, Prospects, edited by Jomo K. S., pp. 190–209. London: Routledge.

Ali, A.; and Wong, P. K. 1993. Direct Foreign Investment in the Malaysian Industrial Sector. In Industrializing Malaysia: Policy, Performance, Prospects, edited by Jomo K. S., pp. 77–117. London: Routledge.

Amsden, A. 1989. Asia’s Next Giant: South Korea and Late Industrialization. Oxford: Oxford University Press.

Anand, R. 2016. Budget 2017 Sees BR1M Hikes. Malay Mail Online. October 21. http://www.themalaymailonline.com/malaysia/article/budget-2017-sees-br1m-hikes, accessed February 11, 2018.

Ariff, M. 1994. External Trade. In Malaysia’s Economy in the Nineties, edited by Jomo K. S., pp. 1–36. Petaling Jaya: Pelanduk Publications.

Arrow, K. 1962. The Economic Implications of Learning by Doing. Review of Economic Studies 29: 155–173.

Aziz, Zariza Ahmad. 1997. Mahathir’s Paradigm Shift. Taiping: Firma.

Bhide, A. 2005. What Role Entrepreneurship in India? Chazen Web Journal of International Business. http://www.gsb.columbia.edu/chazen/journal, accessed February 11, 2018.

Bowie, A. 1991. Crossing the Industrial Divide (State, Society and the Politics of Economic Transformation in Malaysia). New York: Columbia University Press.

Boycko, M.; Shleifer, A.; and Vishny, R. 1996. A Theory of Privatization. Economic Journal 106(435): 309–319.

Brenner, R. 2002. The Boom and the Bubble: The US in the World Economy. London: Verso.

―. 1976. Agrarian Class Structure and Economic Development in Pre-industrial Europe. Past and Present 70: 30–75.

Bruton, H. 1992. Sri Lanka and Malaysia. Washington, DC: Oxford University Press.

Buchanan, J. 1980. Rent Seeking and Profit Seeking. In Toward a Theory of Rent Seeking Society, edited by J. Buchanan, R. Tollison, and G. Tullock, pp. 3–15. College Station: Texas A&M University Press.

Case, W. 2014. Malaysia’s Unexceptionalism: Like Elsewhere, Elites Are Fractious. In Malaysia: Policies and Issues in Economic Development, edited by ISIS, pp. 36–49. Kuala Lumpur: Institute of Strategic and International Studies Malaysia.

Cham, B. N. 1975. Class and Communal Conflict in Malaysia. Journal of Contemporary Asia 5(4): 446–461.

Chang H. J. 1994. The Political Economy of Industrial Policy. Basingstoke: Macmillan.

Chin K. F.; and Jomo K. S. 2001. Financial Liberalisation and System Vulnerability. In Malaysian Eclipse: Economic Crisis and Recovery, edited by Jomo K. S., pp. 90–133. London: Zed Books.

―. 2000. Financial Sector Rents in Malaysia. In Rents, Rent Seeking and Economic Development, edited by M. H. Khan and Jomo K. S., pp. 304–326. Cambridge: Cambridge University Press.

Crouch, H. 1996. Government and Society in Malaysia. Ithaca: Cornell University Press.

―. 1993. Malaysia: Neither Authoritarian nor Democratic. In Southeast Asia in the 1990s: Authoritarianism, Democracy and Capitalism, edited by K. Hewison, R. Robison, and G. Rodan, pp. 133–158. Sydney: Allen & Unwin.

―. 1992. Authoritarian Trends, the UMNO Split and Limits to State Power. In Fragmented Vision: Culture and Politics in Contemporary Malaysia, edited by J. Kahn and F. Loh, pp. 21–42. Sydney: Allen & Unwin.

Department of Statistics, Malaysia. 2015. Malaysia Economic Statistics Time Series 2015. Putrajaya: Department of Statistics, Malaysia.

Di John, J.; and Putzel, J. 2009. Political Settlements: Issues Paper. International Development Department, University of Birmingham.

Doner, R.; and Ritchie, B. 2001. Economic Crisis and Technological Trajectories: Hard Disk Drive Production in Southeast Asia. Paper presented at the Workshop on Innovation and Crisis—Asian Innovation after the Millennium, Massachusetts Institute of Technology, September 15–16.

Duménil, G.; and Lévy, D. 2004. Capital Resurgent: The Roots of the Neoliberal Revolution. London: Harvard University Press.

Dunning, T. 2005. Resource Dependence, Economic Performance, and Political Stability. Journal of Conflict Resolution 49(4): 451–482.

Evans, P. 1995. Embedded Autonomy. Cambridge: Policy Press.

Felker, G. 2014. Malaysia’s Development Strategies: Governing Distribution-through-Growth. In Routledge Handbook of Contemporary Malaysia, edited by M. Weiss, pp. 133–147. Abingdon: Routledge.

―. 1999. Malaysia’s Innovation System. In Technology, Competitiveness and the State: Malaysia’s Industrial Technology Policies, edited by Jomo K. S. and G. Felker, pp. 98–120. London: Routledge.

―. 1998. Political Economy and Malaysian Technology Policy. In Malaysian Industrialisation: Governance and the Technical Change, edited by I. Yussof and A. G. Ismail, pp. 82–127. Bangi: Penerbit Universiti Kebangsaan Malaysia.

Fine, B. 1997. Privatization: Theory and Lessons from the UK and South Africa. Seoul Journal of Economics 10(4): 373–414.

Gale, B. 1981. Politics and Public Enterprise in Malaysia. Singapore: Eastern Universities Press.

Gomez, E. T. 2002. Introduction: Political Business in East Asia. In Political Business in East Asia, edited by E. T. Gomez, pp. 1–33. London: Routledge.

―. 1994. Political Business: Corporate Involvement in Malaysian Political Parties. Townsville: James Cook University.

―. 1991. Money Politics in the Barisan Nasional. Kuala Lumpur: Forum.

Gomez, E. T.; and Jomo, K. S. 1997. Malaysia’s Political Economy: Politics, Patronage and Profits. Cambridge: Cambridge University Press.

Gomez, E. T.; Padmanabhan, T.; Kamaruddin, N.; Bhalla, S.; and Fisal, F. 2018. Minister of Finance Incorporated: Ownership and Control of Corporate Malaysia. Singapore: Palgrave Macmillan.

Gries, T.; and Naude, W. 2008. Entrepreneurship and Structural Economic Transformation. Research Paper No. 2008/62. Helsinki: UNI-WIDER.

Henderson, J.; and Phillips, R. 2007. Unintended Consequences: Social Policy, State Institutions and the “Stalling” of the Malaysian Industrialization Project. Economy and Society 36(1): 78–102.

Hirschman, C. 1975. Ethnic Social Stratification in Peninsular Malaysia. Washington, DC: American Sociological Association.

Ho K. L. 1988. Indigenizing the State: The NEP and the Bumiputra State in Peninsular Malaysia. PhD dissertation, Ohio State University.

Hobday, M. 2000. East versus Southeast Asian Innovation Systems: Comparing OEM- and TNC-Led Growth in Electronics. In Technology, Learning and Innovation, edited by L. Kim and R. Nelson, pp. 129–169. Cambridge: Cambridge University Press.

Hodges, D. 1961. The “Intermediate Classes” in Marxian Theory. Social Research 28(1): 23–36.

Jesudason, J. 1989. Ethnicity and the Economy: The State, Chinese Business, and Multinationals in Malaysia. Singapore: Oxford University Press.

Jomo K. S. 2002. Privatization’s Distributional Impact in Malaysia. New York: Initiative for Policy Dialogue Task Force Working Paper.

―. 2001. From Currency Crisis to Recession. In Malaysian Eclipse: Economic Crisis and Recovery, edited by Jomo K. S., pp. 1–46. London: Zed Books.

―. 1999. A Malaysian Middle Class? Some Preliminary Analytical Considerations. In Rethinking Malaysia, edited by Jomo K. S., pp. 126–148. Hong Kong: Asia 2000.

―. 1990. Whither Malaysia’s New Economic Policy? Pacific Affairs 63(4): 469–499.

―. 1986. A Question of Class: Capital, the State and Uneven Development in Malaya. Singapore: Oxford University Press.

Jomo K. S.; and Edwards, C. 1993. Malaysian Industrialisation in Historical Perspective. In Industrializing Malaysia: Policy, Performance, Prospects, edited by Jomo K. S., pp. 14–39. London: Routledge.

Jomo K. S.; and Tan K. W. 1999. Industrial Policy in East Asia: Lessons for Malaysia. Kuala Lumpur: University of Malaya Press.

Kennedy, J. C. 2002. National Economic Action Council Executive Director Dato’ Mustapa Mohamed on Economic Growth and Investment in Malaysia. Academy of Management Executive 16(3): 8–14.

Khan, M. H. 2010. Political Settlement and the Governance of Growth-Enhancing Institutions. Draft Paper in Research Paper Series, Department of Economics, SOAS, University of London.

―. 2005. Markets, States and Democracy: Patron-Client Networks and the Case for Democracy in Developing Countries. Democratization 12(5): 704–724.

―. 2004. State Failure in Developing Countries and Institutional Reform Strategies. In Annual World Bank Conference on Development Economics—Europe 2003, pp. 165–195. Washington, DC: World Bank.

―. 2000a. Rent-Seeking as Process. In Rents, Rent-Seeking and Economic Development: Theory and Evidence in Asia, edited by Mushtaq H. Khan and Jomo K. S., pp. 74–144. Cambridge: Cambridge University Press.

―. 2000b. Rents, Efficiency and Growth. In Rents, Rent-Seeking and Economic Development: Theory and Evidence in Asia, edited by M. H. Khan and Jomo K. S., pp. 21–69. Cambridge: Cambridge University Press.

―. 1999. The Political Economy of Industrial Policy in Pakistan 1947–1971. Department of Economics Working Paper No. 98, SOAS, University of London.

―. 1998a. Patron-Client Networks and the Economic Effects of Corruption in Asia. European Journal of Development Research 10(1): 15–39.

―. 1998b. The Role of Civil Society and Patron-Client Networks in the Analysis of Corruption. In Corruption and Integrity Improvement Initiatives in Developing Countries, pp. 111–127. New York: UNDP, Management Development and Governance Division.

Khoo B. T. 2005. Ethnic Structure, Inequality and Governance in the Public Sector: Malaysian Experiences. Democracy, Governance and Human Rights Programme Paper No. 20. Geneva: UNRISD.

―. 1995. Paradoxes of Mahathirism. Kuala Lumpur: Oxford University Press.

Khoo K. J. 1992. The Grand Vision: Mahathir and Modernisation. In Fragmented Vision: Culture and Politics in Contemporary Malaysia, edited by J. Kahn and F. Loh. Sydney: Allen & Unwin.

Krippner, G. 2005. Financialisation of the American Economy. Socio-Economic Review 3: 173–208.

Krueger, A. 1990. Government Failures in Development. Journal of Economic Perspectives 4(3): 9–23.

Krueger, A. O. 1974. The Political Economy of Rent-Seeking Society. American Economic Review 64(3): 291–303.

Kua, K. S. 2007. May 13: Declassified Documents on the Malaysian Riots of 1969. Petaling Jaya: SUARAM.

Lall, S. 1999. Technology Policy and Competitiveness in Malaysia. In Technology, Competitiveness and the State, edited by Jomo K. S. and G. Felker, pp. 148–179. London: Routledge.

―. 1995. Malaysia: Industrial Success and the Role of the Government. Journal of International Development 7(5): 759–773.

Lim, D. 2011. Economic Development: A Historical Survey. Malaysia: Policies and Issues in Economic Development, edited by ISIS, pp. 1–38. Kuala Lumpur: Institute of Strategic and International Studies.

Lim, L. 2000. A Dynamic Bumiputera Commercial and Industrial Class?: A Mismatch with Market Rationality. Southeast Asian Studies 37(4): 443–457.

Lim, M. H. 1985. Contradictions in the Development of Malay Capital: State, Accumulation and Legitimation. Journal of Contemporary Asia 15(1): 37–63.

Malaysia. 2015. Malaysia Economic Statistics Time Series. Department of Statistics.

―. 2013. 2013 Labour Force Survey. Department of Statistics.

―. 2011. Tenth Malaysia Plan, 2011–15. Putrajaya: Economic Planning Unit.

―. 2009. Distribution of Work to Contractors Class E (Bumiputera) & F. Ministry of Works. December 16. http://www.kkr.gov.my/en/node/18320, accessed February 14, 2017.

―. 2006. Ninth Malaysia Plan 2006–2010. Putrajaya: Economic Planning Unit, Prime Minister’s Department.

―. 2001. White Paper: Status of the Malaysian Economy. Kuala Lumpur: Economic Planning Unit. November 30.