Contents>> Vol. 7, No. 2

Art Auctions and the Poorer Rich: The Impact of the 2015 Stock Market Sell-off on the Emerging Philippine Art Market

Rosalina Palanca-Tan* and J. Sedfrey S. Santiago**

*Department of Economics, Ateneo de Manila University, Loyola Heights, Quezon City 1108, Philippines

Corresponding author’s e-mail: rtan[at]ateneo.edu

** Marketing and Law Department, John Gokongwei School of Management, Ateneo de Manila University, Loyola Heights, Quezon City 1108, Philippines

DOI: 10.20495/seas.7.2_183

This paper looks into the Philippine secondary art market, which has recently emerged with the country’s booming economy. Specifically, the paper aims to determine the effect of the August 2015 stock market sell-off on prices and profitability of art auction sales in the Philippines. Works of art may be considered as alternative investment goods for stocks. There may be greater demand for artworks as part of an investment diversification strategy when the equity market is bearish. On the other hand, artworks may also be part of a conspicuous consumption behavioral pattern, such that when income and wealth levels fall, the demand for artworks drops. To determine the net effect of stock market conditions on the Philippine art market, an empirical model is estimated using the ratio of the auctions’ hammer price to the starting bid as a measure of art market profitability and vitality. Our regression results reveal that artworks are more of a conspicuous consumption good in the Philippines. Reduced income and wealth after the stock market plunge in August 2015 led to lower willingness to pay for artworks and lower returns in the September 2015 auctions compared to the September 2014 auctions. The “poorer rich” effect appears to prevail over the alternative investment effect in the Philippines.

Keywords: art market, Philippine art auctions, art pricing, stock market,

investment, conspicuous consumption

Introduction

Art is priceless. Yet a work of art is an economic good that is traded in a market. The market price of a work of art is determined primarily by demand, by the amount of money collectors are willing to give up for it. Each work of art is a first degree price discriminating monopolist in itself: it realizes a price that is equivalent to the maximum willingness to pay of the buyer revealed through a succession of price offers as is done in auctions.

Works of art command high values that are well beyond the cost of production. They are luxury goods whose demand is commonly analyzed using the Veblen effect framework (Veblen 1994). Luxury goods are desirable because they are expensive. Purchase of these goods signals wealth, and hence a means to achieve social status and recognition, a phenomenon referred to as conspicuous consumption (Bagwell and Bernheim 1996). To the extent that acclaimed works of art are highly priced, and that their limited if not totally fixed supply can lead to value appreciation, works of art also serve as a form of investment.

Individuals who possess wealth can keep their wealth in different forms of assets such as cash and bank deposits, stocks, bonds, real estate properties, jewelry, and artworks. As a form of investment, artworks are closest to real estate—they are very heterogeneous and extremely illiquid, and may yield substantial positive returns only in the very long run (Candela and Scorcu 1997). Since art is a luxury consumption good and a form of investment, the market for it is affected by developments in other markets and macroeconomic conditions. W. N. Goetzmann, L. Renneboog, and C. Spaenjers (2011) constructed an art price index for the British art market for the period 1765–2007 and found significant correlations between the index and economic fluctuations. They found that art prices dropped during periods of economic turmoil such as during World War I, the Great Depression of the 1930s, and the oil crisis in 1973 and rose during periods of economic prosperity in the 1960s, 1980s, and early 2000s. Further, M. L. Biey and R. Zanola (1999) observed that people buy paintings as a form of “speculative investment” during periods of economic boom. The debate on art as an alternative investment instrument, however, remains unsettled (Teti et al. 2014).

Buyers of artworks are those with excess wealth, just like buyers in the stock market. Theoretically, developments in the stock market can affect the art market in two ways. As an alternative form of wealth, works of art can substitute for stocks. In times of bearish stock market conditions, freed funds from unloading of stocks and reduced exposure to the equity market may eventually find their way into the art market. On the other hand, lower returns to stocks and the subsequent devaluation of stock assets diminish income and wealth, resulting in less consumption, the most affected component of which would be expenditures on conspicuous or luxury goods. Thus, the downturn in the equity market can also affect the art market negatively. The asset-substitution effect could be offset partially or fully or even be exceeded by the income-consumption effect. In the long-run analysis of the British art market, Goetzmann et al. (2011) found a positive correlation between the stock market index and the art price index. This finding reveals that the conspicuous consumption function of artworks dominates the alternative form of wealth function in the case of the British art market.

The stock market sell-off in August 2015, triggered by Greece’s default on its foreign loan payments (Jolly and Bradsher 2015) and China’s stock market crash (Thomson and Riley 2015), caused steep falls in stock market prices worldwide and created chills in the global art market. There were mixed opinions on how this recent stock market sell-off would impact on the art market. Key art market players were somewhat optimistic but wary. West Bund Director, Artist, and Curator Zhou Tiehai projected that “buyers would start to acquire more art because of the slowdown,” claiming that there were “signs that companies prefer to buy artwork rather than invest in the stock market” (Adam 2015). Citi Private Group Art Advisory and Finance Group Managing Director and Global Head Suzanne Gyorgy suggested that “the super-rich Chinese art collectors are less affected by gyrations in the economy and the stock market because of their larger wealth cushion” but warned that “art is as much a psychological market as a financial one—if there is one sale that isn’t strong, people get spooked” (Frank 2015). The latest available data on global art market turnover show the equity market and art market moving in the same direction. For the first six months of 2015, fine art auction sales contracted by 5 percent to US$7.6 billion from 2014’s first half sales of US$8 billion, while number of lots sold declined more substantially by 17 percent (ArtMarket.com 2015). In China and Hong Kong, total art sales fell 30 percent in the first half of 2015 to US$1.5 billion from US$2.2 billion in the same period in 2014 (Frank 2015).

This paper looks into the emerging art market in the Philippines, a low-income but fast-growing economy in recent years, and one that is persistently beset by a high incidence of income inequality. The paper aims to determine the effect of the August 2015 stock market sell-off on prices and profitability of auction sales in the Philippine art market. The Philippine Stock Exchange index plunged by 6.7 percent on August 24, 16 percent off the highest mark reached in April 2015 (Rappler 2015). This wiped out a substantial US$16.31 billion of equity wealth in the country. What is the net impact of the lower returns to stocks and wealth contraction on the Philippine art market? Do Filipino art collectors consider works of art as investment goods that can be alternatives to stocks in their portfolio, more of which will be demanded as part of their investment diversification strategy when the equity market is bearish? Or are artworks more part of a conspicuous consumption behavioral pattern, such that when income and wealth levels fall, the demand for them subsequently drops?

This paper is a pioneering work on the art market in the Philippines, at present one of the more rapidly growing and resilient economies in Asia, the new growth center in the world. The regular operation of art auction houses in the country is a very recent development. This study is the first systematic analysis of the movements in Philippine art auction prices and how they relate to the stock market and the macro-economy.

Value of Art Literature

Art buyers are made up of elite groups of connoisseurs, speculators, corporations, and private and public cultural institutions (Fillitz 2014) with motives that U. Sigg (2013) categorizes into five: (1) affinity with an artwork or “I like this art” motive, (2) investment motive (purchase of artwork “by ear rather than by eye”), (3) status-enhancement (acquiring “must-have” artists), (4) focused purchase (collecting artworks with a particular theme), and (5) web of artworks purchase (collecting artworks that provide the fullest context for a core idea). Although not hinting at a hierarchical order, Sigg says that most common among these five is the “I like this art” motive—a person buying art because of attraction to the piece. According to Sigg, this is the stage many collectors initially go through and remain at. An interesting socio-psychological explanation of why individuals collect artworks is provided by the terror management theory. The theory asserts that people engage in “culturally prescribed behavior to bolster self-esteem. Self-esteem in turn defends the self from the threat of mortality, and allows one to successfully navigate death anxiety” (McIntosh and Schmeichel 2004). E. Atukeren and A. Seçkin (2007) assert that the purchase of art by collectors is basically for “aesthetic appreciation.” It is this “aesthetic return” or “viewing pleasure” that makes the collector unmindful of the high price paid for an artwork (Valsan 2002). Atukeren and Seçkin, however, concede that even those who buy artworks mainly for aesthetic reasons may also be hoping for an eventual appreciation of their purchase’s value. H. Yoon and H. Shin (2014) look at corporate art collectors in particular and discuss three reasons why corporations amass artworks. One, patronage of the arts is considered a “desirable corporate behavior” and hence can be a means by which a corporate entity achieves legitimacy (Lindenberg and Oosterlinck 2011; Dowling and Pfeffer 1975, as cited in Yoon and Shin 2014). Two, the corporation may be able to strengthen relationships with its stakeholders by making its art collection accessible to the public through a corporate museum (Garriga and Melé 2004; Nissley and Casey 2002, as cited in Yoon and Shin 2014). Three, it is a business strategy—the use of the art collection to differentiate the company from others in an industry where services are more or less generic (Lindenberg and Oosterlinck 2011, as cited in Yoon and Shin 2014). A common thread in these three reasons is the projection of a company image. The corporate art collection is an investment that will not only yield financial returns but, more important, contribute to business longevity.

Because of the confounding motives in the purchase of artwork, ascribing value to it is ticklish (Colbert 2012). An artwork is not an ordinary good whose price is explained by basic supply and demand forces. S. Plattner (1998) insists that the high price of an artwork signifies “high elite value” and not “scarce supply and high demand.” H. W. Ursprung and C. Wiermann’s study (2011), for instance, shows that the artist’s death alone, an indicator of scarcity of supply, does not significantly affect pricing. There are two basic perspectives on art pricing (Candela and Scorcu 1997). One perspective considers artworks as having no fundamental value, and hence their prices are inherently unpredictable. The other perspective maintains that generally accepted social valuations influence the price of an artwork and allow determination of fundamental values. Studies adhering to the second view attempt to identify the factors influencing the value of an artwork. Art price is seen as evolving from an inter-subjective process wherein experts, institutions, and media in the art field assess merits and confer reputation to a piece of art (Bourdieu 1999 and Janssen 2001, as cited in Beckert and Rössel 2013). More weight may be ascribed to the subjective judgments and desires of only a handful of collectors (Kallir 2011). S. Jalbuena (2015) writes that in some instances the valuation of art is reduced to a popularity game that rewards the charisma of the artist, the marketing infrastructure, and the public relations machinery over the quality of work.

Although it may be true that it is not possible to determine the full value of art (Baumol 1986), interest in understanding how the art market relates to other markets such as the stock and bonds markets has led to the construction of art price indices or yardsticks of art value and art market performance. R. Kraeussl and C. Wiehenkamp (2012) constructed a price index for German art using the following factors as determinants: artwork specifications such as type of work and art medium and materials; the artist’s reputation, attribution, living status; and the auction house. Goetzmann et al. (2011) created a price index based on changes in auction prices in the British market and found it to be highly elastic to income changes of the wealthiest. H. Higgs and J. Forster (2014) group determinants of art auction price into three general categories: (1) artist-level factors, (2) physical characteristics of the artwork, and (3) factors related to the auction transaction (e.g., auction house and date of auction). E. Teti, P. L. Sacco, and T. C. Galli (2014) point out that art prices are explained not only by “objective variables” but also by “intangible peculiarities” that are not easily incorporated in statistical models. D. Maddison and A. J. Pedersen (2008), for instance, consider the artist’s death and its nostalgia effect on the art market. D. G. de Silva, R. A. J. Pownall, and L. Wolk (2012) go so far as to use variation in local weather to proxy for market mood.

The Philippine Art Market

The Philippine art market, much like art markets of other countries, may be classified into primary and secondary. It is in the primary market where artworks are first sold. The first sale usually takes place in art galleries, art exhibits, and art fairs, or through direct purchase from dealers and artists. Any resale of an artwork, commonly carried out by auction houses as well as art galleries and dealers, is categorized as the secondary market. Art galleries and dealers may simultaneously operate in both primary and secondary markets. The Philippines has a longer tradition in the primary market. Commercial art galleries in the Philippines date back to the 1950s. During that time the leading gallery was the Philippine Art Gallery, which did not only provide exhibition space but also served as a “venue for artists, leading literary men and intellectuals” to discuss art (Yusi 2015; see also Kalaw-Ledesma 1987). Based on a quick survey, albeit mainly virtual, there are at least 157 art galleries, more than half of which (around 101) are situated in Metro Manila (see also Manila Arthop 2016–17). This confirms G. Fairley’s (2012) observation that Philippine contemporary art remains “almost exclusively sited around a Manila scene.” Among the older art galleries are Finale Art File, Galleria Duemila, and Hiraya; and among the relatively new ones are the artist-centered Galerie Joaquin and multidisciplinary 1335Mabini. Many galleries are clustered in malls (e.g., Renaissance Gallery, Galerie Francesca, Galerie Raphael, Galleria Nicolas); but because of high rents in malls, some dealers sell artworks through pop-up galleries that are temporarily set up in nontraditional venues such as hospitals and building hallways. Art fairs are relatively recent occurrences in the Philippines. Presently, there are three significant art fairs in the country: (1) Art in the Park, the oldest one, was first staged in 2006; (2) ManilArt was first staged in 2009 by the Bona Fide Art Galleries Organization in partnership with the National Commission for Culture and the Arts; and (3) ArtFair Philippines was founded in 2013 and is currently managed by Philippine Art Events, Inc.

Constituting part of the secondary art market in the Philippines are the two leading auction houses, León Gallery Fine Art & Antiques (León Auctions) and Salcedo Auctions (both established only in 2010); and two less-active and lower-profile auction houses, Now Gallery and Harringtons Lifestyle Auction. With the exception of Harringtons Lifestyle Auction, all are based in Makati City, the premier financial district of the Philippines. Previously, if a seller wanted to vend an artwork through auction, the nearest venue would have been the Hong Kong or Singapore auctions of Christie’s and Sotheby’s (the two leading auction houses in the world for nearly two centuries), or Larasati Auctioneers and other auction houses in the Asian region. The recent establishment of the four auction houses in the Philippines has allowed local sellers to participate in auction sales without going out of the country. Even collectors residing outside the Philippines have disposed of their collections through these Philippine auction houses.1)

Similar to its foreign counterparts, the Philippine art market is highly unregulated and marked by opacity. The exact number of transactions that artists and art dealers enter into with their clients, and the value of the transactions, may be highly uncertain as receipts are not always issued. In the case of the Philippines, as in other art markets around the world, the most transparent sector is the auction houses since they publicize the realized value of their auctions as a marketing strategy (Fillitz 2014). León Auctions posts the results of its auction sales on its website (a total of eight auctions: June, September, and November in 2014; and two auctions in February as well as one each in June, September, and December in 2015). Salcedo Auctions used to post the results of its most recent auctions (up to September 2015), but starting November 2015 it has discontinued the practice and has adopted the policy of providing auction results data only to its clients upon request.

Past literature suggests that the price of art depends on income levels of the richest, the main buyers of art. Goetzmann et al. (2011) found that art price variations are very sensitive to income increases among the wealthiest in society, and that art prices rise when income inequality goes up. The observation that the art market benefits from a worsening income inequality may help understand why the Philippine art market is thriving in recent years. The gap between the country’s rich and poor is widening, with high-earning individuals enjoying significantly faster growth in incomes compared with people from the middle- and low-income classes, and hence the benefits of the robustly growing Philippine economy are enjoyed more by the rich than the poor (Remo 2013). A. Martinez et al. (2014) showed that the income ratio of the top 10 percent to the bottom 40 percent increased from 3.09 in 2003 to 3.27 in 2009 while the Gini coefficient increased from 0.438 in 1991 to 0.506 in 2009. In 2011, people from the high-income class, which accounted for about 15 percent of the country’s population, enjoyed a 10.4 percent annual growth in income (Albert and Martinez 2015), compared to overall income growth of just 3.7 percent.

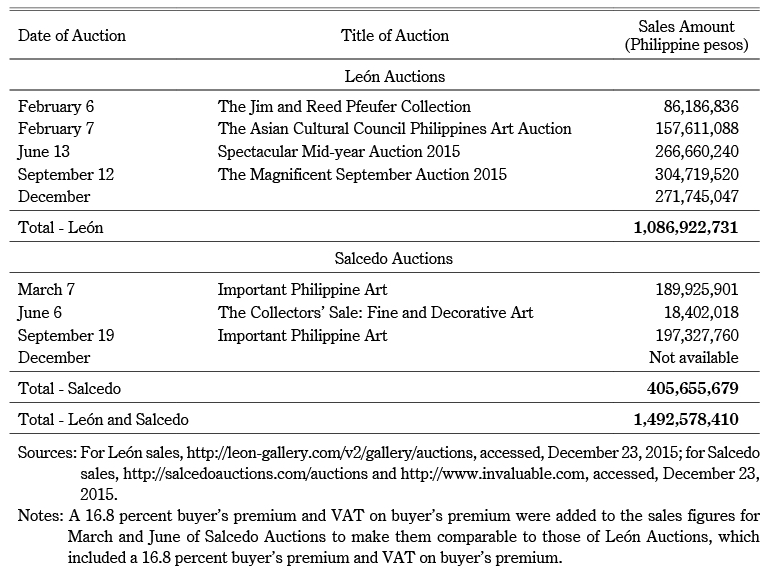

Data on auction sales in the past few years reveal an active and vibrant art market. León Auctions has been recording an almost 100 percent batting average in its auction sales since 2014. Although León Auctions and Salcedo Auctions were put up in 2010, auction activities in León started only in 2013 and Salcedo Auctions in 2010 (Maneker 2010). Presently, León Auctions concentrates mainly on Philippine art while Salcedo Auctions conducts separate auction sessions for Philippine art, fine jewelry and timepieces, artifacts, home accessories, rare automobiles, and other items that are grouped as the connoisseur collection. In 2015 the combined sales of the two auction houses for Philippine art totaled about 1.5 billion Philippine pesos (see Table 1 for the breakdown).

Table 1 Art Auction Sales by León Auctions and Salcedo Auctions, 2015

The Impact of the August 2015 Global Stock Market Sell-off

Econometric Model

To analyze the relationship between the stock market and the art market in the Philippines, we look at auction results before and after the August 2015 stock market plunge. We limit our sample to auction results in the same period, that is, during the month of September in the two years 2014 and 2015 to eliminate seasonal factors. Salcedo Auctions offers a high variety of articles, including fine china, personal accessories such as branded watches, antique furniture, and carpets. León Auctions, on the other hand, specializes in art pieces. To minimize random noise in the regression that can be brought about by highly heterogeneous goods, we use the data sets of León Auctions, particularly for auctioned paintings that are sui generis regardless of medium (oil, watercolor, acrylic, pastel, pen and ink, pencil, mixed media, and the like as applied on canvas, paper, wood, and other surfaces), style (representational and nonrepresentational), and size. We exclude auction lots offering works that exist or could exist in multiples such as prints, serigraphs, lithographs, as well as sculptures and those that combine paintings and other genres in one lot.

As a measure of the profitability and vitality of the stock market, we use the ratio of the buyer’s price to the starting bid. The buyer’s price is the sum of the hammer price (amount at which an artwork is sold by the auctioneer when he/she bangs the hammer) and the buyer’s premium (the fee collected by the auctioneer from the winning bidder, computed as a certain percentage of the hammer price). The buyer’s price is the maximum willingness to pay for any particular work of art, and is therefore reflective of underlying market conditions and the optimism of key players in the Philippine art market at the time of the auction. On the other hand, the starting bid that is decided by the auction house, presumably in consultation with the seller, is a measure of the base value of the artwork that may include production costs and artist-related factors such as reputation. The ratio of buyer’s price to starting bid can therefore be a measure or indicator of the profitability of the auction sale. The stock market shock in August 2015 is modeled with a dummy variable assigning the value of 1 for all art pieces or lots auctioned in the September 2015 auction, or 0 for all lots auctioned in the September 2014 auction. Factors that weigh in the valuation of artwork as revealed in past literature (see, for instance, O’Neil 2008; and Kraeussl and Wiehenkamp 2012) are also incorporated in the regression analysis. These include artwork-specific factors such as art medium (oil on canvas versus other media), size of the work, titling of the work, year of creation of the work, and presence of the artist’s signature on the work as well as artist-specific factors such as the age of the artist, whether the artist is still living or not, and awards bestowed on the artist (National Artists Award and Thirteen Artists Award).2) The empirical model specified for this study is given by the equation:

R = α + βS + cZ + dW + ε

R is the ratio of total buyer’s price to the starting bid, S is the dummy variable for the stock market shock (the market plunge in August 2015), Z is the vector of work-specific variables, W is the vector of artist-specific variables; α, β, c, and d are the regression coefficients; and ε is the error term representing all other factors not included in the model. This regression model is run using the linear regression procedure in the econometrics software STATA.

Results

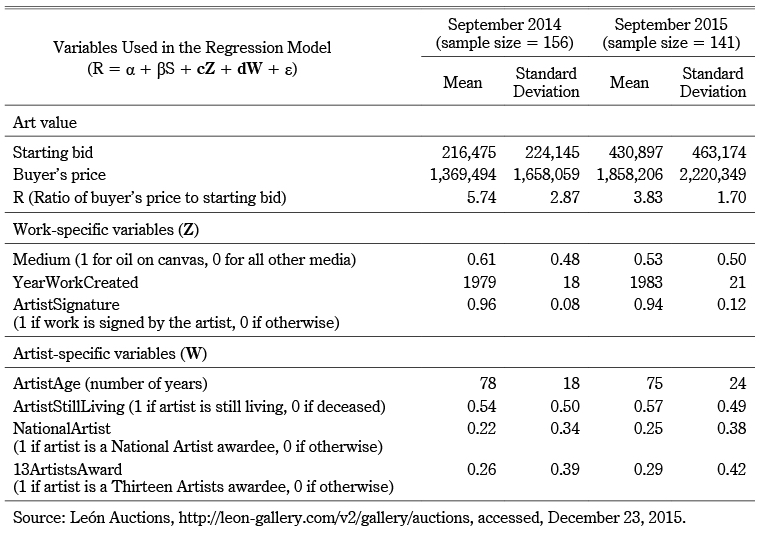

Summary statistics for the sample of artworks used in the regression are shown in Table 2. The average values of artworks in terms of starting bid and buyer’s price are both higher in September 2015. However, the ratio of the buyer’s price to the starting bid is lower after the August 2015 stock market plunge. The average values are more a function of the kind and quality of works (such as the art medium, painting material, size of art piece, style, artist, etc.) that are available for auctioning at any period of time, rather than of market conditions. The means and standard deviations of work-specific and artist-specific variables in the 2014 auction do not vary much from those in 2015, indicating comparable baskets of artworks in terms of art media, year of creation, artist signature, and artist-related attributes in the samples before and after the stock market plunge. The majority of paintings auctioned in our samples are oil on canvas. The average artwork auctioned was created in the late 1970s to early 1980s. With the average age of artists being 75–78 years, the average work was created when the artist was about 40 years old. Almost all (94–96 percent) the artworks auctioned are signed by the creators, and the majority (54–57 percent) of artists are still alive. About a quarter (22–25 percent) are works of National Artists, while slightly more than a quarter (26–29 percent) are works of Thirteen Artists awardees.

Table 2 Descriptive Statistics

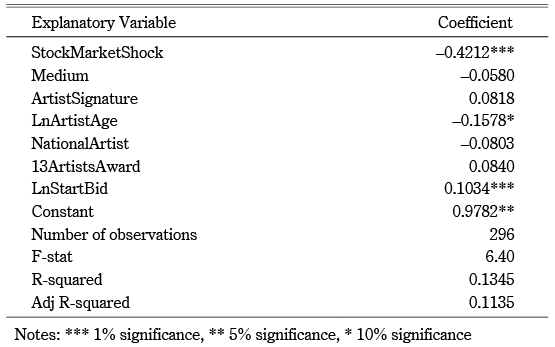

Correlation tests reveal some degree of multicollinearity among three explanatory variables, namely, ArtistAge, YearWorkCreated, and ArtistStillLiving; and hence, the latter two variables are removed and only the first, ArtistAge, is retained. Due to skewness, the variables Ratio, StartingBid, and ArtistAge are transformed into their logarithmic forms to satisfy the normal distribution assumption of ordinary least squares estimation. The results of the regression analysis are summarized in Table 3.

Table 3 Regression Results, Dependent Variable = LnRatio

The coefficient of the StockMarketShock is significantly negative, implying that the August 2015 stock market plunge reduced the ratio of the buyer’s price to the starting bid, indicating waning interest in the Philippine art market as a result of the stock market plunge. The relationship between the ratio and the starting bid is significantly positive, which means that higher-value artworks will result in higher ratios. Table 2 reveals that the mean starting bid in the September 2015 auction was higher than that in the September 2014 auction. Despite the higher starting bid in the 2015 auction that could have raised the profitability ratio (significant positive relationship between the ratio and the starting bid), the negative effect of the stock market plunge lowered it. Among the other factors (art-specific and artist-specific) included in the regression model, only the age of the artist is shown to significantly affect the ratio. The coefficient is negative, implying that the ratio is higher for works of younger artists. The statistical insignificance of the coefficients of work and artist-related factors may imply that these factors are embodied in the starting bid, the base value of the artwork, rather than in the ratio of the buyer’s price to the starting bid.

Conclusion

The secondary art market (auction houses) in the Philippines has emerged as a result of the booming economy in recent years. National income or gross domestic product grew at a remarkable annual rate of 6.3 percent during 2010–15, the fastest streak since 1978. During the first quarter of 2016 it further expanded at a rate of 6.9 percent over the same period in 2015, faster than China’s 6.7 percent and Vietnam’s 5.7 percent (CNN Philippines 2016). The boom has benefited to a greater extent the high-income groups to which the art market caters. The sensitivity of the emerging Philippine art market to fluctuations in the equity market and macroeconomic conditions is of key interest to players in the market—artists, galleries, dealers, investors, etc. This information will guide key market players in formulating strategies to stabilize and maximize returns.

The regression results reveal that artworks in the Philippine art market are more of a conspicuous consumption good. The reduced income and wealth after the stock market plunge in August 2015 (negative returns to stock holdings and lower value of stock holdings due to the plunge in stock prices) led to lower willingness to pay for artworks and lower returns to the art auction in September 2015 compared to the same period in the preceding year, 2014. It appears that funds have not been moved from equities to art as an alternative form of investment. The “poorer rich” effect appears to prevail over the alternative investment effect.

A recent news article on the main drivers of the art market boom in the Philippines presented a rough sketch of the profile of the clientele in the Philippine art market: “a new breed of art collectors, young, flush with cash and supremely confident in their tastes” (Caruncho 2016). They include “yuppies, young entrepreneurs, young politicians and old rich family heirs with second- and third-generation money” (ibid.). Interestingly, this description matches the worsening inequality trend to which the recent dynamism in the Philippine art market is partly attributed.

This paper is a cursory study on the workings of the art market in the Philippines. The results presented in this paper only capture the immediate effect of the stock market crisis, which is still ongoing. It will be interesting to see the impact of a prolonged slump in the stock market on the art market. Equally interesting to determine is the long-term effect. Will there be spillover effects? Will the spillover effects be diminishing or accumulating? Another interesting economic issue that can be further investigated is the link between increasing domestic inequality and increased dynamism of the art market. These are some of the questions that can be addressed in future economic analyses of the Philippine art market when more and long-term data sets become available.

Apart from the economic dimensions, there are aspects of the Philippine art market that warrant further and more intensive research. A closer look at the composition of the art market in the country is one of these. Who are the main players in the market? What is the extent of foreign collectors’ participation vis-à-vis local collectors’ participation? It will also be interesting to compare the developments in the Philippine art market with those in other developing economies. These types of analyses can shed more light on the economics of the Philippine art market.

Accepted: January 18, 2018

References

Adam, Georgina. 2015. The Art Market: Impact of Weakening Chinese Economy. Financial Times Online. http://www.ft.com/cms/s/0/64b32e1a-5c66-11e5-9846-de406ccb37f2.html, accessed November 13, 2015.

Albert, Jose Ramon G.; and Martinez, Jr., Arturo. 2015. Are Poverty and Inequality Changing? Rappler. http://www.rappler.com/thought-leaders/84833-poverty-inequality-data#_ftnref1, accessed November 21, 2015.

ArtMarket.com. 2015. Artprice’s Overview of the Global Art Market in H1 2015–USA Recovers Top Position from China.

https://artmarketinsight.wordpress.com/2015/08/02/artprices-overview-of-the-global-fine-art-auction-market-in-the-first-semester-of-2015/, accessed November 23, 2015.

Atukeren, Erdal; and Seçkin, Aylin. 2007. On the Valuation of Psychic Returns to Art Market Investments. Economics Bulletin 26(5): 1–12.

Bagwell, Laurie S.; and Bernheim, B. Douglas. 1996. Veblen Effects in a Theory of Conspicuous Consumption. American Economic Review 86(3): 349–373.

Baumol, William J. 1986. Unnatural Value: Or Art Investment as Floating Crap Game. American Economic Review 76(2): 10–14.

Beckert, Jens; and Rössel, Jörg. 2013. The Price of Art: Uncertainty and Reputation in the Art Field. European Societies 15(2): 178–195.

Biey, Marilena L.; and Zanola, Roberto. 1999. Investment in Paintings: A Short-Run Price Index. Journal of Cultural Economics 23: 211–222.

Bourdieu, Pierre. 1999. Die Regeln der Kunst: Genese und Struktur des literarischen Feldes [The rules of art: Genesis and structure of the literary field]. Frankfurt a.M.: Suhrkamp.

Candela, Guido; and Scorcu, Antonello Eugenio. 1997. A Price Index for Art Market Auctions: An Application to the Italian Market of Modern and Contemporary Oil Paintings. Journal of Cultural Economics 21: 175–196.

Caruncho, Eric S. 2016. Millennials Are Driving the Current Boom in Philippine Art. Philippine Daily Inquirer. March 20, pp. F1, F2.

CNN Philippines. 2016. PH Is Fastest Growing Economy in Asia, Expands by 6.9% in Q1. CNN Philippines. May 20. http://cnnphilippines.com/news/2016/05/19/philippines-fastest-growing-economy-asia-gdp-q1.html, accessed April 18, 2017.

Colbert, François. 2012. Financing the Arts: Some Issues for a Mature Market. Megatrend Review 9(1): 83–96.

De Silva, Dakshina G.; Pownall, Rachel A. J.; and Wolk, Leonard. 2012. Does the Sun ‘Shine’ on Art Prices? Journal of Economic Behavior & Organization 82(1): 167–178.

Dowling, John; and Pfeffer, Jeffrey. 1975. Organizational Legitimacy: Social Values and Organizational Behavior. Pacific Sociological Review 18(1): 122–136.

Fairley, Gina. 2012. Outside In/Inside Out Contemporary Philippine Art: Observing Artists, Artworks, Scenes and Markets. Thesis Eleven 112(1): 63–86.

Fillitz, Thomas. 2014. The Booming Global Market of Contemporary Art. Focaal: Journal of Global and Historical Anthropology 69: 84–96.

Frank, Robert. 2015. Here’s How China Could Crash the Art Market. CNBC News Online. http://www.cnbc.com/2015/07/30/heres-how-china-could-crash-the-art-market.html, accessed November 13, 2015.

Garriga, Elisabet; and Melé, Domènec. 2004. Corporate Social Responsibility Theories: Mapping the Territory. Journal of Business Ethics 53: 51–71.

Goetzmann, William N.; Renneboog, Luc; and Spaenjers, Christophe. 2011. Art and Money. American Economic Review 101(3): 222–226.

Higgs, Helen; and Forster, John. 2014. The Auction Market for Artworks and Their Physical Dimensions: Australia—1986 to 2009. Journal of Cultural Economics 38(1): 85–104.

Jalbuena, Samito. 2015. What Makes Art Valuable? BusinessMirror. July 29, p. D4.

Janssen, Susanne. 2001. The Empirical Study of Careers in Literature and Arts. In The Psychology and Sociology of Literature, edited by Dick Schram and Gerard Steen, pp. 323–357. Amsterdam: John Benjamins.

Jolly, David; and Bradsher, Keith. 2015. Greece’s Debt Crisis Sends Stocks Falling around the Globe. New York Times International Business.

http://www.nytimes.com/2015/06/30/business/international/daily-stock-market-activity.html?_r=0,

accessed November 23, 2015.

Kalaw-Ledesma, Purita. 1987. The Biggest Little Room. Manila: Kalaw-Ledesma Art Foundation.

Kallir, Jane. 2011. Speculating on the Art Market. The New Criterion. December, p. 34.

Kraeussl, Roman; and Wiehenkamp, Christian. 2012. A Call on Art Investments. Review of Derivative Research 15(1): 1–23.

Lindenberg, Morgane; and Oosterlinck, Kim. 2011. Art Collections as a Strategy Tool: A Typology Based on the Belgian Financial Sector. International Journal of Arts Management 13(3): 4–19.

Maddison, David; and Pedersen, Anders Jul. 2008. The Death Effect in Art Prices: Evidence from Denmark. Applied Economics 40(14): 1789–1793.

Maneker, Marlon. 2010. Manila Gets an Auction House. Art Market Monitor. http://www.artmarketmonitor.com/2010/07/21/manila-gets-an-auction-house/, accessed March 10, 2016.

Manila Arthop. 2016–17. Copyright 2016 Planting Rice, Electrolychee and Lena Cobangbang.

Martinez, Arturo; Western, Mark; Haynes, Michele Ann; and Tomaszewski, Wojtek. 2014. Is There Income Mobility in the Philippines? Asian-Pacific Economic Literature 28(1): 96–115.

McIntosh, William D.; and Schmeichel, Brandon. 2004. Collectors and Collecting: A Social Psychological Perspective. Leisure Sciences: An Interdisciplinary Journal 26(1): 85–97.

Nissley, Nick; and Casey, Andrea. 2002. The Politics of Exhibition: Viewing Corporate Museums through the Paradigmatic Lens of Organizational Memory. British Journal of Management 13: 35–45.

O’Neil, Kathleen M. 2008. Bringing Art to the Market: The Diversity of Pricing Styles in a Local Art Market. Poetics 36: 94–113.

Plattner, Stuart. 1998. A Most Ingenious Paradox: The Market for Contemporary Fine Art. American Anthropologist 100(2): 482–493.

Rappler. 2015. Philippine Stocks Plunge 6.7% amid Global Equities Rout. http://www.rappler.com/business/industries/210-capital-markets/103565-philippine-stocks-plunge, accessed December 2, 2015.

Remo, Michelle V. 2013. Rich-Poor Divide in PH Widening. Philippine Daily Inquirer. http://newsinfo.inquirer.net/441817/rich-poor-divide-in-ph-widening#ixzz3s6j5I3yp, accessed November 21, 2015.

Sigg, Uli. 2013. How People Collect: My Typology of Collecting Styles. Artasiapacific 85 (September/October): 59–60.

Teti, Emanuele; Sacco, Pier Luigi; and Galli, Tecla Carlotta. 2014. Ephemeral Estimation of the Value of Art. Empirical Studies of the Arts 32(1): 75–92.

Thomson, Mark; and Riley, Charles. 2015. World Markets Plunge as China’s Stocks Crash. CNN Money Online. August 23. http://money.cnn.com/2015/08/23/investing/world-stock-markets/, accessed November 23, 2015.

Ursprung, Heinrich W.; and Wiermann, Christian. 2011. Reputation, Price, and Death: An Empirical Analysis of Art Price Formation. Economic Inquiry 49: 697–713.

Valsan, Calin. 2002. Canadian versus American Art: What Pays Off and Why. Journal of Cultural Economics 26(3): 203–216.

Veblen, Thorstein. 1994. The Theory of the Leisure Class: An Economic Study of Institutions. Penguin Twentieth-Century Classics. Introduction by Robert Lekachman. New York: Penguin Books.

Yoon, Hyejung; and Shin, Hyung-Deok. 2014. Determinants of the Number of Artworks in Corporate Art Collections. International Journal of Arts Management 16(2): 19–28.

Yusi, Lyn. 2015. The Development of Art Galleries in the Philippines.

http://ncca.gov.ph/subcommissions/subcommission-on-cultural-heritagesch/art-galleries/the-development-of-art-galleries-in-the-philippines/, posted April 16, 2015, accessed October 10, 2015.

1) In 2016 at least two more auction houses—AVANT Auctions and Casa de Memoria—opened and conducted their first auctions.

2) The Order of the National Artists Award is conferred by the president of the Philippines upon the recommendation of the National Commission for Culture and the Arts and the Cultural Center of the Philippines (CCP), which jointly administer the Order. The Thirteen Artists Awards, on the other hand, are bestowed by the CCP Visual Arts and Museum Division in a triennial event.