Technocracy in Economic Policy-Making in Malaysia

Khadijah Md Khalid* and Mahani Zainal Abidin**

* International Institute of Public Policy and Management (INPUMA), University of Malaya, Academic and International Building, 50603 Kuala Lumpur, Malaysia

Corresponding author’s e-mail: dijut[at]email.com

** Mahani Zainal Abidin was the chief executive of Institute of Strategic and International Studies (ISIS), Malaysia from 2010 until her untimely demise on June 22, 2013.

DOI: doi.org/10.20495/seas.3.2_383

This article looks at the role of the technocracy in economic policy-making in Malaysia. The analysis was conducted across two phases, namely the period before and after the 1997/98 economic and financial crises, and during the premiership of four prime ministers namely Tun Razak, Dr Mahathir, Abdullah Ahmad Badawi, and Najib Razak. It is claimed that the technocrats played an important role in helping the political leadership achieve their objectives.

The article traces the changing fortunes of the technocracy from the 1970s to the present. Under the premiership of Tun Razak, technocrats played an important role in ensuring the success of his programs. However, under Dr Mahathir, the technocrats sometimes took a back seat because their approach was not in line with some of his more visionary ventures and his unconventional approach particularly in managing the 1997/98 financial crisis. Under the leadership of both Abdullah Ahmad Badawi and Najib Razak, the technocrats regain their previous position of prominence in policy-making. In conclusion, the technocracy with their expert knowledge, have served as an important force in Malaysia. Although their approach is based on economic rationality, their skills have been effectively negotiated with the demands of the political leadership, because of which Malaysia is able to maintain both economic growth and political stability.

Keywords: technocracy, the New Economic Policy (NEP), Tun Abdul Razak, Dr Mahathir Mohamad, National Economic Action Council (NEAC), government-linked companies (GLCs), Abdullah Ahmad Badawi, Najib Tun Razak

Introduction

Malaysia is a resource rich economy that had achieved high economic growth since early 1970s until the outbreak of the Asian crisis in 1998. However, growth has been moderate in the post-Asian crisis period. Malaysia began, in early 1960s, as an agriculture-based economy but had embarked on an industrialization path when growth rates varied substantially due to fluctuating global primary commodity prices. From 1970, Foreign Direct Investment (FDI) inflow and operations by multinational companies in electrical and electronic and textile industries producing for exports were the catalyst for Malaysian industrialization. At the same time, Malaysia also experimented with import substitution industrialization by introducing heavy industries such as the national car, Proton. As the economy matured, Malaysia entered another phase beginning in the mid-1990s where growth was to be based on knowledge and the services sector would play a larger role.

Malaysia is a small but very open economy; trade is twice the size of its Gross Domestic Product (GDP). Its balance of payment has traditionally been characterized by surpluses in the merchandise account from a strong export performance but it has persistent deficits in the services account. In addition to hosting large FDI inflow, Malaysia also received short-term capital, which began arriving in large volumes in the early 1990s. This was a product of globalization and the policy of liberalizing the capital account, which later exposed the economy to new vulnerabilities. During the period 1990–96, total net flows to Malaysia amounted to over 12% of GDP or USD8.6 billion, compared to 4.2% (USD1.5 billion) in the 1980s.

A noteworthy feature of the Malaysian development is that growth was achieved with equity. The incidence of poverty was reduced drastically from 49.3% in 1970 to 3.8% in 2009. This performance was achieved based on stable and sound macro-economic fundamentals and policies. Yet, at the micro-economic level, some distortions took place to accommodate sectoral group or racial interests. Although, the policies were targeting high overall growth, selected sectors were promoted through, among others, direct public sector intervention and the introduction of specific programs, which sometime were not consistent with market-based economic principles.

The analysis of Malaysia’s economic performance can be divided into three distinct phases:

(i) From Independence in 1957 to 1981

During the first part of this period (1957 to 1969), although laissez-faire economic policies were implemented, mild import substitution industrialization was also put in place in order to develop domestic industries. This import substitution effort was only partially successful. In the second part, from 1970, industrialization was promoted through the establishment of the export processing zone, which attracted many multinational companies that formed the base for manufacturing exports. Malaysia had taken full advantage of the relocation of FDI from the United States, Europe, and Japan seeking for investment location that offered lower labor costs.

Although industrialization became a major economic contributor, the focus of Malaysia’s economic development during this period was developing the rural economy. A lot of effort was undertaken to diversify the agriculture sector and upgrade the rural economy because these constituencies were the base for the ruling coalition party. Malaysia was a major exporter of rubber and tin but subsequently, with the diversification of agriculture, palm oil overtook rubber as the main agricultural export. Large amount of funds were allocated for the rural sector for infrastructure development and activities to raise rural income.

Responding to the racial riot in 1969, the government launched the New Economic Policy (NEP) in 1970 with the twin objectives: poverty eradication irrespective of race and the restructuring of society to correct economic imbalances in order to reduce and eliminate the identification of race with economic functions. The NEP is a major policy that shapes Malaysia’s socio-economic development because there were interventions made to ensure these objectives were met. This policy has a major impact on technocracy in the public sector through the building of human capital and the dominance of one ethnic group—the Bumiputeras (sons of the soil)—in the public sector.

(ii) From 1981 until the outbreak of the Asian crisis in 1998

Dr Mahathir Mohamed became Malaysia’s fourth prime minister in 1981 and he embarked on a developmentalist state strategy that saw high state intervention and the expansion of the public sector’s role in the economy. Many state-owned companies were established, especially those which are entrusted to carry out the heavy industrialization policy. The economic crisis in 1985 due to large fiscal deficits and the collapse of primary commodity prices had triggered a fundamental policy change. The size of the public sector was reduced and privatization was introduced to drive growth and efficiency. This period also saw many liberalization and deregulation measures and the beginning of a closer cooperation between the public and private sectors.

As a result, the 1986–97 period is eulogized as Malaysia’s golden age; from 1990 to 1996 the economy grew at an average annual rate of 8.5%, the longest period of sustained high growth in Malaysian history. Exports grew by double digits annually. Malaysia reached full employment from 1993 to 1997, had low inflation and the public sector registered average fiscal surplus of about 2.4% of GDP annually (1993–97), which is a vast improvement from the 1985’s deficit of 0.6% of GDP. Vision 2020 was launched in 1991 with the aim of turning Malaysia into a developed country by the year 2020. The attainment of this goal is predicated on the economy growing on average at an annual rate of 7% during the period 1990–2020 and therefore it is important for Malaysia to achieve long term macro-economic stability. The private sector was given the task to be the engine of growth while the public sector’s role is to facilitate private sector activities.

(iii) 1998 onwards: the Post-Asian crisis period

The economic recession in 1998 was the worst in Malaysian history, with the GDP contracting by 7.4%. This crisis was triggered by regional contagion when the Thai baht depreciated massively. However, internal difficulties such as excessive bank lending, and property bubbles had worsened the impact of the regional contagion and loss of investors’ confidence. Malaysia introduced measures that were contrary to the conventional wisdom; it introduced capital controls and pegged the exchange rate. Malaysia recovered sharply in 2000, as with the other crisis hit economy, South Korea. Dr Mahathir took credit for these unconventional and controversial measures that worked.

During this post-crisis period, Malaysia’s growth has been moderated; GDP grew on average at about 5.0% during the 1999–2010 period as compared to 8.3% during the 1986–97 period. This performance is not unique to Malaysia because other regional countries also had the same sub-par growth. Private investment, which fell significantly during the crisis, has not recovered. To sustain growth, the public sector had to take a leading role by increasing its investment and expenditure, resulting in a persistent fiscal deficit. On the other hand, exports, both manufacturing and primary commodities continue their high performance. This performance has led to the rethinking of the Malaysian economic strategy to put the country back on a higher growth path and to improve its competitiveness and productivity. The New Economic Model (NEM) for Malaysia was launched in 2010 with the goals of achieving a high income economy and inclusive and sustainable growth.

Role of Technocracy in Development

The role of technocrats has become increasingly more prominent in Malaysian development since 1981. Technocrats are an elite group with expert knowledge and ability that has continually served the governing elite (Miyakawa 2000, 11). Technocrats are experts who formulate economic policy and implement it to achieve a set of targets, and are usually civil servants or professionals who receive special training in economics, business, or related field.

At the macro-level, Malaysia is an economic success story. It has enjoyed high, steady GDP and per capita income growth with macro-economic stability. It has become an important trading nation and a host to a large inflow of FDI. In addition, social development was not neglected—poverty had been significantly reduced and the wealth gained was relatively well distributed. Does technocracy have a role in these achievements?

Technocrats’ role in Malaysia’s economic policy-making and implementation has changed over these three periods. Without doubt, technocrats were given the tasks to manage the economy at the macro-level so that the country could have an impressive economic growth. But, at the same time, technocrats were side-stepped at the micro-economic level. Moreover, the changing role of technocrats depends largely on the balance of influence between technocracy and political leadership.

To understand the role of technocracy in economic development, it would be useful to examine the reasons why political leaders seek the assistance of technocrats, the background of the technocrats, and their relationship with politicians as well as their contributions. As an open economy, technocrats are not needed in order for Malaysia to get international acceptance or assistance. Instead their expertise and professionalism are likely to be used to ensure that development is properly done and the benefits of progress reach the people.

In the early stage of Malaysia’s development, the technocrats came from the civil services but in the later stages, businessmen and professionals had a larger role. There were occasions when technocrats who were given key responsibilities turned to become politicians and be the leaders of other technocrats, many of whom were their former colleagues. What is clear is that the role and contribution of technocrats are very much dependent on the personality and vision of the prime ministers. This economic vision will also determine the type of technocracy needed.

In the Southeast Asian experience, macro-economic management was delegated to largely autonomous agencies and insulated technocrats, who pursued conservative policies. In Indonesia, the so-called “Berkeley Mafia” (a group of economists sponsored by the US Government to receive their tertiary training in US economic faculties) was credited for steering the New Order’s economic policy and emphasizing macro-economic discipline (Neumann 2002). The influence of technocracy on the country’s political leadership was such that interests of specific groups were not able to override national interests. Similarly, in Thailand the bureaucrats in the Ministry of Finance (MOF) and the Central Bank were allowed to pursue prudent policies.

Was the high economic growth in Malaysia as well as Thailand and Indonesia due to the economic technocrats being insulated from political pressures? Is it true that a strong developmental state should ensure a high degree of autonomy enjoyed by decision-makers, especially in the bureaucracy? According to Booth (1998) “. . . in Thailand, Indonesia and Malaysia, technocrats in the ministries of finance have been able to insulate key areas of macroeconomic policy-making from overt political interference.” Neumann (2002) is of the view that a hands-off approach in macro-economic management as well as insulating technocrats from political and business pressures had led to stability. However, inevitably, vertical patron-client network and political interests would lead to abuse of micro-economic policy for political advantage (ibid., 9). Clearly, there is divergence in effectiveness between macro-economic and micro-economic policies.

This inference raises the question of the role of technocracy in economic policy-making when a country needs to achieve a relatively high rate of growth under increasing challenges of globalization, a public sector that is supposed to take a facilitative role, a dynamic private sector to drive growth, and a democratic system where the interest of the public must be given due consideration. These challenges faced by Malaysia in economic policy-making became more acute in the period after the 1998 Asian financial crisis. An important aspect to examine is whether the separation between economic imperatives and special interests can be done at both the macro- and micro-levels. Thus, the analysis of the role of technocracy in economic policy-making cannot avoid examining the relationship between state and markets and how these two sides interact and influence one another and their effects on institutions and growth performance. Emphasis will be given to the understanding of the dynamics of the relationship between technocrats and the political elite as well as the contribution of the former in the development of Malaysia after the Asian crisis.

The focus of this article is to study the role of technocracy in managing the Malaysian economy during and after the Asian crisis. Economic technocracy should put market and economic rationality at the forefront of economic policy to ensure that growth is well founded, resources are used efficiently, and the country is resilient and continues to be competitive. The analysis will focus on two interrelated components—issues and players. The issues are economic growth, sustainability, and competitiveness while the players are political leaders, institutions, and technocrats. The conventional wisdom is that the market knows best and by extension technocrats can manage economic matters efficiently to produce the desired outcomes. “. . . The market claims that standard economic solutions as set out by the western capitalism ideals, in particular the neo-classic economics should be the right solution and this claim is presented by technocracy” (Shiraishi 2001). By extension, institutional technocracy advocates “economic rationality.”

This article will examine whether the “conventional wisdom” is applied or is applicable to Malaysia, especially in the period after the Asian crisis (the post-crisis period). The discussion begins with a review of the role of technocracy from Malaysia’s independence in 1957 until the Asian crisis in 1998. This is followed by an analysis of the management of the crisis and the economy during the post-crisis period. The post-crisis period is divided into three phases marked by the changing of the guards in Malaysian leadership. Dr Mahathir Mohamed who steered Malaysia out of the Asian crisis stepped down in October 2003 after 22 years as prime minister and he was succeeded by Dato’ Seri Abdullah Ahmad Badawi. Dato’ Sri Najib Razak took over as prime minister in April 2009, where he had to steer the economy through the global financial crisis which broke out in late 2008. Undoubtedly, the analysis of economic policy-making and management in Malaysia in the post crisis period will no doubt be linked to the vision and style of the three leaders.

The Role of Technocracy in Malaysia’s Economic Development before the Asian Crisis

Although technocrats have always served the governing elite, “. . . however, technocracy is not completely in consonance with the democratic governance of the general public, and as such there has always been tension between governing elite and the general public throughout history” (Miyakawa 2000). The tense relationship between rational governance and democracy is brought about by the fact that policy-making depends more and more on technocratic policy analysis and on bureaucratic organizations that have special expertise and relevant information. Consequently, the democratic deliberation by the general public (in Malaysia’s case, the parliamentary deliberation) became less important. Often, policies formulated by the technocracy and approved by the executive branch are passed through the Malaysian Parliament without sufficient deliberation.

Notwithstanding the role of the Parliament, in Malaysia, the more interesting relationship is between the technocracy and the ruling elite as symbolized by the Cabinet. In some periods, the Cabinet is represented by the Prime Minster and thus, the control of economic policy-making is largely dependent on the style and approach taken by the Prime Minister.

Technocracy in Malaysia is inherited from the British colonial system where the bureaucracy is set to be independent from the political process. Besides the civil servants in the bureaucracy, from time to time, selected professionals from the business sector and academia are recruited to join the technocracy for specific tasks. During the early period of Malaysia’s nationhood, the civil service attracted the best brains because it was considered an elite service and many were trained in Britain. They were placed at key ministries and central agencies such as the MOF, the Bank Negara of Malaysia (the central bank), and the Economic Planning Unit (EPU). In the later years, as the size of the civil service expanded, the recruitment was less stringent while most of them received their training in local higher educational institutions. Nevertheless, the upper echelon of the civil service continues to receive their post-graduate training overseas.

Technocrats’ influence is best seen in central agencies such as the central bank, the Treasury, the EPU, and Implementation Coordination Unit (ICU). However, another important aspect of economic technocracy is the role played by government agencies in meeting specific development objectives. These agencies are bodies under ministries that were established with special mandate to upgrade the rural areas and the economic status of the Bumiputeras. Examples of such agencies are the Majlis Amanah Rakyat, Federal Land Development Authority (FELDA) and Federal Land Consolidation and Rehabilitation Authority (FELCRA).

Generally, technocrats are considered to have made positive and influential contribution to the socio-economic development of Malaysia. The imperative of delicate race relations has to a large extent protected macro-economic policy-makers from parochial interference and hence allowed them to pursue long-term strategies without needing to focus solely on short-term outcomes. The strategies and policies formed by these technocrats could have been influenced by their training in Western academic institutions as well as interaction with business leaders and world economic bodies such as the World Bank and the International Monetary Fund (IMF).

The discussion on the role of technocrats in Malaysian economic development during the period before the Asian Crisis can be divided into two phases:

(i) From Independence in 1957 to 1981

Under the leadership of Tunku Abdul Rahman (the first prime minister), Tun Abdul Razak (the second), and Tun Hussein Onn (the third), technocrats experienced a relatively harmonious relationship with the political elite. In fact, they were considered as valued partners and their views and advice were taken seriously. Their contributions to economic policy formulation and the implementation of these policies were enormous. The technocrats were instrumental in designing many of the key economic policies such as the green revolution, export-oriented industrialization, national petroleum policy, and the development strategies embedded in the five-year plans.

This close relationship was not surprising, considering that both Tunku Abdul Rahman and Tun Abdul Razak were members of the bureaucracy and many of the technocrats studied together with these leaders either at schools or universities. The EPU was perceived to be the most influential institution because it decided on the allocation of development budget. Senior EPU officers such as Thong Yaw Hong, G. K. Rama Iyer, and Radin Soenarno worked closely with the political leaders to implement the government vision and plans. The government agriculture policy, albeit conservative, has successfully diversified and modernized the sector with the creation of new land development schemes by the federal land authority. These new land schemes, which were planted with palm oil, were used to mitigate the adverse effect of low and fluctuating rubber prices as well as solving the problem of landless farmers.

Tun Razak had paid a special focus on rural development and technocrats were critical in ensuring that his ideas were effectively implemented. For example, Taib Andak, a close friend of Tun Razak was tasked to implement land redistribution scheme for the landless through FELDA. When Taib retired, Raja Muhammad Alias Raja Muhammad Ali, another technocrat was given the responsibility on FELDA to ensure that this important project was successful. Likewise, technocrats in the Ministries of Finance and International Trade and Industries (MITI) as well as specialized agencies like the Malaysian Industrial Development Authority (MIDA) played a major role in designing incentives and industrial estates to attract FDI and to promote export-oriented industrialization.

Clearly, the technocrats had enjoyed a considerable leeway and influence in the formulation and implementation of macro-economic policies up to the early 1980s. Political leaders relied on technocrats not because the latter sought legitimacy or international acceptance but on the former’s ability and professionalism so that development would take place. The technocrats were knowledgeable, professional, and skilful and were able to offer advice to politicians and were effective in implementation. Delegation of macro-economic policy formulation and implementation to insulated technocrats had enabled them to pursue conservative macro-economic policies. During this period, technocrats were in the driving seats and some of the leading technocrats became national figures and household names. For example, Ghazali Shafie, who was the Secretary General of the Ministry of Home Affairs and a very influential bureaucrat, joined the political elite by becoming the Minister of Home Affairs and thus brought the bureaucracy closer to the power apex.

Following the racial riot in 1969, the government declared a state of emergency, suspended the Parliament, and formed the National Operations Council (NOC). This council was chaired by Tun Razak and he was assisted by the bureaucracy, Army, and Police. During this time, the NEP was formulated by key technocrats, both Bumiputeras and non-Bumiputeras.

(ii) From 1981 until the outbreak of the Asian crisis in 1998

The changing balance of influence and role between technocrats and political leadership was evident when Dr Mahathir took office in 1981 as the nation’s fourth prime minister. He introduced measures to inculcate higher discipline in the bureaucracy and demanded greater productivity. Dr Mahathir had strong visionary ideas on how to leap-frog the economy to a higher level of development. Some of Dr Mahathir’s ideas were modeled after the developmental experience of Japan and South Korea, namely state intervention to spur industrialization, which in turn would be the mainstay of the nation’s economic activities.

Heavy industrialization policy was introduced to drive the industrialization process. The public sector was used as a channel to realize these ideas and many government companies were established to implement the heavy industrialization policy such as the national car project. As a consequence, the size of the public sector ballooned. The technocrats’ role was to implement the strategies through the establishment of public enterprises and many were appointed to head these entities and the state-owned companies. Clearly, Dr Mahathir asserted a stronger role of the political elite over the “traditional” economic actors, namely the technocrats.

The 1985 economic recession had changed Dr Mahathir’s economic approach. Liberalization was seen as a way for Malaysia to attain higher growth. The “new Mahathir leadership” became critical of the large bureaucracy and perhaps regarded it even as a hindrance to development. Conversely, the private sector was given the responsibility to drive economic growth, resulting in the “rolling back” of the public sector by privatizing or closing inefficient public sector agencies and departments. To provide the right environment for the private sector to take the lead role, the Government had introduced a number of liberalization measures such as in the banking sector, capital market, and relaxation of equity rules for FDI.

Dr Mahathir brought in Daim Zainuddin, a businessman-lawyer-politician and a close ally, into the government as his Finance Minister in order to implement his new economic approach of liberalization and privatization. Daim supervised the creation of many private companies and nurtured a cadre of young Bumiputera entrepreneurs to ensure that the private sector become the main engine for growth.

The Malaysian Business Council was established in 1991 to bring the public sector and the business community closer. Although the Malaysian Business Council served an important informational function, it had no authority to make decisions or provide direct input for policy-making. During this period, a number of economic ideas, particularly concerning privatization, came from the private sector while the technocrats were given the task of implementing these ideas only. Dr Mahathir’s grand vision of making Malaysia a developed country—Vision 2020—was developed together with Dr Noordin Sopiee from the Institute of Strategic and International Studies (ISIS), a think tank. Subsequently, the role played by technocrats took a back seat.

The increasing influence of the private sector and others from outside the bureaucracy did not mean that Dr Mahathir had totally sidelined the civil service. He trusted and relied heavily on a few key civil servants. Azizan Zainul Abidin, his chief of staff, was entrusted with many important responsibilities and upon retirement from the civil service he was appointed to head Petronas, the national oil company. Chief Secretaries to the government (head of the civil service) such as Sallehuddin Mohamed and Ahmad Sarji Abdul Hamid were close to and highly regarded by Dr Mahathir as they were tasked to ensure that the civil service implement policies efficiently. Similarly, Raja Tun Mohar Raja Badiozaman, a key economic technocrat, was associated with a number of key projects such as Proton, the national car and later became the economic adviser to Dr Mahathir when he retired from the civil service.

It is clear that Dr Mahathir stamped his own idea on economic growth and along the way reduced the role of technocrats. The fact that his tenure as prime minister covered 22 years meant that he had a longer institutional memory than the technocrats. As a result, he had a better understanding and grasp of the path of economic development that has been or should be taken. His prime ministership also dispelled the idea that technocrats were guiding or advising the government—rather it was the technocrats who were the instruments of political rulers. In effect, technocrats were an endogenous part of some deeper political processes.

Dr Mahathir’s economic vision was largely influenced by his desire to uplift Malaysia’s economic status, for it to be a modern economy, have an economic strength and competitive edge, enhance its role in the international trading system, have science and technological capability, and integrate well into a globalized economic system. He believes that input and support from the business sector in economic strategies and growth are critical.

Dr Mahathir’s economic vision was premised on a strategy of high growth, which had also brought some macro-economic shortcomings, namely the formation of a savings-investment gap, persistent current account deficits, and high private sector domestic debt. Looking beyond the traditional indicators of economic fundamentals, there are also some signs of weaknesses such as the de facto peg exchange rate, asset price bubbles, and exposure to a large capital outflow. At the micro-level, deficiencies were even more glaring—the high level of debts accumulated by some major companies, over-reliance on the stock market for funding, asset price inflation, excess capacity in some sectors such as the construction industry, and the promotion of projects with questionable viability.

Macro-economic indicators prior to the Asian crisis showed that the Malaysian economy was well managed. It had a robust external sector, the public fiscal position was in surplus, the banking sector was well supervised and had sufficient capital, it was a receiver of foreign capital inflow (both short- and long-term ones), and its equity market was the third largest in Asia. In addition, it had full employment and inflation was low. These developments were achieved by market-based and private sector driven economic policies. But when the crisis hit, the micro-level deficiencies outweigh the macro-economic fundamentals and pushed the economy downward, resulting in the strategies and policies being questioned and policy-makers scrutinized.

Management of the Asian Crisis

The impact of the 1997/98 economic and financial crisis was severe and it could destroy all the economic achievements that Malaysia had made over the past 40 years since its independence. The most severe effect was on the financial sector—the ringgit exchange rate depreciated by 45% from its July 1997 level of RM2.50 to USD1; the equity market lost 80% of its market valuation; the short-term capital account showed a substantial net outflow of RM21.7 billion; and the interest rate level had jumped while the level of non-performing loans (NPLs) of financial institutions had increased significantly. The other severe impact was the massive contraction in the construction sector, sharp decline of domestic consumption and domestic private investment. But the crisis also brought some positive effects, namely on exports where the initial exports reduction was reversed when the ringgit was pegged (at RM3.80 for one US dollar). By virtue of depreciation, in nominal ringgit value of the total export, revenue had increased by 29.8%. Fortunately, the price impact was limited with inflation capped at 5.3% and unemployment rate at 3.2% (the unemployment effect was absorbed by foreign labor who returned to their home countries when the economy slowed down).

The impact and the causes of the crisis were the key factors in shaping Malaysia’s response to the crisis. The crisis was triggered by external factors and worsened by internal weaknesses. The contagion effects were set off by the baht devaluation in July 1997, which caused the market and foreign investors to lose confidence in the health of the Malaysian and other regional economies. The “voting by the feet” saw a massive outflow of short-term foreign capital, with the devastating effects of pushing down the value of the exchange rate. The Malaysian domestic private sector which depended heavily on loans from the banking sector and the stock market had to brutally reduce their activities. When interest rates increased and domestic consumption slowed down, the excess capacity especially in the construction industries had forced companies into heavy losses. In sum, these weaknesses were mostly the product of liberalization efforts introduced earlier without the accompanying safeguard measures.

As with the other affected countries, Malaysia’s early response was to adopt the standard IMF-style measures,1) namely tightened fiscal and monetary policies, introduce measures to redress balance of payment deficits and float the exchange rate. The government had also deferred mega projects and initiated cutbacks on government purchase of foreign goods. In the financial sector, a comprehensive set of measures was implemented such as reclassifying the NPLs in arrears from six to three months and greater financial disclosure by financial institutions. A credit plan was also introduced to limit overall credit growth to 25% by end-1997 and 15% by end-1998, where priority was given to productive and export-oriented activities. The central bank had also raised the three-month intervention rate from 10% to 11%, increased the minimum risk-weighted capital adequacy ratio from 8% to 10 %, and reduced the single customer limit from 30% to 25%. The level of provisions against uncollateralized loans was also increased to 20%.

However, these initial policies as advocated by the “Washington Consensus”2) did not produce the expected results. The fiscal reduction of 20% and infrastructure projects deferment had severely contracted domestic demand. In addition, higher interest rate and credit tightening had starved domestic firms of funds at a reasonable cost. As a result, the domestic economy continued to deteriorate and the exchange rate remained volatile. The private sector was in serious trouble and it could not lead the recovery as it did in the 1985 crisis. Moreover, the private sector’s rising debts could threaten the stability of banking institutions due to the inadequacy of capital to meet the rising NPLs. The external environment was very volatile and uncertain and recovery from the crisis would need much more than an export-driven recovery strategy. In other words, the standard solution as suggested by the IMF was not working.

The ferocity and speed of the unfolding events of the crisis required a different and radical approach. If the situation continued to worsen, the crisis could have destroyed Malaysia’s economic achievements. Therefore, a co-ordinated, comprehensive, and centralized approach was adopted. This was a departure from the 1985 crisis management, which was primarily the responsibility of the MOF. In 1985, the globalization was not as extensive and the domestic economy was less integrated with the regional and global economies as in the 1990s. As such, the government had the time to prepare for any transmission of shocks as capital flows was also less volatile then. Unlike in 1998 when the public sector position was a surplus, Malaysia experienced twin deficits in the fiscal and external payment positions in 1985. Hence, the fiscal policy stance adopted by the MOF then was different with the focus mainly on fiscal restraint through a privatization exercise as government downsized its role in the economy.

In 1998 it was the private sector that was the weak link in the economic chain and this posed a greater problem—if the private sector were to succumb to the crisis, and then it would bring down the banking sector in its wake. Fortunately, the public sector was in a stronger position (having a smaller share of outstanding external debt at 11.4% in 1998 as compared to 53.6% in 1985) and so was able to effectively lead in the recovery process. Indeed it was very clear that a hands-on crisis management style of keeping a constant watch on the economy, sometimes down to the micro-level, was needed because of the potentially dire consequences brought upon by the unprecedented speed of crisis.

When the crisis first broke in July 1997, Dr Mahathir was preparing for his retirement and the management of the economy was left largely to Anwar Ibrahim, the Deputy Prime Minister and the Minister of Finance. Dr Mahathir was alarmed and unhappy when the early crisis response measures, which followed the standard prescription of cutback in public sector expenditure and higher interest rate, did not produce the desired outcome but instead made the economy worse. Dr Mahathir decided that the response to the crisis must be comprehensive and quick, address the critical issues, and serve the needs and interest of the nation. More importantly, since the standard economic remedies were not working, new measures must be introduced. For quick and effective implementation, a new body must be created that can overcome the issues of overlapping ministerial jurisdiction. The National Economic Action Council (NEAC) was established in early 1998 for this purpose.

The priorities set by the NEAC were:

• The domestic economy to lead the recovery process

In view of the external volatility and uncertainty, expansion of the domestic economy was essential to compensate for the adverse impact of contracting externally linked economic activities.• Stabilization of the ringgit

With a stable ringgit, domestic production could resume because exchange rate uncertainty would have been removed. Most businesses could operate at any exchange rate level, after making adjustments, as long as there was some degree of stability.• Regaining monetary policy independence

Malaysia must regain the control of its monetary policy and this could be done only if the link between interest and exchange rates was severed. Monetary independence would allow a substantial reduction of the interest rate without putting pressure on the currency.• Restoring market confidence

Malaysia had a reputation as a good investment location and the crisis was, in part, attributed to the loss of confidence among international investors. The loss of domestic confidence followed when the economy deteriorated and the exchange rate plunged. The restoration of market confidence, particularly domestic, was crucial to bringing back a favorable environment for investment.• Maintaining financial market stability

Financial institutions without adequate capital to meet this contingency would not be able to perform their intermediary functions of funding business activities and this could throttle the economy.• Ensuring adequate liquidity to finance economic activities

For the economy to stabilize and grow, there must be sufficient liquidity and a reasonable level of interest rate, which will allow companies to borrow again and resume their activities.• Preserving socio-economic stability

In an ethnically diverse society, socio-economic considerations are vital for continued stability and harmony. Experience has shown that economic hardship could feed racial tension, if one ethnic group perceived that it was suffering more than other groups or if one group was less distressed. The recovery measures must ensure that policies were not only economically efficient and market consistent but also supported socio-economic and strategic objectives.• Assisting affected sectors

Some sectors were more affected than others during the crisis, and since some of them are critical to the economy, steps must be taken to maintain their viability.

Before the formation of the NEAC, management of the economy was primarily in the hands of the Treasury which is, part of the MOF. But the Treasury did not have jurisdiction over other parts of the government structure that are also essential in dealing with the crisis. The government needed a national committee (NEAC) that brought together all the relevant ministries and interest groups to overcome the problem of inter-agency areas of responsibility. This would eventually allow a more focused and integrated strategy, applied consistently to all ministries. NEAC would also consolidate the national institutional capacity in implementing measures and to ensure a quick response to any new challenges triggered by the crisis.

The need for impartiality of the crisis management team decisions was paramount. It must look beyond a particular inclination or stance of any ministry or central public agency. In the early stage of the crisis, the MOF, including Bank Negara Malaysia, favored the adoption of IMF-style solutions. But others, particularly Dr Mahathir, had argued for possible counter measures, namely an easier interest rate and expansionary fiscal policies. This policy dichotomy was not a good platform from which to develop a crisis response. The often cited example of the policy differences between Dr Mahathir and the MOF was the forced resignations of the Governor and Deputy Governor of Bank Negara Malaysia when these officials disagreed with Dr Mahathir’s suggestion that interest rate should not be increased but instead should be lowered.3) Some commentators interpreted these resignations as part of the political feud between Dr Mahathir and Anwar Ibrahim, leading up to the sacking of the latter on September 2, 1998 (Khoo 2003).

Ideally of course, Malaysia would be best served by policies flowing from all ministries and public agencies, which also reflected the general sentiment. Such neutrality would ensure that whatever policies adopted were not perceived by the public and media, as coming solely from one influential group. Also conflicting and over-lapping jurisdiction of ministries and public agencies could vitiate the full implementation of crisis. Unfortunately with the division in views becoming more and more evident, the opportunity to develop consensus was diminishing. Another policy vehicle was needed, one that had credibility and broad bipartisan support. To overcome this, the NEAC therefore had to be a high-level council with a strong executive implementation mandate.

By virtue of its diverse membership and powerful leadership, the NEAC was well positioned to integrate the diverse functions and jurisdiction of the many ministries and government agencies. This later proved to be a key factor in solving the many and complex problems that were to come the NEAC’s way. These two strengths—an integrated policy response and overcoming institutional rigidity—came from having the Prime Minister as the chairman of the NEAC. The NEAC members included the private sectors and professionals from outside the bureaucracy. In fact, the Executive Director of NEAC at that time was Daim Zainuddin, a former Finance Minister, businessman, and confidante of Dr Mahathir and some view this as a move to marginalize Anwar Ibrahim. The other members of the NEAC were Anwar Ibrahim (Deputy Chairman), Daim Zainuddin, Dr Noordin Sopiee (Chairman of ISIS), and Oh Siew Nam (businessman). The work of the NEAC was supported by the EPU as the Secretariat and the NEAC Working Group. The NEAC Working Group worked directly for the Executive Director to produce the National Economic Recovery Plan which proposed the response measures to be taken. Members of the Working Group came from the private sector, a think tank, and academia.4)

NEAC was established as a consultative body to the Cabinet, and many parties questioned its effectiveness without an implementation mandate. Moreover, at that time the Treasury was in charge of most economic and financial decisions and so few could imagine that the NEAC was going to lead the crisis management process. However, the NEAC needed a mandate and clout to implement its decisions, something that it would not be able to do should it be just another consultative body. It was decided while the executive powers would remain with the Cabinet and the NEAC be its consultative body on economic matters, the latter should be conferred some executive powers. The control structure of NEAC requires that every important decision made by the Council has to be approved or endorsed by the Cabinet, although sometimes there was a time lag when some of the measures had to be implemented immediately. In addition, the Parliament must also approve any major policies or institutional changes. During the course of NEAC’s operations, however, it became very influential, primarily because the mandate was derived from its chairman, the Prime Minister.

The Malaysian response was certainly unconventional and not based on the standard economic reasoning as advocated by the technocrats. Capital controls were clearly against the economic conventional wisdom and normally introduced by countries to solve non-economic problems. The solutions, which could be interpreted as isolating or insulating the country against external vagaries, were also not usually taken by a small open economy which is dependent on the world for its well-being. Although Dr Mahathir was an early supporter of globalization, his criticism on the harmful side of globalization as exhibited by the Asian crisis is consistent with the Malaysian response to the crisis and could be linked with Malaysia’s stance on a more cautious path to liberalization. For example, Malaysia refused to allow foreign investors to buy distressed domestic assets even though this approach was adopted by the other crisis hit countries in the region.

The measures taken which were considered, at that time, to go against the conventional wisdom are:

• Reversing budget surplus into deficit through fiscal stimulus programs

The budget stance was reversed from a surplus of 3.2% of the GNP in 1998 to a deficit of 6% in 1999.• Easing the monetary stance

The statutory reserve requirement for banks was gradually reduced from 13.5% in February 1998 to 4% in September 1998. The base lending rate (BLR) was reduced from a high of 12.3% in June 1998 to 6.79% in October 1999.• Stabilization of the ringgit

Introduced capital controls measures on September 1, 1998. The selective capital controls have two inter-related parts: first, the pegging of the ringgit to the US dollar at a rate of RM3.80 to USD1 and second, the restriction on the outflow of short-term capital.

But at the same time, the political leadership also paid heed to the economic technocracy and introduced market-based measures to address some of the causes of the crisis. These measures, which were based on industry best practice, were targeted to ensure that the banking sector remained sound. For this purpose an asset management company (Danaharta) was set up to manage NPLs of financial institutions. Then, a Special Purpose Vehicle (Danamodal) was set up to capitalize the banking sector and the Corporate Debt Restructuring Committee (CDRC) was set up to facilitate debt restructuring of viable companies.

An array of measures was also introduced to further strengthen the governance environment including improving transparency and disclosure standards; establishing a committee on corporate governance; enhancing monitoring and surveillance; enhancing accountability of company’s directors; protecting the rights of minority shareholders; and reviewing codes and acts to minimize weaknesses.

The economic governance process during the crisis, particularly in the key years of 1997 and 1998, was the product of an extremely dynamic situation. The Malaysian economy was, in the 1990s, already very much integrated with the global one, and many of its crisis parameters were external. Thus, any policy decisions must bear in mind the openness of the economy. The question of whether the policies were reactive or pro-active was also critical—in crisis times, while the reactive process dominated policy decisions, the government must also be pro-active for policies to be effective and efficient.

Dr Mahathir was frustrated with the approach proposed by the bureaucracy, which had followed the standard crisis solutions. He wanted a new approach, a “thinking outside the box,” particularly in dealing with the sharply depreciating currency. Nor Mohamed Yakcop, a former senior official of the Bank Negara Malaysia explained to him the workings of speculation on currency and this confirmed to Dr Mahathir that the ringgit had to be pegged if the economy was to be saved. Other ideas on the formation of special vehicles to deal with NPLs and to recapitalize the financial institutions came from models that have been successfully implemented in other countries.

In managing this crisis, Dr Mahathir employed a new set of technocrats from amongst the retired civil servants, businessmen, professionals, researchers, and academicians. The civil service was used primarily for implementing the measures suggested by this new set of technocrats. Dr Mahathir took this route because he disagreed with the earlier crisis response measures implemented by the bureaucracy and wanted new solutions, even though they were deemed controversial. However, another explanation is that Dr Mahathir wanted to wrest control of the economy from Anwar Ibrahim and thus, he had to establish a new economic team. Notwithstanding the political struggle between the two leaders, the civil service implemented the measures proposed by the NEAC effectively, particularly the capital controls and the pegging of the ringgit, which were crucial for Malaysia in overcoming the crisis.

The Role of Technocracy during the Post-Crisis Period

Dr Mahathir felt vindicated because although initially the world had denounced Malaysia’s response to the crisis, the measures had worked. Malaysia recovered relatively well with less economic and social costs as compared with some other crisis-hit countries. Even the IMF, in time, acknowledged that capital controls could be alternative solutions to a crisis. After recovery from the crisis, Malaysia as many other countries in the region and world faced a number of economic shocks namely the September 11 incidence, SARS epidemic, and the Middle East conflicts. Dr Mahathir, through NEAC, continued the Asian crisis policy response by keeping an accommodative monetary policy and expanding the fiscal stimulus programs. By then, the world had taken note of the earlier Asian crisis experience and response and most countries followed that approach in dealing with these shocks.

It is worthwhile to note that even though Dr Mahathir had introduced response measures that were contrary to the conventional wisdom, Malaysia had followed the standard solutions in other areas particularly in terms of enhancing corporate governance and in dealing with the financial sector’s problems. Dr Mahathir continued the mechanism of economic management even when the economy had recovered from the crisis. Yet, there were also criticisms that Malaysia had refused to “bite the bullet” namely to allow problem companies to fail and for deep restructuring to take place. One thing is clear—the public sector is back in the driving seat for driving economic recovery and growth when the private is unable to do so.

The Asian crisis has redefined the new economic priorities for Malaysia, as follows:

• To achieve a sustained high growth path

The 1997–98 turmoil highlighted the pitfall of a growth strategy based on accumulation of inputs, in this case high capital investment. Therefore, Malaysia’s economic goals—to be an industrialized nation and to restructure its society—must now be based on productivity, technology, and knowledge. The government had announced new policy initiatives to produce high growth, namely:i. Knowledge-based economy: This strategy is to respond to the changing nature of the global economic activity driven by rapid advancements in information and communication technologies. A key ingredient for a successful knowledge-based economy is the availability of the right human capital, which requires a sufficient pool of educated, flexible, well-trained, and highly skilled manpower.

ii. Human capital: This vision of the future economic and competitive landscape naturally requires a high quality human capital. Malaysia’s education sector has to make a quantum leap to build a labor force that is not only proficient in employing today’s technology but also able to contribute to and shape the technology and ideas of tomorrow.

• New sources of growth: The next growth cycle would have to come from the services sector. To achieve this target, service sector’s productivity must be improved.

• Revisiting the privatization policy: A review is useful to ensure that balance between efficiency and benefit of privatization is maximized.

• Deepening the capital market: One of the main reasons for the 1997–98 crisis was the over-dependence of companies on the banking sector and the equity market in raising funds to finance their activities. The third source of capital, that is the bond market, should be developed further to reduce the reliance on the two other sources and to better match funding risks and returns.

• Increasing economic competitiveness:

i. Malaysia can no longer compete on cost alone: The sales pitch must point to world class quality and service. A key consideration is for Malaysia to reposition itself in the global supply chain by becoming a base for R&D, production of critical components and design and procurement centers.ii. Continue with plans to liberalize selected sectors: The financial sector consolidation plan has merged 58 financial institutions into 10 banking groups. This exercise is part preparation for liberalization where ultimately domestic financial institutions will have to compete freely with larger and more efficient foreign financial institutions.

• Restructuring of the corporate sector: More professional managers are needed. The question that was put forward in the aftermath of the crisis was whether there is a need to remake Malaysia Inc. because of over-reliance on a number of owner-entrepreneurs has not produced a robust corporate Malaysia. While this model benefits from their risk-taking dynamism, there is concern that this trait would lead to insufficient emphasis on controls, good governance, and risk management and asset-liability management.

• Continuing with the objectives of restructuring the society to achieve a more balanced socio-economic composition: Although the NEP has reduced poverty, it has not been very successful in its task of raising the Bumiputeras corporate equity to the targeted 30% share. The issue of the restructuring of society has now an added dimension: while the numerical targets are still important and are being pursued, of equal importance is the question of quality of these achievements.

When Abdullah Ahmad Badawi took over as Prime Minister in November 2003, naturally there were questions about the new prime minister’s approach towards economic strategy and policy formulation. Highest in the mind of the public and the investing community is whether Abdullah Badawi would maintain the existing economic strategies and economic policy-making structure.

Although Dr Mahathir had set out many policies for Malaysia, it is not unexpected that Abdullah Badawi would introduce his own strategy for Malaysia’s economic growth as well as the players who would influence economic policy. It is worthwhile to note that Abdullah Badawi came from the civil service—he held a high ranking position in the bureaucracy before joining politics.5) Therefore, his preference towards restoring the role of technocrats was understandable. Even though there were calls for the private sector to resume their role as the driver for economic growth, there were little concrete measures to back this call. The government continued to stimulate growth through its investment and thus unable to reduce the fiscal deficits.

Abdullah Badawi’s economic strategy was to focus on soft infrastructure (enhancing human capital and knowledge). Among his major policies were:

• Setting targets forwards achieving a balanced budget

• Continuing the liberalization efforts in order to attract foreign investment inflows, particularly portfolio investment

• Allowing more competition in the automotive industry, which may ultimately reduced the dominance of the national cars

• Deferment of mega projects

• Removal of oil subsidy

• Making the agriculture industry as another engine for growth

• Focus on biotechnology

This focus on soft infrastructure was in contrast to Dr Mahathir’s preference for hard infrastructure (highways, airports, hospitals, and schools) and some groups had interpreted this as reversing earlier policies.

The conservative and cautious approach of technocrats in the MOF and Bank Negara Malaysia was obvious in the Government’s response to key contemporary economic issues. For example, the Government was largely silent on the calls to review the ringgit peg including from Dr Mahathir, the architect of the scheme, and the ringgit peg was only removed when China did so in July 2005. Similarly, there is no immediate and comprehensive response to the steeper than usual increases in the Consumer Price Index in 2005, as a result of higher oil price.

Abdullah Badawi’s new style of governance is characterized by inclusiveness, which was supposed to be different from Dr Mahathir’s. He urged the people to “work with me, and not for me” and presented a style of leadership that invited greater participation, offered accommodation, and built consensus.6) His people-friendly measures were comprehensive and systematic and extended beyond the public service delivery system to the general public and the private sector. A high-powered taskforce called PEMUDAH was established to reduce bureaucratic red-tape and facilitate the public-private sector partnership and to support the transformation of the public service from a regulator to an enabler. As part of his program to increase professionalism in the government, Abdullah Badawi appointed non-politicians—Nor Mohamed Yakcop, who was Dr Mahathir’s economic adviser and Amirsham Aziz, a former banker—in his Cabinet.

The expectation that the bureaucracy’s role, which was marginalized and side-lined in key decision-making process in the previous administration would be restored did not fully materialize. It is true that technocracy played a more important role in formulating and steering the economic direction in Abdullah Badawi’s Administration, however, the players were not from the public service but from different groups. Unlike Dr Mahathir, who sourced economic and business ideas directly from top business leaders, Abdullah Badawi sought counsel from professionals in the private sector.

This inability of the civil service to resume a lead role in public administration and in giving advice to the political leaders to meet the more sophisticated and complex demands of the nation’s socio-economic development could be partly due to the structure of the public sector that is heavily dominated by the Malays. In 2010, 77% of the 900,000 civil service was made up of Malays, 9.4% Chinese, 5.1% Indians, and the balance by other Bumiputeras.7) This structure does not reflect the country’s demographic composition of 67.4% Bumiputeras (including Malays), 24.6% Chinese, 7.3% Indians, and 0.7% others. The NEP had favored a higher employment of Malays in the public sector to compensate for the lower ratio of Malays employed in the private sector. In the 1970s and 1980s, there was a higher proportion of non-Malays in the important ministries and in critical posts as compared to now. Some observers concluded that this preference for employing Malays has undermined the practice of meritocracy in the recruitment and promotion in the civil service. Low salary is also a factor that discourages the Chinese from joining the civil service.

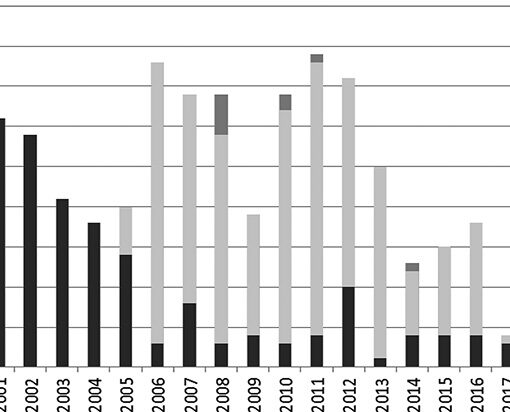

Another important departure from the Mahathir era was the appointment of young business professionals in key public sector agencies such as Khazanah Nasional (the investment arm of the government), Tenaga Nasional (the privatized national energy company), and Telekom Malaysia (the privatized national telecommunication company). These technocrats were tasked to transform Khazanah Nasional and government-linked companies (GLCs) to be the new national economic pace setter and create dynamic and efficient companies that would drive the national economic growth. The Government-Linked Company Transformation Program was launched in 2004 and these GLCs were given performance targets. They had performed well and were a dominant force in the economy: during the 2004–12 period, the GLCs gave a 14.5% per annum total shareholder return, increased their market capitalization by USD65.3 billion, and delivered 18.2% per annum earnings growth. As well as having a dominant presence in some domestic industries, some of these GLCs have successfully ventured abroad, particularly in financial and telecommunication sectors in ASEAN.

Khazanah Nasional and GLCs were the new technocracy, where professionals with private sector experience brought new approaches to public sector governance and policy formulation. Many of these technocrats were trained in business schools or served in management consultancy. This elite group included Azman Mokhtar (head of Khazanah Nasional), Wahid Omar (Telekom Malaysia and later Maybank),8) and Che Khalib Mohamed Nor (Tenaga Nasional). The injection of these new technocrats, who are qualified Bumiputeras (many were graduates from top tier world universities and have worked internationally) is also to overcome the lack of technical competency in the civil service. Thus, although the NEP remains the underlying policy, the new Bumiputera technocrats are highly skilled, competitive and have international experience. They also work together and are supported by non-Bumiputera technocrats in Khazanah Nasional and many of the GLCs. For example, there are four non-Bumiputera Executive Directors working with four other Bumiputera Executive Directors in the key investments portfolio. Likewise, CIMB Bank, a GLC that was formed through the amalgamation of various banks including the Bank Bumiputera,9) and now one of the top two banks in Malaysia and has a significant ASEAN footprint, has non-Bumiputeras in its top management team such as Deputy Chief Executive Officer (CEO) in charge of corporate banking, Deputy CEO in charge of consumer banking and chief financial officer.

These private sector but government-linked technocrats had the stamp of prime ministerial authority to promote efficiency, effectiveness, and professionalism in the government machinery. This increasing “privatization” of the technocracy (as distinguished from the bureaucracy as a whole) has blurred the lines between a true technocrat and a “corporate-technocrat.” They also increasingly functioned as “mediators” between the Cabinet and the ministries. This is discerned most clearly in the measuring of the performance of ministries under the Ministry Key Result Areas (MKRAs) which was later introduced by the Najib Razak’s administration. It is interesting to note that although Dr Mahathir himself never went that far in the “privatization” of the bureaucracy with the appointment of “outsiders” into technocratic roles and positions, it conformed to his agenda of continuously modernizing the public service. The increasing role and influence of the GLCs strengthens the conceptual framework that the public and private sectors are partners and must develop synergistic relationship.

Clearly in the Abdullah Badawi Administration, technocrats were given a more prominent role but unlike the 1970s and early 1980s, and the control of economic policy-making was with the new technocrats—young professionals with corporate experience—from the GLCs. Another important development was that Abdullah Badawi allowed the Parliament a closer scrutiny of the government economic policies and measures.

The euphoria and “feel-good” sentiments which initially accompanied the results of the 2004 general election, where Abdullah Badawi and Barisan Nasional (the ruling coalition) won the largest mandate, later gave way to cynicism, sense of betrayal, and growing disenchantment. Rising costs of living, rising crime, and the continuance of a corrupt culture were some of the main factors contributing to an increasingly negative perception of Abdullah Badawi—broken promises, unfulfilled pledges, and shattered expectations.

The 2008 general election gave the Barisan Nasional its worst election result, where it lost for the first time its two-thirds parliamentary majority and five states plus the Federal Territory to the opposition coalition.10) Besides the perception of unfulfilled expectations and promises, it was argued that the massive election loss was attributed to the role played by and influence of the “Fourth Floor Boys,” Abdullah Badawi’s young advisers led by his son-in-law, which was touted as the “real power behind the throne.”

With such election results, it was untenable for Abdullah Badawi to continue as Prime Minister. However, Najib Razak only assumed the premiership in April 2009, 12 months after the 2008 general election. The global economy, which had just entered its worst crisis since the Great Depression in late 2008 was not a welcoming curtain raiser for the new prime minister. Although the Malaysian financial sector was not affected, the impact of the global crisis came through the real sector, where the sizeable drop in exports had threatened to push the economy into a recession.

Najib Razak had once described himself as a “technocratic politician” in an interview with the Malaysian Business Magazine (1993). This was based on his early experience as an executive with Petronas from 1974–76. He also served briefly with Bank Negara. Trained as an economist and with Malaysia’s experience in dealing with the 1998 Asian Crisis, Najib Razak firmly responded by launching a large fiscal stimulus package, with a size of about 10% of the gross domestic product and lowering of interest rates. Part of the stimulus package was spent on skills training and infrastructure development. These measures were the new standard prescription for responding to a crisis where the market demand collapsed. In such cases, the public sector had to stimulate the economy through fiscal surplus and accommodative monetary policy. These new standard prescription was implemented well by the bureaucracy and the Malaysian economy recovered well in 2010 after declining by 1.7% in 2009.

Since the Asian crisis, the Malaysian economy was only growing at a moderate rate and it was stuck in the “middle income trap.” After attaining a middle income country status in the early 1990s, Malaysia was unable to progress well to join the group of high income countries. Najib Razak saw it as his mission to uplift the status of the Malaysian economy through a new economic model. For this purpose, he established the NEAC in June 2009. The Chairman of the Council was Amirsham Aziz, the former minister in charge of the EPU in the Abdullah Badawi Administration. Two members of the NEAC Working Group under Dr Mahathir (the body that was charged with the formulation and implementing the recovery measures during the Asian crisis, and hence warranting the word “Action” in its name), Dr Zainal Aznam Yusof and Dr Mahani Zainal Abidin were brought back into service. Other members of the Council are Andrew Sheng (former Chairman of the Hong Kong Securities and Futures Commission), Dzulkifli Abdul Razak (Vice-Chancellor, Universiti Sains Malaysia), Dr Hamzah Kassim (technology and public policy consultant), Dr Yukon Huang (World Bank), Dr Homi Kharas (Brookings Institution), Prof. Danny Quah (London School of Economics), and Nicholas S. Zefferys (businessman).

Najib Razak also launched the NKEA to complete his economic transformation program. This work has been tasked to Idris Jala, the former Chief Executive Officer of Malaysian Airlines and now appointed a Minister in the Prime Minister’s Department and the head of PEMANDU (Performance Management and Delivery Unit). PEMANDU, formed in September 2009 is also responsible for monitoring the key performance index of ministers and ministries and its staff are recruited from outside of the public service.

Hence, under Najib Razak the trend started by his predecessor, Abdullah Badawi in increasing reliance on the new technocrats is reinforced. It is still too early to determine the impact of these new actors in economic policies on the relationship between the public and private sectors. It is important to analyze if the new technocrats have improved the economic policies and have positively contributed to the modernization and improvement of the bureaucracy. An example is the Iskandar Regional Development Authority (IRDA) staffed mainly by people from outside the public service, which manages the Iskandar Malaysia economic region. IRDA functions as a one-stop center including processing investor applications, which tries to reduce the problems of multiple or overlapping jurisdictions, thus saving business time and costs. In other words, IRDA combines the administrative capacity of the bureaucracy with the corporate efficiency of the private sector.

Analysis and Concluding Remarks

Technocrats are a crucial part of Malaysian economic growth and development. In the earlier periods, they were valued because of their ability, skills, and professionalism to advise on policy formulation and to implement measures and programs. Subsequently, the role of technocrats took a lower profile when political leaders had their own visions and strategies on how to develop the country. However, there were still a small number of technocrats who had key roles and were highly trusted by the political leaders. During these periods, technocrats pushed for economic efficiency, liberalization, and rural development as well as the building of national capacities and industries.

Since the 1997–98 Asian crisis, the role and composition of technocrats have changed. Although there was the pronouncement that the role of technocracy as represented by the public service/bureaucracy would be restored after being marginalized or sidelined during the Mahathir years, this did not actually occur. It is obvious that technocracy is playing a more prominent role in the Abdullah Badawi and Najib Razak’s Administration but the technocrats are not from the public service. These new technocrats are professionals with corporate or consulting experience, many with Masters in Business Administration degrees but not from businesses. This group has the qualification, experience, and skills required to lead the government economic growth initiatives that are mostly carried out through the GLCs. Naturally, public servants do not have such skills because their work and experience are mainly in implementing public policies.

The use of GLCs as the vehicles to generate private sector-led growth is understandable after the failures of government-promoted Bumiputera entrepreneurs during the Asian crisis. Dr Mahathir and Daim Zainuddin nurtured and promoted a number of Bumiputera and non-Bumiputera entrepreneurs through the privatization of government companies, infrastructure projects, and the commissioning of services required by the government. This preferential treatment was resented and when many failed, this was a good reason to seek a new approach to promote the private sector role in the economy.

If the public sector technocrats wish to re-establish their former influence, they must possess the highest level of competency in economic policy-making and implementation as well as corporate governance. Moreover, they have to benchmark their ability with the best in the business world. For this, the bureaucracy must be able to attract the best graduates. Recognizing this, Najib Razak has opened the public service to direct entry at any level for candidates with talent and exceptional qualifications. More importantly, besides having technical competency, the technocrats must uphold the highest code of conduct and yet have to be flexible to accommodate political interests.

The issue faced by the political leadership will continue to be on how to balance the conservative and sound economic policies recommended by the technocrats with the practical demand of the business world, the public and political constituency. For example, although technocrats have advised on reducing the budget deficits by cutting down drastically subsidies, political leaders have to weigh this advice carefully. The losses incurred during the 2008 general election were partly attributed to the decision made by Abdullah Badawi to reduce petrol subsidies, which caused the price of petrol to increase substantially. In working with the new technocrats, political leaders will also have to be mindful of the resentment that may arise from the public service because this may jeopardize the effective implementation of policies. There may also be criticism from other quarters if the new technocrats do not put national and public interests above corporate considerations.

Striking this balance and the efforts to distance technocracy from politics, have their roots in the NEP, the role of United Malays National Organization (UMNO) in Malaysian politics and national development as well as the legacy of Dr Mahathir. Until the introduction of the NEP in 1971, UMNO—as the strongest component of the ruling coalition party—had not encroached into the technocratic domain so that the boundaries between politics and government were observed (and respected). In other words, technocratic integrity was upheld on the basis that political interference and intervention was a breach of—at least—the implicit trust between the political and policy-making elites (as two distinct groups in the system of government). That is to say, the technocrats could be relied on to formulate and execute policies in consonance with the political agenda of national development. Any purported attempt to directly manipulate and direct the technocracy as “a government arm of the ruling party” can only disrupt the policy-making processes and concomitantly result in demoralization. This situation, however, was to change in the aftermath of the racial riots of 1969.

UMNO, as much as the country, was to be profoundly affected by the socio-economic changes brought about by the NEP. In fact, one could even contend that the transformation of UMNO went in tandem with the national transformation during the era of the NEP (which actually went beyond the stipulated time-frame of 20 years—1971–90). The ranks of UMNO became swelled with members from “non-traditional” backgrounds and profiles. From humble beginnings with the original membership consisting of teachers and lower level bureaucrats, the image of UMNO had changed “overnight” by the advent of the NEP. This sociological transformation would in turn impact on the party’s relationship and attitude towards the technocracy.

Dr Mahathir’s intrusive role in relation to the management of the technocracy was but a natural reflection of the state-interventionist character of the NEP itself. The “politicized” nature of the NEP—i.e. as a policy tool to consolidate UMNO’s political dominance “required” that the party should be more “audacious” in politicizing the technocracy. In short, the UMNO-ization of policy-making could only be a prelude to the UMNO-ization of the policy-makers themselves. Hence, technocrats who were hitherto politically insulated, became more politically conscious.

The sociological transformation of UMNO, with its growing factionalism (linked to either Razaleigh/Musa or Mahathir/Daim) led to the split of the party in late 1980s. This had an impact on Malaysian domestic politics and economy in the 1980s and beyond. The involvement of UMNO in business and the corporate world reflected the government’s interventionist approach in the economy (i.e. the Malaysian version of state capitalism to promote rapid growth and development). UMNO’s flagship company, Renong, was particularly active in representing UMNO’s presence in the capital market—acquisitions and investments. Thus, Renong acted as a proxy or front company for UMNO as a political party. The nexus between politics and business tended to crowd out domestic direct investment (DDI) either by encouraging capital flight by local businesses (mainly from the Chinese community) or concentrating government procurement in crony companies (as well as “reducing” it to a form of rent-seeking).

Interested parties within UMNO and the ruling government had made it difficult for technocrats and senior bureaucrats to work independently. Daim Zainuddin was appointed by Dr Mahathir as Finance Minister twice (1985–91, 1999–2001) and later served as a powerful UMNO Treasurer for 17 years. Subsequently, the involvement of UMNO in business definitely had serious repercussions not only on Malaysian development in the 1980s and beyond but also on the role and contribution of the economic technocrats. These technocrats and the public bureaucracy were also expected to fulfil the interests of certain UMNO personalities who were either linked or even became part of the ruling government.

Dr Mahathir’s own survival in a faction-riven UMNO meant that developmental policies of the country must also protect his interests and those of his allies or supporters including those outside the party and selective non-Malay businessmen (groups) such as Vincent Tan (Berjaya Group), Ting Pek Khiing (Ekran Group), Yeoh Tiong Lay and Francis Yeoh Sock Ping (YTL Group), Eric Chia (Perwaja Steel), and Ananda Krishnan (Usaha Tegas Group).