Contents>> Vol. 14, No. 1

Progress and Challenges of Islamic Economics and Finance in the Contemporary Malay World*

Kambara Kentaro**

*This is a revised version of Chapter 2 of my Ph.D. thesis, 現代マレー世界におけるイスラーム型マイクロクレジットと実体経済―動産担保貸付(アッ=ラフヌ)の役割と動態― (Islamic Microcredit and Real Economy in the Contemporary Malay World: Role and Dynamics of Islamic Collateral Loan, Ar-Rahnu) (Kyoto University, 2018).

**上原健太郎, Faculty of Comprehensive Management, Department of Comprehensive

Management, Matsumoto University, Niimura 2095-1, Matsumoto, Nagano 390-1295, Japan

e-mail: k.kambara[at]t.matsu.ac.jp

![]() https://orcid.org/0009-0001-7880-3888

https://orcid.org/0009-0001-7880-3888

DOI: 10.20495/seas.14.1_127

This article describes the progress and challenges of Islamic economics and finance in Malaysia and Brunei Darussalam. Islamic economics can be defined as the system of economic knowledge that Islamic economics thinkers established based on Islamic teachings, while Islamic finance refers to financial services adhering to Shari’a (Islamic law). The Islamic financial industry has developed predominantly in Malaysia and Brunei Darussalam over the past four decades. There are some criticisms of Islamic financial services in terms of their Shari’a compliance. By tracing the development of Islamic finance in the contemporary Malay world, this article shows what the ideal method of Islamic financial services has been and why and how the practice has faced criticism.

Keywords: Islamic economics, Islamic financial services, Shari’a-compliant finance, Malaysia, Brunei Darussalam

Introduction

In recent years, the Islamic financial industry has grown rapidly in Southeast Asia. Its stable growth has made Southeast Asia an important area for global Islamic finance. In 2022 Southeast Asian markets made up 17 percent of global Islamic banking assets, and it is forecasted that the Islamic financial industry in the region will grow faster than conventional banking. Along with the global increase in awareness of environmental, social, and governance investing, countries in the region have increased their Islamic banking products and institutions in the development of Islamic economics and finance. Among ASEAN countries, Malaysia has become the fastest growing in developing Islamic banking over the last four decades. In addition, Brunei Darussalam (hereafter Brunei) has established Islamic banking as an alternative strategic industry to the oil and gas sector.

How has the Islamic financial industry developed in the contemporary Malay world (i.e., Brunei, Indonesia, and Malaysia), where the government establishes relevant policies and guidelines?

This paper focuses on two countries, Malaysia and Brunei, where the formation of Islamic finance is based largely on the intention to promote the real economy, especially the development of businesses by the Malay population.1) Kitamura Hideki (2021, 259) concluded, “in Malaysia, Islamic banking is an ethno-political tool rather than simply a religious economic phenomenon, and Shari’ah compliance in banking implies promoting the economic success of Malay Muslims.” In Brunei, one of the objectives behind the establishment of the Islamic Development Bank of Brunei (IDBB), which was Islamized and reorganized in 2000, included the intention of the Economic Planning Unit to encourage the development of businesses by Malay Muslims (Kambara 2015). Thus, the formation of Islamic financial institutions in both countries is regarded as promoting the economic development of the Malay population.

In Indonesia, the drive for the introduction of Islamic finance is not completely government oriented. Since the government formulated Pancasila as the state philosophy, there has not been a strong need to establish Islamic finance or support its institutions in order to please the Muslim population as in Malaysia and Brunei. The New Order government in its early period (1966–81) was overly cautious about political activism among the Muslim population and hence implemented a depoliticization policy (Yasin 2010, 117). It was only during 1986–97, after depoliticization was considered accomplished, that the government tried to accommodate the aspirations of the Muslim population. Mutiara Dwi Sari et al. (2016, 180) showed that Muslim intellectuals and ulama revisited the idea of establishing Islamic banks in Indonesia in the 1980s. The formation of Islamic finance in Indonesia is said to have been triggered by the 1997 Asian financial crisis, after which institutional efforts were enhanced (Hamada 2010). Thus, Indonesia linked full-fledged participation in Islamic financial institutions with the promotion of the real economy under the command of the government.

This article aims to clarify the progress and challenges of the Islamic financial industry in Malaysia and Brunei in relation to the real economy. In particular, it investigates both the external and internal variables that determine the development of Islamic finance in both countries.

Generally, the financial sector’s contribution to economic development is to facilitate the transfer of funds between economic agents. Modern banks are therefore required to collect deposits from “surplus entities” in their receiving operations and provide loans to “deficit entities,” that is, households and firms willing to spend and invest beyond their income and savings, in their credit operations.

This article examines the receiving and credit operations of Islamic financial institutions in Malaysia and Brunei from the perspective of their contribution to the real economy. It starts with a historical overview of the Islamic financial system in the two countries—its introduction and development. This description is based on official papers obtained from Islamic financial institutions in the region as well as secondary sources in Malay, English, and Japanese. Next, referring to data on the receiving and credit operations of the Islamic banking sector, this article examines the relationship between Islamic finance and the real economy. It concludes with a brief review of the significance and contribution of the Islamic financial industry to Southeast Asia’s economy.

Overview of the Establishment of the Islamic Financial System in the Contemporary Malay World

This section provides a history of the development of Islamic finance in Malaysia and Brunei, countries representing the modern Malay world. Specifically, we discuss financial institutions—such as Islamic banks in Malaysia and Brunei—as well as institutions that embody and facilitate financial transactions, such as laws and Shari’a advisory boards and councils. Furthermore, we examine the ratio of Islamic financial assets to total financial assets in Malaysia and Brunei. Finally, we discuss the characteristics of the development of the Islamic financial system in the contemporary Malay world.

History of the Islamic Financial System in Malaysia

One of the Islamic financial strategies in Malaysia is to “develop a comprehensive Islamic financial system which would have a greater outreach to the various segments of Malaysian society” (Muhammad and Ahmed 2016, 116). The introduction of Islamic finance in Malaysia dates back to 1962, with the establishment of Perbadanan Wang Simpanan Bakal Bakal Haji (Pilgrims Savings Fund Corporation). In 1969 the organization was merged with the Hajj Affairs Office, established in 1951 in Penang, to form Lembaga Urusan Tabung Haji (Pilgrims Management and Fund Board).

When comparing the system of Islamic finance in Malaysia with that in Middle Eastern countries, Lembaga Urusan Tabung Haji—which provides installment savings for pilgrims—represents the uniqueness of Southeast Asian Islamic finance (Kosugi and Nagaoka 2010). The significance of this fund is its contribution to future developments in the Islamic financial system, such as the establishment of the Islamic Bank of Malaysia. In relation to the real economy, the Pilgrims Fund plays the role of “a developmental financial institution that invests the savings of would-be pilgrims in accordance with the Shari’ah” (Muhammad and Ahmed 2016, 114).

Marjan Muhammad and Mezbah Uddin Ahmed (2016) divided the development of Malaysia’s Islamic financial system into three stages. First, from 1983 to 1993, financial institutions were established and laws were enacted to serve as the foundation of the Islamic financial system. After the Islamic Banking Act (1983) was passed, Bank Islam Malaysia Berhad was established as the first Islamic commercial bank in the country. This was followed by the introduction of the Interest-Free Banking Scheme in 1993. This scheme provides for an Islamic banking window in conventional banks, where customers can enjoy Islamic financial services. The Syarikat Takaful Malaysia Berhad initiative began in 1981. This came about through the efforts of a project team set up by the Malaysian government to investigate the feasibility of an Islamic insurance company in the country. The head office was incorporated on November 29, 1984 and opened for business on July 22, 1985, when Islamic insurance products were offered (Syarikat Takaful Malaysia Berhad 2024).

The second stage was from 1993 to 2001. In 1994 the Islamic Interbank Money Market was established to secure liquid assets for Islamic banks. In 1996 the Shari’a Advisory Council was formed at the Islamic Bank of Malaysia, followed by the establishment of a Shari’a Advisory Council at the Securities Commission Malaysia in 1997. In July 1997 the Shari’a Advisory Council was incorporated at Bank Negara Malaysia (BNM; Central Bank of Malaysia). Its purpose was to unify decisions on Islamic law issues associated with the business of Islamic finance and advise BNM accordingly. Its significance was such that in 2003 it was positioned as the sole authoritative body dealing with Shari’a issues in Islamic finance, takaful, and financing (Muhammad and Ahmed 2016). In 1999 the second Islamic bank in Malaysia, Bank Muamalat Malaysia, was established.

In the third stage of the development of Malaysia’s Islamic financial system, after 2001, the vision for the Islamic financial industry and its internationalization was promoted. From the 2000s, various government and central bank policies and guidelines were issued to set the future direction for the Islamic financial industry. For example, BNM announced the Financial Sector Master Plan 2001, which set the goal for the Islamic banking sector to acquire a share of more than 20 percent of total financial assets by 2010. In an effort to internationalize the industry, the Malaysia International Islamic Finance Centre Concept was announced; this aimed to make Malaysia a hub for the growing international Islamic financial industry. “Guidelines on International Islamic Bank,” which embodied this concept, was formulated by BNM in 2008 and outlined the procedures for establishing an international Islamic bank. In 2010 BNM published the Financial Sector Blueprint 2011–2015, which identified the internationalization of Islamic finance as a priority area.

In the 2000s a number of research and educational institutions for Islamic finance were established. In 2001 the Islamic Banking and Financial Institute Malaysia was set up for practitioners. The Research Center for Islamic Finance was established at the National University of Malaysia in 2001 with the primary objective of promoting research activities in the field of Islamic economics and finance. The IIUM Institute of Islamic Banking and Finance was established in 2004 at the International Islamic University Malaysia. The International Center of Education in Islamic Finance and the International Shari’a Research Academy for Islamic Finance were established in 2006 to meet the demand for human resources in the growing global Islamic financial industry.

The Islamic Financial Services Board was created in Kuala Lumpur in 2002 as an international body to standardize regulations for Islamic finance. International Islamic Liquidity Management, established in 2010, started creating a Shari’a-compliant short-term Islamic financial instrument for efficient Islamic financial liquidity management.

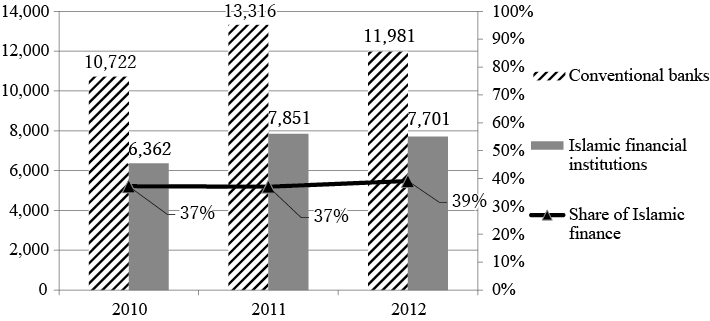

With respect to the size of Islamic financial assets in Malaysia, Islamic banks and the banking sector as a whole increased in value between 1997 and 2022 ( Fig. 1). Comparing the two, it can be seen that in 1997 the total assets of Islamic banks accounted for approximately 2.64 percent of the assets of the banking sector. However, by 2012 this share had increased to approximately 20 percent. The increase suggests that the Financial Sector Master Plan’s goal of increasing the Islamic banking sector’s financial assets to at least 20 percent of total assets by 2010 was achieved. The figure had reached 30 percent by November 2022.

Fig. 1 Comparison of Assets between Islamic Banks and the Banking Sector as a Whole in Malaysia (in million ringgit)

History of the Islamic Financial System in Brunei

Before undertaking an overview of the history of the Islamic financial system in Brunei, it would be prudent to recall how the banking sector developed prior to the introduction of the Islamic financial system in the country. After that, we explore the significance and characteristics of Islamic financial practices.

The formation of the banking sector in Brunei dates back to the 1940s and 1950s, when branches of Western banks were set up in the country. Commercial banking started with the opening of a branch of the Hong Kong and Shanghai Banking Cooperation (HSBC) in 1947, when Brunei was a British protectorate. In the 1960s, Southeast Asian banks started to emerge in addition to Western banks. In the Malaysian capital, the Malayan Bank and United Malayan Banking Corp. opened branches in October 1960 and June 1963, respectively.

The first Bruneian-owned bank, the National Bank of Brunei, was established in 1965. In 1980 the Philippine-owned Island Development Bank was established, with the Bruneian royal family holding approximately 60 percent of the capital and Enrique Zobel of the Ayala Group in the Philippines holding approximately 40 percent and serving as the bank’s president. The bank later came to be owned by the Brunei government (Sugawara 1986; Sidhu 2010).

In 1985 Japan’s Dai-Ichi Kangyo Bank (第一勧銀) took a 20 percent stake in Island Development Bank. The following year the bank was renamed the International Bank of Brunei, with Zobel resigning from the bank’s board and Abdul Rahman of the Ministry of Finance becoming president (Saunders 2002).

As described above, Western and Southeast Asian banks dominated the banking sector in Brunei. Notably, HSBC and the Chartered Bank of Brunei had a significant share in the sector through their deals with Brunei Shell Petroleum (Skully 1984).

From the 1990s, interest-free Islamic financial institutions were established in Brunei. Hassanal Bolkiah, the 29th sultan, set up the first one, Perbadanan Tabung Amanah Islam Brunei (TAIB), in 1991. The initial objectives of the corporation were to plan and participate in industrial and economic development projects in Brunei and abroad through financial services and to enable Malay Muslims to accumulate funds for performing their religious obligation of Hajj, the pilgrimage to Makkah. Notably, the Religious Advisory Committee in TAIB was responsible for making recommendations to the sultan about whether investments could be allowed from a Shari’a-compliant perspective. The sultan appointed the president, vice president, and other directors of TAIB.

In January 1993 the International Bank of Brunei was renamed Islamic Bank of Brunei (IBB). Later the same year, IBB decided to offer shares to local Muslim investors; 7,583 people applied for about 15.11 million shares (totaling approximately BND 30.23 million). Consequently, 14 million shares totaling 28 million Brunei dollars were offered to them (Torii 1995).

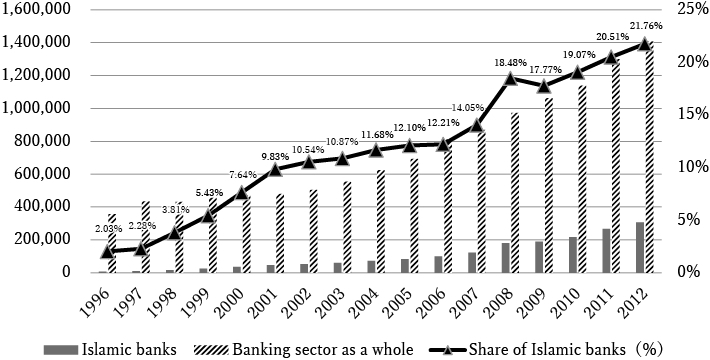

Fig. 2 shows that from 1991 to 1999, the assets of Islamic banks had increased not only in absolute value but also in their share of total banking assets—from approximately 1 percent to 27 percent. In particular, it can be seen that from 1996 to 1999, the amount of assets of Islamic banks increased in inverse proportion to the decrease in assets of non-Islamic banks.

Fig. 2 Assets of Islamic and Non-Islamic Banks and the Share of Islamic Banks in Brunei, 1991–99 (in million Brunei dollars)

Source: Compiled by Kambara Kentaro from TAIB and IBB annual reports for each year (IBB since 1993) and Brunei Darussalam Statistical Yearbook 2002.

The Development Bank of Brunei was established in March 1995 and referred to in the Fifth National Development Plan for industrial development (Torii 1995). In 2000 it was renamed the Islamic Development Bank of Brunei. The bank was required to contribute to the policies of the Economic Planning Unit, which aimed to promote Brunei Malays’ businesses. The bank gradually converted its assets and liabilities to the Islamic financial system beginning in July 2000. For instance, in 2000 only about one-tenth—BND 90.98 million—of its total assets of BND 938.72 million were invested in the Islamic financial system. But in 2001 the figure had risen to a quarter of its total assets of BND 1,190.25 million.

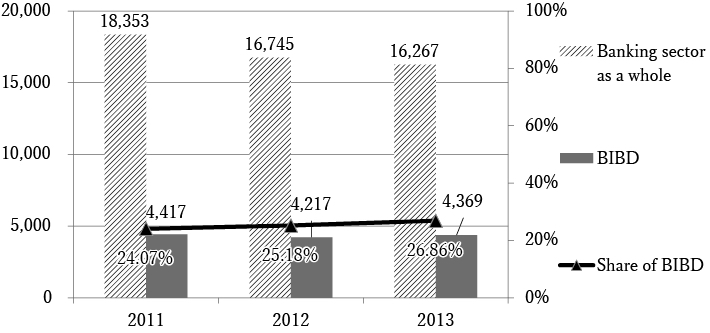

In 2005 IBB and IDBB merged to form Bank Islam Brunei Darussalam (BIBD), which opened in 2006 and was one of the largest financial institutions in Brunei, with total assets of BND 7.5 billion, total deposits of BND 5.3 billion, more than seven hundred employees, and 150,000 customers that year. As shown in Fig. 3, the asset share of the Islamic banking sector increased from 2010 to 2012, whereas that of non-Islamic banks decreased from 2010 to 2011.

Fig. 3 Assets of Islamic and Conventional Banks and Share of Islamic Bank Assets, Brunei, 2010–12 (in million Brunei dollars)

Source: Prepared by Kambara Kentaro from the website of the Monetary and Financial Services Authority of Brunei Darussalam.

The Role of Islamic Finance in Receiving Operations and Its Reality

With respect to the functioning of the Islamic financial system in the real economy of the modern Malay world, this article shows how the receiving operations of Islamic financial institutions developed. Nagaoka Shinsuke (2011, 23) has pointed out that one of the reasons for the commercial success of Islamic banks in Middle Eastern countries was that they “succeeded in collecting ‘savings’ from many Muslims who had been hesitant to deposit money in modern capitalist-type banks that charged interest for religious reasons.” Receiving operations in the retail field are regarded as important not only in terms of management but also in terms of contributing to the real economy. This is because through financing, deficit entities use more of their own production to earn profits, but their source of funds is the financial resources saved by surplus entities (World Bank 1989).

Receiving Services of Islamic Financial Institutions in Malaysia

Fig. 4 presents the amount and share of deposits in the Malaysian banking sector as a whole as well as in Islamic banks from 1996 to 2012. First, as in the case of total assets, the figure shows that Islamic banks’ deposits increased in value, and their share of deposits in the banking sector as a whole also increased. In 2012 this share was approximately 21.76 percent.

Fig. 4 Deposits in Islamic and Conventional Banks and Share of Islamic Bank Deposits, Malaysia (in million ringgit)

Source: Prepared by Kambara Kentaro based on Bank Negara Malaysia (2013) and Bank Negara Malaysia annual reports.

Islamic finance in Malaysia plays a significant role in the operations of Muslims who do not prefer interest-bearing financial instruments. One successful example of Malaysia’s efforts in building an Islamic financial system is the Muslim Pilgrimage Savings Corporation, Malaysia’s first Islamic financial institution. The purposes of this institution were to “manage the funds of Malaysian Muslims who wish to make the pilgrimage to Makkah” (Nagaoka 2011, 20) and to “increase the savings rate of the Malays and use it as a source of funds for economic development” (Torii 2002, 763) through managing funds for the pilgrimage. In 1963, when the Muslim Pilgrimage Savings Corporation commenced operations, it collected approximately 46,600 ringgit from 1,281 depositors (Mannan 1996). In 2015 it was reorganized into the Pilgrimage Reserve Management Fund. The number of the depositors was approximately 9.15 million and the amount of the total savings approximately 89 billion ringgit in 2023 (Lembaga Tabung Haji 2023).

Pointing out that Muslims in Malaysian rural areas tended to have an aversion to interest-bearing financial instruments, Zakariya Man (1988) highlighted the importance of exploring the possibility of their developing a relationship with the Islamic Bank of Malaysia. He explained that the majority of potential rural depositors were Muslims who had never had a bank account and had been saving in kind rather than cash, and that their deposits could provide support for banks in the future. In other words, Man believed there was room for Malaysia’s Islamic banking sector to mobilize the savings of rural Muslims, which had been stagnant. In turn, these savings could be used to finance economic development.

From 2006 to 2012, there were more firms and financial institutions than individuals making deposits (BNM 2013). The share of deposits by businesses (approximately 34 percent) ranked first, followed by financial institutions (approximately 25.3 percent) and individuals (approximately 24.5 percent). Government deposits also accounted for approximately 13–16 percent of total deposits between 2006 and 2012. This may have been because public institutions, such as governments and universities, encouraged public employees to set up accounts with Islamic banks for salary transfers and other purposes.

Receiving Services by Islamic Financial Institutions in Brunei

This article looks at deposit data to describe and evaluate the development of Islamic financial operations in Brunei.

Fig. 5 shows the total deposits of the banking sector as a whole and of the Islamic banking sector in Brunei in the 1990s, based on the annual reports of Brunei Islamic Bank and Brunei Islamic Credit and Savings Corporation. Fig. 6 displays the total deposits of the banking sector as a whole and of the Islamic banking sector in Brunei from 2011 to 2013, compiled from the annual reports of BIBD for each year and Autoriti Monetari Brunei Darussalam (2014).

Fig. 5 Deposits in Islamic and Conventional Banks and Share of Islamic Bank Deposits, Brunei (in million Brunei dollars)

Source: Prepared by Kambara Kentaro based on the annual reports of Bank Islam Brunei Darussalam and Brunei Islamic Credit and Savings Corporation for each year and Brunei Darussalam Statistical Yearbook 2000/2001.

Fig. 6 Deposits in Bank Islam Brunei Darussalam and the Banking Sector as a Whole and Share of BIBD Deposits (in million Brunei dollars)

Source: Prepared by Kambara Kentaro based on annual reports of Bank Islam Brunei Darussalam for each year and Autoriti Monetari Brunei Darussalam (2014).

Fig. 5 shows that deposits in the Islamic banking sector increased rapidly after IBB was established in 1993. The ratio of Islamic banking sector deposits to total banking sector deposits also increased from 1992—when only TAIB had been established and Islamic banking deposits accounted for 2.66 percent of the total—to 1993, when the figure was almost 14 percent. Fig. 6 indicates that from 2011 to 2013, BIBD’s share of deposits in the total banking sector remained constant at an average of 25.4 percent. However, data on the total deposits of TAIB from 2011 to 2013 is not included in Fig. 6 due to data constraints, so it is not possible to show the total deposits of Islamic financial institutions here.

In previous studies, the introduction and operation of the Islamic banking sector were credited with successfully mobilizing domestic savings. Muhammed Ebrahim and Tan Kai Joo (2001) noted that both TAIB and IBB attracted deposits in the retail sector rapidly and on a large scale during the 1990s. In particular, TAIB is credited with serving a niche market in the retail sector by building long-term relationships with its clients (Salma 2007; Venardos 2012). This is specifically the case with savings accounts for children under the age of 12 and savings accounts opened for the pilgrimage to Makkah. In fact, when TAIB was first established, it had ten thousand depositors and BND 118 million in deposits. By 1997, it had expanded to thirty-four thousand depositors and BND 430 million in deposits (Jabatan Penerangan 1998).

Role and Problems of Islamic Financial Credit Services in the Real Economy

In this section we examine the relationship between Islamic finance and the real economy, focusing on the credit operations of Islamic banks in the contemporary Malay world. Specifically, we use the annual reports of Islamic banks in Malaysia and Brunei to analyze their lending operations and compare them to the banking sector as a whole in order to identify the characteristics of Islamic banks’ lending operations.

Credit Services by Islamic Banks in Malaysia

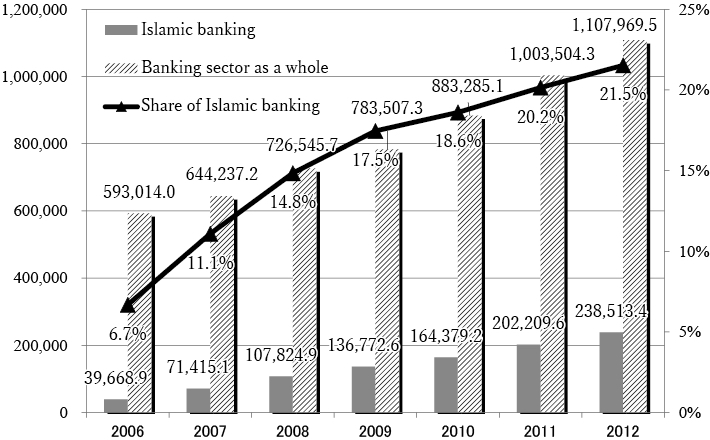

First, we look at the kind of lending done by the Islamic banking sector in Malaysia between 2006 and 2012, based on a report by BNM (2013).

Rodney Wilson (1998) notes that Islamic financing accounted for only 0.6–2.2 percent of total lending between 1993 and 1997 in Malaysia. He concludes that the role of Islam in Malaysia’s economic development is questionable and that Islamic influence on economic development has been marginal. However, from Fig. 7 we see that Islamic banks accounted for approximately 6.7 percent of total lending in 2006. From then, the amount and share of the banking sector as a whole increased, and as of 2012 Islamic banks accounted for approximately 21.5 percent of all loans.

Fig. 7 Lending by Islamic and Conventional Banks and Share of Islamic Bank Lending, Malaysia (in million ringgit)

Source: Prepared by Kambara Kentaro based on Bank Negara Malaysia (2013).

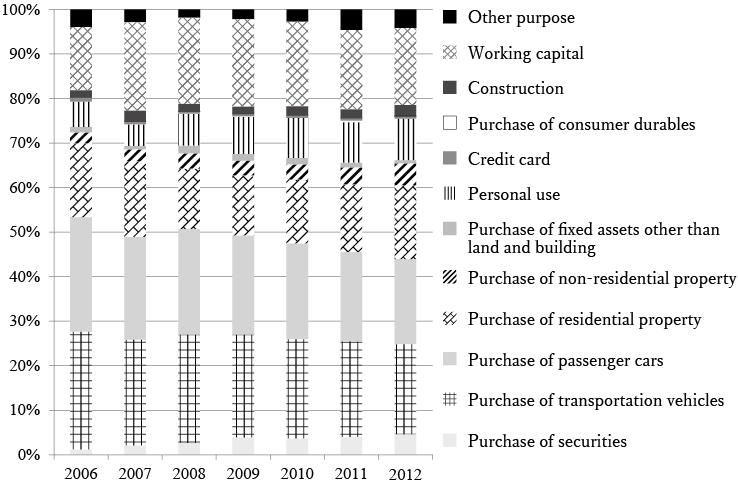

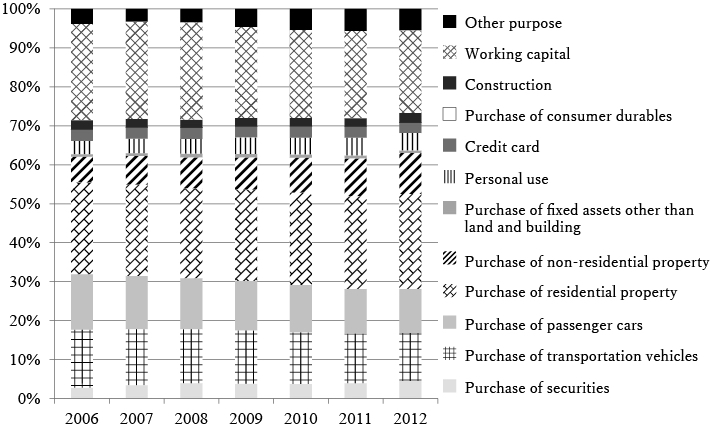

Which needs of the real economy are being met by lending by the Islamic banking sector? In this section, we compare data for the banking sector as a whole and the Islamic banking sector according to the purpose of lending from 2006 to 2012 and list the latter’s characteristics ( Figs. 8 and 9).

Fig. 8 Islamic Banking Sector Lending in Malaysia, by Purpose

Source: Prepared by Kambara Kentaro based on Bank Negara Malaysia (2013).

Fig. 9 Overall Banking Sector Lending in Malaysia, by Purpose

Source: Prepared by Kambara Kentaro based on Bank Negara Malaysia (2013).

The first characteristic of loans given by the Islamic banking sector between 2006 and 2012 is that a large percentage of these were for purchasing transportation and passenger vehicles—approximately 29.7 percent and 28.7 percent, respectively. On the other hand, approximately 15.5 percent and 14.6 percent of loans given by the overall banking sector during the same period were for the purchase of transportation and passenger vehicles, respectively. This data shows that Islamic banks provided more loans for purchasing transportation and passenger vehicles than did conventional banks.

Second, loans for personal consumption purposes were larger in Islamic banks than in the banking sector as a whole from 2006 to 2012. Such loans in the banking sector as a whole accounted for an average of about 4.6 percent of all loans, compared to about 9.8 percent in Islamic banks. For example, in 2012 loans for personal consumption purposes accounted for approximately 5 percent of all loans in the banking sector but approximately 11.4 percent of all loans in Islamic banks. Thus, Islamic banks financed a larger proportion of consumption activities by individual customers than did conventional banks.

Conversely, the average share of loans for working capital purposes related to production activities in the real economy was approximately 26.8 percent of total loans, while the average share of Islamic banks was approximately 23.3 percent. In other words, during 2006–12 loans provided by Islamic banks were less likely to be channeled to the production sector.

Credit Services by Islamic Banks in Brunei

How have Islamic banks provided credit in Brunei since the early 1990s? In this section, we examine the lending operations of the Islamic banking sector in Brunei—namely, TAIB, IBB, and BIBD—from a quantitative perspective. Until the early 2000s, the majority of lending by Islamic banks did not contribute to the production sector made up of firms but to the consumption sector made up of households and non-productive sectors (Salma 2007, 290). However, the lending trends in the early 2010s have not been clarified to date. Therefore, this section examines lending trends in the Islamic banking sector based on its financial statements and compares them with those in the banking sector as a whole.

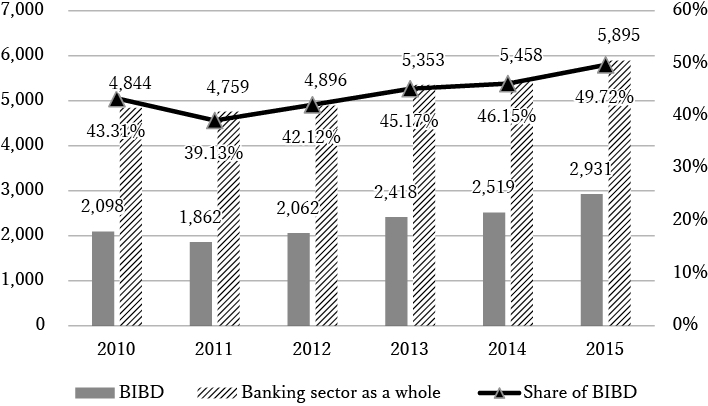

First, we compare trends in bank lending in the Islamic banking sector and the banking sector as a whole from 2010 to 2015 (Fig. 10). Looking at BIBD’s lending in the 2010s, the Islamic banking sector’s lending increased approximately 1.4 times—from BND 2,098 million in 2010 to BND 2,931 million in 2015. BIBD’s share of total lending by the banking sector as a whole also increased—from approximately 39.1 percent in 2011 to 49.7 percent in 2015. Moreover, if TAIB lending, for which no data are available, is included, it can be estimated that lending by the Islamic banking sector as of 2015 was more than half the amount of the entire banking sector.

Fig. 10 Lending by All Bruneian Financial Institutions and BIBD (2010–15) (in million Brunei dollars)

Sources: BIBD annual reports 2011–15; Brunei Darussalam Statistical Yearbook 2013 (p. 173) and 2015 (p. 178)

Next, we examine trends in lending by sector, referring to the data on financing and advances by sector from BIBD’s 2011–15 annual reports. BIBD lending can be divided into the corporate sector (agriculture, finance, manufacturing, transportation, infrastructure, commercial services, real estate development for commercial purposes, tourism, telecommunications, information and technology, oil and natural gas) and the household sector (residential assets and personal consumption).

Lending to the corporate sector was particularly brisk in the 2010s. From 2011 to 2015, lending to the household sector increased by approximately 1.36 times, from BND 1,215 million to BND 1,659.89 million, while lending to the corporate sector almost doubled—from BND 647.17 million to BND 1,278.36 million.

The increase in corporate sector lending was driven primarily by the manufacturing and transportation sectors as well as the oil and natural gas industry, which is considered to include these sectors. Lending to the manufacturing sector increased sharply from BND 95.19 million in 2011 to BND 174.03 million in 2012, while lending to the transportation sector increased from BND 46.17 million to BND 173.41 million. For the transportation industry in particular, the increase in lending from 2011 to 2012 was approximately 2.76 times.

These remarkable increases were due largely to the following two developments in wholesale banking in 2012. First, BIBD signed a cooperation agreement with the Belait Shipping Company to jointly invest in its shipbuilding business. Second, BIBD, together with the Bank of Tokyo-Mitsubishi UFJ (Malaysia), Sumitomo Mitsui Banking Corporation (Europe), and HSBC as co-lead managers, arranged a USD 170 million loan agreement for Brunei Gas Carriers, a state-owned shipping company, to build liquefied natural gas ships (Oxford Business Group 2014).

In terms of BIBD’s lending, from 2013 its lending to the oil and natural gas industry led corporate sector lending and the bank’s overall lending, accounting for approximately 46.1 percent of corporate sector lending and approximately 19.6 percent of total lending, at BND 474.78 million in 2013. As of 2015, its lending had increased to BND 747.25 million, or about 58.5 percent of corporate lending and 25.5 percent of total lending.

According to BIBD’s 2013 annual report, on September 6, 2013, when lending to the oil and natural gas industry was in full swing, a new branch of the bank was established in Kuala Bright, which houses BIBD’s first corporate banking center. Opened by Mr. Bahrin (Yang Mulia Dato Paduka Awang Hj Bahrin bin Abdullah), deputy minister of finance and president of BIBD, the branch was part of the Local Business Development Framework for the Oil & Gas Industry. This framework was expected to contribute to a certain percentage of lending to the oil and gas industry by BIBD.

In the 1990s and early 2000s BIBD lending was mainly to the household sector, and in the 2010s there was a trend toward lending to the corporate sector. However, even in the 2010s, lending to the household sector accounted for approximately 60 percent of total lending, and the oil and natural gas sector, which is a wholesale business, was the driving force for lending to the corporate sector. Thus, lending to the production sector, which is oriented toward the economic diversification of the economy away from dependence on the oil and natural gas sector, was conspicuously absent, as pointed out in previous studies.

Characteristics of the Islamic Banking Sector in the Contemporary Malay World

We have analyzed the history of the Islamic banking sector in Malaysia and Brunei in the modern Malay world and the trends and characteristics of the receiving and credit operations of the sector in relation to the real economy. This article shows that the origins of the Islamic financial system and its operations in Malaysia and Brunei share similar characteristics and challenges.

The first similarity is that pilgrimage funds such as Tabung Haji in Malaysia and TAIB in Brunei were catalysts for the establishment of the Islamic financial system. Second, pilgrimage funds are valued for their receiving operations. The size of deposits in both countries’ Islamic banking sector accounted for approximately 20 percent of the total in 2012.

Until the early 2000s, Islamic finance credit operations accounted for a relatively large share of lending, mainly in the consumption sector and a smaller share in the production sector (Nakagawa 2006). In previous studies on the relationship between Islamic finance credit operations and the real economy, it was pointed out that it would be desirable to channel loans toward productive sectors such as agriculture, forestry, fisheries, and manufacturing (Nakagawa 2006). However, in both Malaysia and Brunei, a large proportion of loans from Islamic banks ended up being for consumption purposes: in Malaysia for the purchase of transportation and passenger vehicles, and in Brunei for personal consumption.

Conclusion

Southeast Asia has received international attention for its contribution to the development of the Islamic financial industry. The ability of the Islamic financial industry to deal with the 1997–98 Asian financial crisis and the 2008 global financial crisis showed its robustness and led to a recognition of the region’s important position in the growing global Islamic financial industry. Since the introduction of Islamic banking in Malaysia and Brunei, the Islamic financial industry has experienced tremendous change beyond its original intentions. Over the years, Malaysia and Brunei have developed a regulatory, legal, and fiscal infrastructure for the industry such that it no longer sits in a niche market. In both countries, the Islamic financial industry has innovated and expanded its roles in response to the prevailing economic situation. As a result, it has gradually come to play an important role in both the overall financial market and the real economy in both countries.

The quantitative expansion of receiving services and the contents of related documents paint a picture of how Islamic finance expanded by mobilizing the savings of the Malay public, who previously did not have bank accounts. In terms of economic benefits to Malay people, Islamic financial institutions have come to play a role in financial inclusion in the Malay world.

Examining the data on credit operations by purpose, it was found that Islamic financial institutions in Malaysia had a larger share of lending for consumption activities, particularly the purchase of vehicles, than for the production sector. On the other hand, in Brunei, while lending for personal consumption purposes constituted a relatively major portion of total lending, the oil and natural gas industry accounted for a larger share. Considering Brunei’s economy, it is possible that the increase in lending to the oil and natural gas industry, which is state-owned, was linked to the goal of stimulating the economy of the Malay population engaged in related industries.

Accepted: October 15, 2024

References

Autoriti Monetari Brunei Darussalam. 2014. Monthly Statistical Bulletin. Bandar Seri Begawan: Autoriti Monetari Brunei Darussalam.↩ ↩

Bank Islam Brunei Darussalam (BIBD). n.d. Annual Report 2011. Bandar Seri Begawan: BIBD.↩ ↩

―. n.d. Annual Report 2012. Bandar Seri Begawan: BIBD.↩ ↩

―. n.d. Annual Report 2013. Bandar Seri Begawan: BIBD. https://bibd.com.bn/wp-content/uploads/2021/12/2013-Annual-Report-English.pdf, accessed February 8, 2023.↩ ↩

―. n.d. Annual Report 2014. Bandar Seri Begawan: BIBD. https://bibd.com.bn/wp-content/uploads/2021/12/2014-Annual-Report-English.pdf, accessed February 8, 2023.↩

―. n.d. Annual Report 2015. Bandar Seri Begawan: BIBD. https://bibd.com.bn/wp-content/uploads/2021/12/2015-Annual-Report-English.pdf, accessed February 8, 2023.↩

Bank Negara Malaysia (BNM). 2023. Monthly Statistical Bulletin. Kuala Lumpur: Bank Negara Malaysia.↩

―. 2013. Monthly Statistical Bulletin. Kuala Lumpur: Bank Negara Malaysia.↩ ↩ ↩ ↩ ↩ ↩ ↩

Ebrahim, Muhammed and Tan Kai Joo. 2001. Islamic Banking in Brunei Darussalam. International Journal of Social Economics 28(4): 314–337. https://doi.org/10.1108/03068290110357708.↩

Hamada Miki 濱田美紀. 2010. インドネシアにおけるイスラーム金融の発展 [The development of Islamic finance in Indonesia]. In 世界に広がるイスラーム金融 [Islamic finance spreading around the world: From the Middle East to Asia and Europe], edited by Hamada Miki 濱田美紀 and Fukuda Sadashi 福田安志, pp. 205–226. Chiba: Institute of Developing Economies, Japan External Trade Organization.↩

Jabatan Penerangan. 1998. Haluan: Sabda/Ucapan Menteri-Menteri Kabinet, Jualai – Disember 1997 [Policy: Speeches and addresses of Brunei cabinet ministers, July to December 1997]. Bandar Seri Begawan: Jabatan Perdana Menteri.↩

Kambara Kentaro 上原健太郎. 2015. ブルネイ・ダルサラームにおけるイスラーム金融部門の形成とその特徴 [Formation and characteristics of Islamic financial sector in Brunei Darussalam]. イスラーム世界研究 [Kyoto Bulletin of Islamic Area Studies] 8: 194–206. https://doi.org/10.14989/198348.↩

Kitamura Hideki. 2021. Policymakers’ Logic on Islamic Banking: Islamic Banking as an Ethno-political Tool in Malaysia. Journal of Current Southeast Asian Affairs 40(2): 245–265. https://doi.org/10.1177/1868103420972406.↩

Kosugi Yasushi 小杉泰 and Nagaoka Shinsuke長岡慎介. 2010. イスラーム銀行―金融と国際経済 [Islamic banking: Finance and the world economy]. Tokyo: Yamakawa Shuppansha.↩

Lembaga Tabung Haji. 2023. Laporan Tahunan 2023 [Annual report 2023]. https://prod-th-assets.s3.ap-southeast-1.amazonaws.com/pdf/press-release/0/2024-10-16/TH_AR23_19.07_compressed.pdf, accessed February 11, 2025.↩

Man, Zakariya. 1988. Islamic Banking: The Malaysian Experience. In Islamic Banking in Southeast Asia, edited by Mohamad Ariff, pp. 67–102. Singapore: Institute of Southeast Asian Studies.↩

Mannan, Muhammad Abdul. 1996. Islamic Socioeconomic Institutions and Mobilization of Resources with Special Reference to Haji Management of Malaysia. Jeddah: Islamic Research and Training Institution.↩

Muhammad, Marjan and Ahmed, Mezbah Uddin, eds. 2016. Islamic Financial System: Principles and Operations. Kuala Lumpur: International Shari’ah Research Academy for Islamic Finance.↩ ↩ ↩ ↩

Mutiara Dwi Sari; Zakaria Bahari; and Zahri Hamat. 2016. History of Islamic Bank in Indonesia: Issues behind Its Establishment. International Journal of Finance and Banking Research 2(5): 178–184. https://doi.org/10.11648/j.ijfbr.20160205.13.↩

Nagaoka Shinsuke 長岡慎介. 2011. 現代イスラーム金融論 [A study on Islamic finance in the modern world]. Nagoya: University of Nagoya Press.↩ ↩

Nakagawa Rika 中川利香. 2006. 開発戦略とイスラーム金融の融合の試み:イスラーム銀行を中心に [The Islamic banking system and economic development: Background, development process, and future perspectives]. In マハティール政権下でのマレーシア―「イスラーム先進国」をめざした22年 [Malaysia under the Mahathir administration: Twenty-two years of striving to create an advanced country with Islamic values], edited by Torii Takashi 鳥居高, pp. 225–259. Chiba: Institute of Developing Economies.↩ ↩

Oxford Business Group. 2014. The Report: Brunei Darussalam 2014. Oxford Business Group. https://oxfordbusinessgroup.com/reports/brunei-darussalam/2014-report, accessed February 8, 2023.↩

Salma, Abdul Latif. 2007. Islamic Banking in Brunei and the Future Role of Centre for Islamic Banking, Finance and Management (CIBFIM). In Islamic Banking and Finance: Fundamentals and Contemporary Issues (Conference Proceedings), edited by Salman Syed Ali and Ausaf Ahmad, pp. 277–300. Jeddah: Islamic Research and Training Institute and Universiti Brunei Darussalam.↩ ↩

Saunders, Graham. 2002. A History of Brunei. London: RoutledgeCurzon.↩

Sidhu, Jatswan S. 2010. Historical Dictionary of Brunei Darussalam. Lanham: Scarecrow Press.↩

Skully, Michael T. 1984. Financial Institutions and Markets in Southeast Asia: A Study of Brunei, Indonesia, Malaysia, Philippines, Singapore and Thailand. New York: St. Martin’s Press.↩

Sugawara Tomota 菅原友太. 1986. ブルネイ・ダルサラーム国:その豊かさと資源・産業 [Brunei Darussalam: Its richness, resources, and industries]. n. p.: Self-published.↩

Syarikat Takaful Malaysia Berhad. 2024. Corporate Profile. Syarikat Takaful Malaysia Berhad. https://www.takaful-malaysia.com.my/wp-content/uploads/2024/01/Corporate-Profile_CP2024-01-V3.pdf, accessed February 11, 2025.↩

Torii Takashi 鳥居高. 2002. ハッジ貯金運営基金 [Lembaga Urusan Tabung Haji, LUTH]. In 岩波イスラーム辞典 [Iwanami dictionary of Islam], edited by Ohtsuka Kazuo大塚和夫 et al., p. 763. Tokyo: Iwanami Shoten.↩

―. 1995. 1994年のブルネイ:イスラム化政策と開放政策の同時進行 [Brunei in 1994: Simultaneous policy of Islamization and openness]. In アジア動向年報 1995年版 [Yearbook of Asian affairs 1995], pp. 343–352. Chiba: Institute of Developing Economies, Japan External Trade Organization.↩ ↩

Venardos, Angelo. 2012. Islamic Banking and Finance in South-east Asia: Its Development and Future. Singapore: World Scientific.↩

Wilson, Rodney. 1998. Islam and Malaysia’s Economic Development. Journal of Islamic Studies 9(2): 259–276.↩

World Bank. 1989. World Development Report. New York: Oxford University Press.↩

Yasin, Mohamad Nur. 2010. Argumen-Argumen Kemunculan Awal Perbankan Syariah di Indonesia [Arguments for the emergence of Islamic banking in Indonesia]. De Jure Jurnal Syariah dan Hukum 2(1): 109–123.↩

1) In Malaysia, Malays are officially defined as Muslims by virtue of Article 160 of the federal constitution. Likewise, in Brunei, Malay citizens are defined by law as Muslims.