Contents>> Vol. 8, No. 2

Chinese Business in Indonesia and Capital Conversion: Breaking the Chain of Patronage

Trissia Wijaya*

* Asia Research Center, Murdoch University, 90 South Street, Murdoch, Western Australia 6150, Australia

e-mail: trissiawijaya92[at]gmail.com; trissia.wijaya[at]murdoch.edu.au

DOI: 10.20495/seas.8.2_295

Taking issues from mainstream research, which has overly coalesced the discussion around patronage-ridden relationships and money politics, this paper argues that democracy has restructured the pattern of state-ethnic Chinese business relationships into a dispersed network, due to the dynamics of capital convertibility within varying scales of power and interests. Offering a unique perspective on capital conversion, this paper aims to debunk the orthodox view of Chinese capital as being merely money that accommodates politics. The revival of Chinese conglomerates in the political-economic life of Indonesia in the aftermath of crises was subject to capital in various forms: economic capital, socio-political capital, ideas, and knowledge. At the time of capital restructuring, an ever-increasing dispersed network of Chinese businesses demonstrated that their position was neither higher than politics nor independent of it, yet the arrangement allowed them to dovetail well with various forces and power holders in a pattern of horizontal connection.

Keywords: political economy, Southeast Asian studies, state-business relationships, patronage, capitalism, Indonesian Chinese, democracy

I Introduction

From petty traders to emigrant workers in the first half of the twentieth century, who struggled over the Japanese occupation and the rise of economic nationalism in Old Order Indonesia, ethnic Chinese and their business firms have long maintained a presence in the trajectory of Indonesia’s development (Robison 1986; Thee 2006). The New Order regime under Soeharto made overtures to Chinese capital acumen to back the regime’s development policy, and a small group of Indonesian Chinese capitalists were co-opted as business clients of the New Order power holders from 1966 onward (Coppel 1983). This patronage-ridden state-business relationship—egregiously dubbed “Cukong and Mr. Ten Percent”1)—paved the way for Chinese capitalists to be more active in the economic sector at the expense of their political rights and cultural freedom. Being patronized by Soeharto, they did extraordinarily well in wielding resources (Vatikiotis 1993). For instance, the cukong’s coalition (comprising many ethnic-Chinese businessmen) was endowed with a $6 billion timber industry, along with cheap access to forest resources and virtual immunity from forestry regulations for decades (Barr et al. 2010). Among the capitalists in the coalition, Prajogo Pangestu, the head of the Barito Pacific Group, controlled 5.5 million hectares of the world’s tropical rainforests and became the largest borrower of state funds: his loans amounted to more than $1 billion (Dauvergne 2005). Soeharto’s longtime business associate Liem Sioe Liong became the undisputed king of Indonesian agricultural commodities, banking, and cement, while his company, the Salim Group—with a market capitalization of $8 billion in 1990—accounted for roughly 5 percent of Indonesia’s GDP (Schwarz 1994).

At the beginning of the new millennium the Asian Financial Crisis, followed by a full-blown political crisis, had severe consequences in Indonesia—for the capitalist group in particular. On the one hand, they suffered from high debt; some of them were even left technically bankrupt or without working capital (Purdey 2005). On the other hand, the consolidation of democracy gave rise to a list of reformasi mandates in which the capitalists sought to reposition themselves in a new mode of conducting political business. The former Foreign Investment Law 1967 and Domestic Investment Law 1967—which had been astutely manipulated by power holders for allocating concessions, business licenses, and other material benefits for cukong—were revised into Law No. 5/1999 Stipulating the Ban on Monopolistic Practices and Unfair Business Competition (Thee 2006; Chua 2008). In tandem with the IMF liberalization package and increasing need for foreign investment, many skeptical pundits predicted that Indonesian Chinese capitalists, with their over-reliance on patronage ties, would not be able to withstand the onslaught of competition on a global scale (Suryadinata 2006).

Despite the sweeping political, economic, and social changes, the Indonesian capitalists continued to do well in business and even achieved record profits during the post-authoritarian regime. On the 2017 Forbes Indonesia Rich List, only 8 of the 50 people were non-Chinese. The remainder were all Indonesian Chinese businessmen—both new players and politically connected Chinese capitalists from the Soeharto era. Clearly, this illustrates how ethnic-Chinese-controlled conglomerates have grown and become an integral part of the democratic regime. How can these contradictory outcomes be explained, since democracy and economic restructuring would be expected to lessen the Chinese businesses’ competitive advantage? Does the patronage network remain relevant in the post-Soeharto era, or is there a new pattern in the state-Chinese business relationship?

Drawing upon both primary and secondary research materials, this paper unpacks those questions by reintroducing Chinese business into the notion of capital and, with it, accumulation and all its effects on state-business relations. This paper argues that the “fall of capital” embedded in the patronage network led to the rise of a new form of social and economic capital that enhanced Chinese capitalists’ bargaining power and simultaneously restructured state-business relations. The decentralization and economic restructuring due to reformasi generated economic and social capital that was vital for the expansion of Chinese economic capital. Chinese capitalists had greater opportunities to tap into the lucrative sectors from which they had been restricted during the New Order (see Dieleman and Sachs 2008; Dieleman 2011). In a nutshell, restored civil rights are often viewed simply as social capital, yet they have been used as a powerful tool for political leverage and for pursuing economic interests.

As a result, the greater flexibility in converting capital (adapting the function of a particular form of capital to make it serve a given purpose) amidst political changes has ultimately restructured patronage into a dispersed network. The dispersed network assumes that Chinese capitalists’ position is neither above the government’s nor independent of politics, and the government’s position is neither above the capitalists’ nor independent of economics. Such a network has enabled Chinese capitalists to dovetail well with any (economic, social, and political) forces or groups/interests and power holders in a pattern of horizontal connection. Any Chinese capitalists, whether new or old, embedded in the dispersal arrangement can play a dual role—both as patron and as agent—depending on the forms of capital they possess and the political circumstances. This new arrangement demonstrates not only shifts in power configurations but also changes in the sociopolitical characteristics of orthodox patronage relationships tailored in the New Order era.

The following section identifies gaps in knowledge, particularly the tendency to over(focus) on the literal meaning of Chinese capitalism in the Indonesian political arena. It introduces a critical context by inserting the concept of capital convertibility into the picture and putting forth a conceptual framework to better analyze how the dynamic of capital convertibility has restructured state-business ties. The third section elaborates on the nexus of the state and Chinese business during the New Order era. The fourth section discusses the new political arena resulting from democracy through which capital conversion takes place. For purposes of analysis, the section is thematically divided into three subsections: (1) the politics of unity in diversity, (2) diversification of political power, and (3) the politics of globalization and nationalism. The last section discusses the trajectory of capital conversion in state-Chinese business relationships and concludes with a summary of the main findings.

This article makes two primary contributions. First, it provides a fresh perspective on the political-economic debate over Indonesian Chinese business through an analysis of capital conversion. By delving into the dynamics of the sociopolitical and economic capital of Chinese business, this paper offers a nuanced, contextual understanding of how Chinese capital has revived in the aftermath of reformasi and since then been converted according to its content, spaces, and viability within various forces in Indonesia. Second, it contributes empirical evidence of the actual dynamic of capital conversion in restructuring the state-Chinese business relationship and reshaping the politics of development in Indonesia. Without neglecting the fact that democracy has given rise to new Chinese business elites at the local level, the term “Chinese business” in this paper refers to top-listed ethnic-Chinese-controlled conglomerates. The argument presented here depicts an overview of Indonesia’s past and contemporary economic development trajectory, in which Chinese conglomerates (cukong and new big players) have become an important, if not decisive, component of development.

II Critique and Analytical Framework

This section aims to establish an analytical framework that underpins the revival of Indonesian Chinese capitalism and identifies changes in the state-Chinese business relationship in the scheme of capital conversion. Mainstream camps tend to underpin Chinese capitalism with pragmatism or unlimited flexibility in political business dealings (Cragg 1995; Hui 1995; Ong and Nonini 1997; Hamilton-Hart 2005) in a bid to ensure survival in the midst of political changes. This is also aligned with the term “ersatz capitalist” coined by K. Yoshihara (1988), projecting the “flexibility” of Chinese businesses in running roughshod over their counterparts. Yoshihara describes Southeast Asia’s Chinese businessmen in a pejorative way. Insofar as the businessmen perceive life as a matter of adaptation, they cultivate informal networks of “ersatz” protection, including collusion with ruling elites, when the legal system fails to provide adequate protection.

Accordingly, regarding the political transformation in Indonesia, a vast amount of literature laments the institutional deficits and inadequacies in the face of competing coalitions of interest and power (McLeod 2000; 2010; Schwarz 2004; Aspinall and Klinken 2010). The new commercial and competition laws designed in haste after the fall of Soeharto proved to be much easier to manipulate than the previous versions because regulations were skewed in favor of entrenched commercial interests in the less predictable environment of democratic Indonesia (Rosser 2002; Hadiz 2003; Aspinall 2005; Fukuoka 2012; Mietzner 2013). Another camp identifies significant changes in the patronage-ridden relationship after the political transformation in Indonesia, where Chinese businesses insinuated their position into the political machinery surrounding prevailing oligarchs (Winters 2013) as well as non-oligarchic forces (Mietzner 2014). In one instance, Indonesia’s new era of democracy was dominated by oligarchic elements, including the circle of political-business families operating from the New Order regime that leveraged power relations of wealth and authority (Hadiz and Robison 2004). In another instance, there was a significant influx of non-oligarchic forces in contemporary Indonesia that became active in the national and local political domains and challenged the oligarchy (Ford and Pepinsky 2014; Mietzner 2014). C. Chua (2008) pinpoints a twofold approach most Chinese capitalists adopted to accommodate such political dynamics. First, they continued with business as usual, taking advantage of their capital and skills. Second, they sought multiple patrons (unlike during the previous era, when Soeharto was the sole patron) in order to withstand political instability. This approach helped to tailor a new pattern of state-business relations that was often associated with “money politics.” The latter to a great extent resonated with the new pattern of state-business relations that W. L. Chong (2015) identifies at the local level. So far as Chinese capitalists remain oriented to their habitus in which the predatory political-business system has been nurtured, they continue to reshape the system in a bid to safeguard their capital and position (Chong 2015).

Although scholarly literature largely depicts current conditions in the Indonesian political economy, it is by no means static. The majority of literature situates the state and Chinese capitalists in a framework of syllogism—in which money is always the vehicle for Chinese capitalists to cope with sudden shifts in the political system, while the state is the predator that seeks legitimacy and power by capitalizing on Chinese money. Simply put, the literature tends to generalize the symbiotic relationship between power holders and Chinese business in the context of conventional features of Chinese capital and consequently can lead researchers down the wrong analytic path. Such a generalization also hinders scholars from acknowledging the interplay of various forms of capital—economic capital, socio-political capital, ideas, and knowledge—that have affected Indonesian Chinese capitalists’ endeavors and their relationship with the state. In hindsight, we need a proper concept to analytically link capital dynamics with changes in the state-business relationship.

Drawing inspiration from P. Bourdieu’s “The Forms of Capital” (1986), I am keen to take his reasoning of capital conversion into account. Bourdieu does not neglect the fundamental existence of economic capital, but he laments scholars who reduce every type of capital to economic capital. For Bourdieu, the notion of capital extends beyond its economic constraints and takes into account a wide variety of resources, such as political, social, and cultural. Economic capital refers to material resources that can be turned into money or property rights. Social capital stands for networks of contracts that can be utilized to leverage one’s social position. Cultural capital consists of non-material goods such as knowledge and ideas, skills, and expertise that can be converted into economic capital (Bourdieu 1986, 243). Political capital refers to a subtype of social capital that has the capacity to mobilize social support (Bourdieu and Wacquant 1992, 119). In essence, the convertibility of different types of capital is the actual basis of social-power relations that reshape the dynamic of power struggles, as Bourdieu (1993, 73) argues:

The field of power is the space of power relations among agents and institutions who own enough capital to share leading positions in the different fields (especially the economic and cultural fields). It is the site of struggles among the holders of different kinds of capital or power. . . . The stakes in these struggles are the rules of transformation or conservation of the different kinds of capital, their comparative values, which themselves rule, at any moment, the forces which can be invested in these struggles.

In other words, differing combinations of capital serve to constitute the resources necessary for the production of other types of capital. For example, social capital such as personal ties with power holders can be converted into economic capital in the form of land or money, either directly or via gathering economic capital for a political purpose such as a campaign fund, in exchange for officials’ discretionary favors to expand the business (Bourdieu 1991; Swartz 2013). Relatedly, convertibility hinges upon the varying degrees of accumulation and the value of different elements of capital. Regardless of its form—be it cultural, social, political, or economic—capital can be materially effective only if it is appropriated by a given agent and the agent has a network of connections where he can effectively mobilize the capital he possesses (Bourdieu 1991). In Bourdieu’s words (1986, 252), forms of capital other than social capital

can be obtained only by virtue of a social capital of relationships (or social obligations) which cannot act instantaneously, at the appropriate moment, unless they have been established and maintained for a long time, as if for their own sake and therefore outside their period of use.

How Bourdieu’s capital conversion relates to the state-Chinese business relationship is the way in which varying combinations of capital embedded in any given state-business relationship, such as a long-standing patronage-ridden relationship, have been maintained as well as simultaneously transformed. If neoliberal pundits see the patronage network in terms of institutional flaws, I instead interpret it as a site of struggle among the holders of different kinds of capital during the New Order. Chinese political vulnerability itself appeared to be a form of social capital that was less harmful for Soeharto’s leadership, and thus it gave leeway for Chinese businessmen to expand their economic capital and nurture solid dyadic politico-business ties. However, such relations are not static, as there are always sites of struggle. State transformations, specifically due to democracy, led to the reconfiguration of power and interests; thus, the value of each form of capital was redefined in varying scales of social-power relations. The renewed capital conversion would finally reinforce the inclusion and exclusion of particular actors in state-Chinese business relationships and subsequently create new patterns of relationship.

To better understand how capital conversion has restructured the patronage system in Indonesia, it is worth using the features of patron-client ties developed by J. C. Scott (1972) as a basis for comparatively assessing shifts in state-Chinese business relations. There are three additional distinguishing features of patron-client ties: (1) their basis in inequality, (2) their face-to-face character, and (3) their diffuse flexibility. The basis in inequality refers to an imbalance in exchange between the two partners that reflects the disparity in their relative wealth, power, and status. In this context, the most embedded characteristic of reciprocity is that the patron unilaterally supplies goods and services that a potential client needs for their survival and well-being while simultaneously demanding compliance from the client who has been enjoying those scarce commodities (Scott 1972; 1977). The balance of reciprocity depends mostly on the competitiveness among patrons and the value of services the client brings. If the client has highly valued services to reciprocate with, or if he can choose among competing patrons, or if he can theoretically manage without the patron’s help, the balance will be close to equal. On the contrary, if the client has weak bargaining power or has a few exchange resources to spoon a monopolist-patron, the patron-client ties tends to be coercive (Scott 1972; 1977; Scott and Kerkvliet 1977; Wolters 1983).

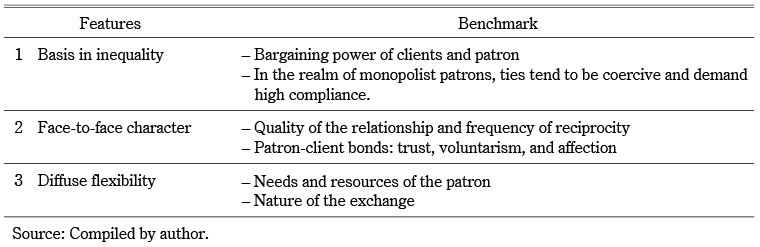

The second feature of this dyadic tie, its face-to-face character, relies on the quality of the relationship. Reciprocity that takes shape over the long term eventually nurtures a solid patron-client bond with trust, voluntarism, and affection between the partners. The roots of reciprocity are not simply limited to mutual advantage but are associated with a mutual devotion and values that thrive among both sides because of the endurance of the patron-client framework (Scott 1972; Roniger 1994). The third salient reflection of patronage relationships is that they are “multiplex.” They are diffuse, “whole-person” relationships rather than explicit, impersonal-contract bonds (Scott 1972). The needs and resources of the patron, as well as the nature of the exchange, may vary widely over time, so the language of flexibility is paramount (Gamson 1968). Table 1 presents a tentative framework to analyze how the interplay of different forms of capital has affected the characteristics of the above-mentioned features and resulted in a centrifugal network of state-Chinese business relationships.

Table 1 Fundamental Features of State-Business Relationship in Indonesia

III The New Order: A Long-Lasting Patronage and Indestructible Economic Capital

While a democratically elected politician knows how long he will face the challenge and leave the oath, authoritarian leaders like Soeharto were fundamentally insecure because they could face a challenge at any time. Political legitimacy based on pembangunan, or the “development” mandate, thus became the nerve center of Soeharto’s vision. To build the economy from scratch, Soeharto acknowledged that the regime had to avoid risky decisions by distributing resources—such as licenses to invest and additional credits—to reliable partners (Vatikiotis 1993; Chua 2008). Clearly, a small group of ethnic Chinese businessmen with whom Soeharto had developed the nucleus of a military financial base prior to the New Order was the right choice (Australia, DFAT 1995). The group included Liem Sioe Liong, Bob Hasan, Prajogo Pangestu, and Eka Tjipta Widjaja, whose economic capital could be put to good use for accomplishing pembangunan without posing any threat to Soeharto’s political power. Consequently, the government’s policies resulted in a heavy concentration of wealth in the hands of a few trusted cukong and indeed became an enabling factor in the rise of Chinese capitalists (Robison 1986; Schwarz 2000).

R. Robison and Vedi Hadiz (1993) labeled this convenient relationship between Soeharto and Chinese capital as dirigisme (dirigisme), a relationship in which the economy was led by one man and a bunch of cronies, which eventually fostered the great leap forward of well-connected cukong to big conglomerates. To a greater extent, such a dirigiste economy nurtured the much-touted patronage network, which was originally tailored by politico-bureaucrats and Chinese capitalists from the Old Order. The patronage-ridden relationship allowed policy formulation and resource distribution to be concentrated in the hands of certain political elites and economic actors, including well-connected cukong.

Yet the relationship was by no means static. Over a period of time, the political dynamics of development and resistance during the New Order reshaped the composition and role of actors embedded in the patronage network. What did not change was that Soeharto remained the sole locus of political power who managed the network. During the oil boom period, the nature of the state-business relationship was much simpler. If Japan’s recipe for pursuing its remarkable development was strongly related to the much-touted robust iron triangle established between the bureaucracy, business groups (keidanren), and the ruling Liberal Democratic Party (Johnson 1995), Indonesia under Soeharto also unwittingly had an informal institution like the iron triangle interlinking Soeharto, the military, and cukong. Those three stakeholders simply took the lead as the “pilot ministry” in directing development. At certain levels of policy making, technocrats or the “Berkeley Mafia”2) were also involved, but they had no greater influence than Indonesia’s iron triangle. In short, the source of patronage was not concentrated on the Istana Merdeka (presidential palace), because the process of establishing long-running patron-client relations rested outside the official layers and instead centered on Rumah Cendana (Soeharto’s residence) (Rosser 2002; Borsuk and Chng 2014).

Interestingly, the “cooperation” between the military and cukong made the state more coherent in its policies and autonomous from social interest groups. The military, represented by “Soeharto men” worth their salt, would get the green light from Soeharto to engage in income-generating activities while Soeharto remained the principal patron (Rieffel and Pramodhawardani 2007, 32). Thus, they were among the most powerful figures in controlling capital, as they could either take the lead as stakeholders of a project or function as “security guards” for cukong (Crouch 2007; McLeod 2010). Having provided the Chinese with the usual litany of favors—such as tax breaks, state bank funding, trading licenses, and introductions to foreign investors—the military displayed its political avarice as it also gradually became the capitalist and coalesced around cukong businesses (Crouch 2007). Powerful generals, such as the “finance generals” Alamsjah Ratu Prawiranegara, Sudjono Humardani, Suryo Wiryohadiputro, and Sofjar, and the “money spinner” Ibnu Sutowo would have at least one cukong to partner with (Borsuk and Chng 2014).

Sudjono Humardani, one of Soeharto’s top fix-it men in the early New Order period, reportedly arranged a series of joint ventures between leading cukong and major Japanese investors, for example, bringing together Toyota and William Soeryadjaya (Tjia Kian Long) and Matsushita and Tjaheb Gobel (Schwarz 2000; Abbott 2003). Sofjar, who controlled Yayasan Dharma Putra Kostrad and Yayasan Trikora, established Bank Windhu Kencana, Seulawah, and Mandala Airlines utilizing a capital injection from Liem Sioe Liong (Crouch 2007). Obviously, the four finance generals held the top positions in the bank management: Sofjar was president director; Alamsjah was director; and Suryo and Sudjono were the chairman and vice chairman respectively (Borsuk and Chng 2014). Suryo also served as president director of the government-owned Hotel Indonesia and was given permission to build the Mandarin Hotel in Jakarta, in which Liem Sioe Liong became the main shareholder (ibid.). The money spinner, Sutowo, also had shares in PT Sarana Buana Handana, a logging company partnering with Bob Hasan, and in PT Atlas, a large paper milling venture that also had Bob Hasan as well as Sutowo’s son Ponco and Japanese companies as stakeholders (Ismantoro 2014).

Such solid ties between the military and cukong, which were supported by Soeharto, underwent changes particularly after the oil boom. There are two turning points worth emphasizing here. First, Soeharto’s favored treatment of Chinese economic capital evoked popular discontent with the New Order and led to widespread protests. In response to the threat of growing opposition from the economic nationalist and Muslim groups, Soeharto apparently decided to modify his policy on Chinese capital and promote a pribumi-favoring policy so as to maintain political stability. The Presidential Decree (“Kepres”) No. 14 of 1979, which was amended and reissued as Kepres 14A and Kepres 10 in 1980, gave the “weak economic group,” a code phrase for indigenous businessmen, priority in obtaining certain government contracts (Robison 1986; Schwarz 2000). A new team, known as Team 10, was set up to decide on project allocations. Headed by Sudharmono, the powerful state secretary, and Ginanjar Kartasasmita, the team gave great leeway for prominent pribumi businessmen to get government-related contracts; these businessmen included Aburizal Bakrie, Fadel Muhammad, Iman Taufik, Jusuf Kalla, Fahmi Idris, Hashim Djojohadikusumo, and Subagio Wiryoatmodjo (Winters 1996; Schwarz 2000). The second turning point was the emergence of “Soeharto Inc.,” the business empire linked to the Soeharto family. The growing economy provided opportunities for Soeharto’s family to create monopolies and toll-gate enterprises (Smith 2001). As of 1998, Soeharto Inc.’s wealth concentration consisted of 417 listed and unlisted companies, particularly state-controlled ones (Claessens et al. 1999).

The affirmative-sounding policy and the increasing share of the Soeharto family in the Indonesian development trajectory did not necessarily impede the accumulation of Chinese capital or erode the long-running patronage network. The two turning points discussed above neither broke down the Soeharto-Chinese network nor diminished Soeharto’s position as an indispensable source of support to Chinese capital. This was possibly due to two underlying reasons. First, in the beginning of the 1980s, technocrats urged Soeharto to issue deregulations in some industries, including banking, transport, trade, and manufacturing, so as to parlay non-oil exports (Sato 1994). While the technocrats’ objective was purely to liberalize the economy, the deregulation package in turn allowed cukong to amass capital, particularly after the lifting of restrictions on the Jakarta Stock Exchange. As a result, almost every Chinese business group founded one or more private banks, and thus their dependence on funds from state banks also decreased slightly (Chua 2008). Accordingly, soon after the world price of Indonesian oil plunged—from $32 per barrel at its peak in 1982 to a low of $9 per barrel in 1986—Soeharto set forth an export-oriented policy that encouraged the private sector, including his cukong, to inject more capital into non-oil products so as to allow the economy to rebound (Habir 1999). When it came to pushing exports, Chinese gained the upper hand as they controlled the economic resources that everyone wanted at the time, namely, sources of credit in the banking and leasing sectors (Borsuk and Chng 2014). In other words, Chinese capital became an integral part of state capital, which was required for advancing pribumi businesses. The established wealth of the Chinese, and their importance, further strengthened their utility in Soeharto’s eyes. On the one hand, considering their political vulnerability, Chinese businessmen simply dovetailed their economic capital into the new political arena that was swayed by pribumi entrepreneurs and Soeharto’s family (Shin 1991). To a greater extent, they even committed to reinvigorate Soeharto Inc. and rolled out what Robison and Hadiz (2004) termed “capitalist oligarchy.” For example, in 1984 President Soeharto’s youngest son, Tommy Soeharto, established the Humpuss Group, which was notorious for its favoritism and patronage rather than talent or professionalism. One of Humpuss’s business dealings was the acquisition of Sempati Air. Established by PT Tri Usaha Bhakti (a military-controlled business group subsidized by prominent Chinese businessmen), it was the first private airline allowed to operate jet aircraft in Indonesia. In 1989 two companies obtained shares in the airline: PT Nusamba, a group controlled by Bob Hasan, got 35 percent; and Humpuss obtained 25 percent (Liddle 1999; Schwarz 2004). Meanwhile, besides Bank Central Asia, Liem also maintained links with Siti Hardiyati Hastuti Rukmana (Tutut) through a stake in Indocement and Citra Marga Nusaphala Persada (CMNP), her toll-road company that operated the Jakarta inner city roads (Davidson 2010). In short, the presence of Chinese capital was too big to ignore, and it nurtured the network through which Soeharto patronized Chinese business in order to prioritize the overriding development focus on non-oil sectors.

The growth in trust between Soeharto and cukong has become invaluable social capital for both parties to pursue their respective interests. The value of this dyadic relationship should not be overlooked. Three decades of an indestructible patronage relationship that has weathered various political and economic headwinds has transformed the quality of the relationship from a material-oriented one into an interpersonal-based one. For example, in October 1990 Soeharto ordered Ginanjar Kartasasmita to dissolve a consortium of pribumi-owned companies led by the CNT group (which Kusumo Martoredjo, Agus Kartasasmita, Ponco Sutomo, and Wiwoho Basuki were part of) to build a joint petrochemical project with Mitsui and Toyo Engineering of Japan in Cilacap, Central Java (Schwarz 2000). Soeharto ordered Ginanjar to make Liem Sioe Liong and Prajogo Pangestu the principal domestic partners in big ticket projects. That decision was their payoff for having bailed out Bank Duta the month before (the bank was owned largely by charitable foundations headed by Soeharto). Between late 1988 and September 1990, it had reportedly lost $420 million in high-risk foreign exchange speculation (Kingsbury 2005; Matsumoto 2007). The two tycoons were believed to have put up ready cash to compensate for the foreign exchange losses of the bank, whose major owners were three foundations connected to the president. Pangestu was also believed to have paid for a monorail at the Taman Mini theme park, a pet project of Tien Soeharto (Ascher 1999; Borsuk and Chng 2014). The cukong had raised the expense of winning the president’s patronage by lavishing the first family with favors. Despite Ginanjar’s reluctance to obey the order, the deal was done, Liem and Pangestu became the domestic partners for Japanese companies, and the pribumi business lobby inevitably was devastated.

The nature of Soeharto-cukong ties has been somewhat upgraded to a more voluntary one. Chinese capitalists frequently helped Soeharto accomplish some of his national development goals, for example, by investing in sectors that private enterprise inherently avoided. For instance, the Salim Group invested in the Krakatau steel-making facility, which eventually went bankrupt (Lim and Stern 2003). This was viewed as Liem’s attempt to return Soeharto’s favor. Following the 1980s post-oil boom there was a recession in Indonesia, which slashed cement consumption; this affected Liem’s cement plants. To cover the severe losses, the government came to the rescue by merging Liem’s fie cement plants into a holding company, Indocement Tunggal Prakarsa. The government paid $325 million for a 35 percent share of the company, which accounted for 44 percent of the country’s cement capacity (Dieleman and Sachs 2008).

In sum, despite the growing inclusion of new actors such as pribumi entrepreneurs, the state-business relationship during the New Order was largely mundane. The patronage network centered on Soeharto, who held supreme authority to terminate deals, ink new concessions, as well as weaken opposition. No matter how large and powerful cukong became, they represented no political threat to Soeharto and thus were tacitly embedded into a “long-established social contract” with the leader. Economically powerful pribumi businessmen, on the other hand, could represent a threat and become a potent political faction. As Salim Said (2016, 21) argued: “Soeharto is like Stalin. First he eliminated the left, and then moved on to the rest of the political spectrum. Then he divided the Muslims and finally he turned on the minorities.” Nonetheless, the 1998 Asian Financial Crisis threw Soeharto a curveball and consequently created desperation among his protegees. For some in the optimist camp, the reform brought about a fair environment for the Indonesian political economy. For the critics, however, the aforementioned social contract was renewed and it restructured the state-business relationship amidst the extension of various forms of capital, as will be elucidated in the following section.

IV Democracy: A Political Arena Riven by Struggles over Capital Convertibility

The 1998 Asian Financial Crisis caused a paradigm shift in the well-connected Chinese business portfolio. Not only did the dramatic effects of the crisis enforce a restructuring of Chinese business, but even populist forces in the country demanded structural reform, such as liberalization and a reduction of the government’s role in the economy, since there was a growing perception that the crisis was the result of political failures, including overly close business-government relations (Suryadinata 2008). As such, one of the reform products, namely, democracy, was expected to establish a more arms-length relationship between business and government and reduce opportunities for favoritism and corruption (McLeod 2000; 2010). While democracy could have limited Chinese business’s flexibility in exerting the art of political dealing with ruling elites, what we got on the ground was divergent political and economic approaches with varying outcomes that did not point back to the initial mandate of democracy.

The nexus between business and politics, established within networks of patronage, has been showing signs of moving beyond its origins. The post-Soeharto political constellation has paved the way for diverse institutional structures that are complex and fragmented, if not contradictory (Heryanto and Hadiz 2005). It embodies diverse groups of newly incorporated politico-bureaucrats, subnational business groups and elites, and counter-elites, while reaffirming the position of old political elites (Robison and Hadiz 2004; Ford and Pepinsky 2014). Given the growing vested political interests of various actors, cukong’s economic capital cannot immediately be converted into wealth accumulation solely by virtue of the cukong’s relationship with certain power holders, as happened in the Soeharto era. Democracy instead opened up a new political arena where Chinese businesses came to mesh with various socio-political forces. This encouraged them to diversify their political opportunities beyond the patronage-ridden relationship as well as to convert their social, cultural, and economic capital based on scales and scopes of interest. That kind of political arena appeared to be less “discriminatory” than the one during Soeharto’s period. It gave various economic actors—new and old—greater flexibility to skillfully convert their capital and ultimately envisage a nuanced version of the state-business relationship. This section is divided into three parts that aim to examine three features of the new political arena through which old and new Chinese big business leveraged various forms of capital and restructured the state-business relationship.

(1) Restored Civil Rights and Politics of “Unity in Diversity”

While discussions about SARA3) were forbidden under Soeharto, during Gus Dur’s administration the nascent pluralism gained a distinct place in society, and civil rights for Indonesians of Chinese descent were restored (including the rights to use the Chinese language and establish political parties) (Lindsey 2005; Suryadinata 2008). It created a trickle-down effect, as the change in minority policies had a tremendous effect on all people categorized as Chinese—either mediocre Chinese or big players in business (Chua 2008). Political protections for the rights of ethnic Chinese simultaneously created social benefits for tycoons to leverage economic resources.

Chinese businesses—which were previously admitted as part of the elite within the crony system—have positioned themselves as rakyat4) who are socially responsible for the consolidation of democracy. For example, given that the issue of race and religion must have been discussed openly after reformasi, businesses have been extensively using the media to promote “unity in diversity.” Such a move was intended to prevent opposition forces from using ethnic clashes for political ends. When the Tempo journalist Harymurti was found guilty of naming the businessman Tomy Winata in a story that suggested Winata—who had strong ties to the military and Soeharto’s family—stood to benefit from a fire that destroyed a Jakarta textile market in 2003, not only did Winata’s supporters attack the Tempo offices, but Winata’s lawyers also filed a series of civil and criminal complaints against the magazine (Woodier 2009). In this way, Chinese businesses tended to see court trials as a legitimate weapon to curb the press as well as set back the opposition, instead of merely refusing to comment or relying on their patron to solve the problem as happened during the New Order era.

Under fire for having exploited Indonesian resources and created uneven development, Chinese businesses now attempt to position themselves with a more independent, open, and benign image. Starkly different from their previously demonized image of siphoning off funds to Soeharto’s yayasan (foundation), most Chinese businesses now set up their own foundation as part of CSR (corporate social responsibility) programs, acting as key stakeholders of Indonesia’s developmental trajectory with strong responsibilities toward the broader community. A myriad of activities and services, including scholarships, green economies, technical assistance, emergency relief, and so forth, can be publicly accessed. For example, the Sinarmas Foundation of Eka Tjipta Widjaja’s Sinarmas Group, Tanoto Foundation of Sukanto Tanoto’s Raja Emas Group, Arta Graha Peduli Foundation of Tomy Winata’s Artha Graha Group, and Bakti Barito Foundation of Prajogo Pangestu’s Barito Pacific are instrumental in showcasing the companies’ good business ethics to the people rather than their image of colluding with power holders.

Another unintended consequence is the establishment of non-party organizations. Ethnic-based parties and sociopolitical organizations were banned at the time Soeharto officially assumed power in 1966. Yet the 1998 riots and the effects of reformasi generated a greater ethnic and political consciousness among Indonesia’s ethnic Chinese. One significant turning point in the state-Chinese business relationship was the establishment of non-party organizations that are considered less contentious for Chinese capitalists to exercise their civil rights and gain a collective political position. These include Perhimpunan Indonesia Tionghoa (Chinese Indonesian Association), Panguyuban Sosial Marga Tionghua Indonesia (Indonesian Chinese Clan Social Association), and Perkumpulan Pengusaha Indonesia Tionghoa (Indonesian Chinese Entrepreneurs Association, Perpit), whose board of supervisors and members are mostly prominent tycoons (Soebagjo 2008; Suryadinata 2008; Setijadi 2016).

In fact, the organizations actively defended the enforcement of Indonesian civil rights (social capital) to parlay the affiliated companies’ economic capital, rather than engaging in purely cultural and philanthropic activities. The organizations’ practices brought more benefits to big business rather than pursuing the pure commitment of the country to guarantee civil rights to all levels of Chinese society. The organizations’ extensive activities included maintaining close relationships with different levels of government on behalf of the “non-party organization” and hosting many Chinese trade delegations that visited Indonesia, as well as conducting visits to cities and provincial areas in China (Setijadi 2016). More important, these organizations have become key instruments for Chinese businesses to expand their social capital by building networks with businessmen, regional government officials, and local chambers of commerce in China (ibid.; Suryadinata 2017). This also strengthens the organizations’ collective political position during decision-making processes.

Thus, unlike the informal “iron triangle” during the Soeharto era, the post-reformasi Kadin (Indonesian Chamber of Commerce) enabled Chinese business to ostensibly be involved in a legal institutional framework. Kadin has a close partnership with the government and has become influential in policy formulation. Chinese business’s authority is reflected through the organization’s structure. Based on an interview I conducted with a former Kadin staff member, the most defining policy is not issued by the chairperson (this position always goes to an indigenous businessman); instead, it is issued by vice chairpersons (WKU) who are divided into different specializations. Indeed, most strategic sectors are managed by prominent big businessmen who wield extensive know-how and capital. Kadin’s management structure in 2016 included five prominent cukong (mostly second-generation Chinese businessmen), among others: (1) James Riady (second generation of the Lippo Group) served as WKU Education and Health; (2) the agribusiness and forestry sectors were led by Franky O. Widjaja (second generation of Sinarmas); (3) the industry sector was led by John Darmawan (Astra); (4) Riady’s son-in-law, Dato Sri Tahir (founder, Mayapada Group), served as WKU Investment; and (5) Hendro Gondokusumo (Intiland Group, previously the Dharmala Group) held a position in the most lucrative sector: property. Meanwhile, the old players and some media-shy tycoons such as Anthony Salim and Prajogo Pangestu occupied the supervisory board (Muhammad Idris 2015). The board is the highest division from where financial support comes, given that Kadin is not subsidized by the state. The cukong’s active participation in Kadin projects a more benign public image. Compared to the informal discussions carried out at Cendana House in the past, the cukong’s presence in Kadin demonstrates transparency in the way the institutions they belong to work under democracy.

Not least important, in their pursuit of “unity in diversity,” Chinese businesses have also been engaging with Islamic groups, the new extra-political forces growing stronger since democracy. James Riady and Sofjan Wanandi repeatedly called for the business sector to engage with Muslim organizations in order to create a conducive atmosphere in Indonesia while fostering economic development. Speaking at the 2016 National Coordinating Meeting of Nahdlatul Ulama (NU), the largest Sunni Islam movement in Indonesia, Riady also acknowledged Lippo’s contribution in the development of the NU head office in Jakarta (Berita Satu, November 19, 2016). More interestingly, the Lippo group recently joined with NU to build Syubbhanul Waton Hospital in Magelang Regency, Central Java (Berita Satu, March 21, 2018). The spirit of pluralism is certainly welcome as it promotes inclusive and participatory development in advancing the health sector in Indonesia. Yet, politically speaking, the way the private sector engages with extra-political forces in this way somewhat illustrates a killing-two-birds-with-one-stone approach. On the one hand, the strategy is driven purely by economics to extend the hospital network into a Muslim-dominated region; on the other hand, it is aimed at accommodating the vested interests of emerging social forces that have considerable leverage in reshaping the Indonesian political economy.

Furthermore, Ahok’s blasphemy case during the re-election of the Jakarta governor in 2016 led business groups to indirectly forge further alliances with the influential Muslim group. The rise of Islam as part of “identity politics” is a double-edged sword for Chinese business (Williams 2017). Islam is a social force that on the one hand could push Indonesia toward a more pluralistic society and encourage civic engagement, but on the other hand it has the potential to be engineered as a political tool to promulgate a counter-hegemonic force against restored civil rights for ethnic Chinese. As has frequently been mentioned in recent political discussions, the verdict in Ahok’s case showed that there are invariably opportunistic politicians who continue to use religion to achieve their political goals and up the ante with the sensitive issue of ethnic Chinese.5) In hindsight, this kind of political dynamic has additional implications upon the Chinese business approach, in which Chinese capitalists skillfully capitalize on unity in diversity and put a great effort into dovetailing their social capital with the interests of emerging forces in a bid to keep their business operations separate from the public face of the pure-ethnic-Chinese business empire.

(2) Diversification of Political Power: Who’s the Horse, and Who’s the Jockey?

In an interview for a book about property developers, Ciputra, one of Indonesia’s top Chinese property developers, implicitly vindicated the symbiotic relationship between him and Jakarta’s then governor, Ali Sadikin, during the New Order period: “I have the philosophy that I am a horse and the jockey is the Jakarta governor. If I want to be used, I have to be a horse that’s good . . . A good horse will be used by any master” (cited in Harefa and Siadari 2006, 106). The entrenched privileges received by Chinese capitalists under the New Order are gone for good. The end of the monopoly of unlimited authoritarian power upended the well-established symbiotic arrangements between big business and the state. State power was much too fragmented, and thus it became impossible to have a single committee with all business, political, and bureaucratic interests in one basket (Chua 2008). In retrospect, the politically patronized Chinese business group are no longer dependent on Golkar, Soeharto, and powerful military groups.6) Who is the horse and who the jockey has become a blur.

Owing to decentralization, the forging of new alliances involving politico-bureaucratic elements has extended to the local level. Consequently, Indonesia’s political economy remains appropriated by state institutions and resources that are rife with political avarice and business interests. The system has unveiled a new trend of political ambitions. For example, small- and medium-scale businessmen who were either forcibly or voluntarily involved in graft to facilitate their business are now developing more lofty ambitions, such as expanding their business opportunities by seeking political office (Mietzner 2009). Likewise, some middle-level civil servants have been chasing after more than mere administrative power and are seeking to wield direct political power by contesting local elections. Bearing in mind how power has been reorganized and how more diverse players are involved in the game, most ethnic Chinese business representatives whom I talked to admitted that both old Chinese businesses and new Chinese businesses born after reformasi now must maintain many jockeys in various ways instead of acting only as a strong horse. Even they have in some way become jockeys for a specific horse.

By and large, varied approaches to playing the horse-and-jockey game are enmeshed in different scales of power and interest. Firstly, more inclusive and participatory political parties and parliaments (Dewan Perwakilan Rakyat) have become the main locus of political power and state institutions—in stark contrast to the pre-Soeharto era, when elites other than Golkar and Soeharto’s men were mainly ornamental (Hadiz 2003). While that kind of political constellation posed challenges to Chinese conglomerates, particularly those that were adept at relying on the central government, democracy has to some extent given business groups more options to accommodate powerful vested interests and their associated political parties. Some Chinese businessmen have even become visible parts of the interests. They have a broader political base and thus quickly convert their wealth power into political capital or vice versa.

Borrowing party dichotomies developed by T. Reuter (2015), the direct involvement of Chinese businesses in political parties can be categorized into two patterns. The first is partai milik pribadi, a party created for the purpose of serving as a political tool for a private individual who wants to gain power within the DPR or as president, or both. Examples are Gerindra, founded by Prabowo Subianto and his billionaire younger brother Hasyim; the National Democrat Party, founded by Metro Group media tycoon Surya Paloh; and the Hanura Party of the wealthy former General Wiranto and his media tycoon friend Hary Tanoesoedibjo. Hary has even established his own party, named Perindo, whose branch representatives are spreading across 80,000 villages in Indonesia (Baker and Salna 2018). Hary, the new Indonesian Chinese conglomerate that emerged after the financial crisis, has been rolling out a non-mainstream political approach that the low-profile Soeharto cukong would never undertake. Having his own political party, Hary has been flexibly accommodating political dynamics and widening the scope for political maneuvering to curry favor with proper coalition partners and stiffen his spine, particularly in the legislature. While he joined the Prabowo camp in the previous election in 2014 and provided the latter with powerful media forces to compete against Jokowi, he surprisingly threw his support behind Jokowi’s bid for re-election in 2019.

Another pattern of involvement in political parties is through sewa kendaraan or “renting vehicles.” In Indonesia, electoral campaigns are expensive as state subsidies for political parties have been reduced since 2009 by almost 90 percent (Mietzner 2009; 2013). Meanwhile, parties have to conduct expensive opinion surveys in order to identify their nominees for the elections, shelling out hundreds of billions of rupiah for consultants, opinion polls, and media advertisements (Rinakit 2005). One egregious example is that of the PDI-P campaign costs, which reportedly reached Rp 376.3 billion in 2009 while the party received only around Rp 1.5 billion in state subsidies at the national level (Mietzner 2015). Consequently, political parties have become highly “transactional” and rely upon donations from individuals or corporations. Based on the 2011 party law, parties can receive Rp 1 billion ($91,000) from individuals and up to Rp 7.5 billion from corporations every year (Mietzner 2007; Ufen 2008).

Against this background, in tandem with restored civil rights, some Indonesian Chinese business groups have openly “rented” an established party to accumulate both political and economic capital. For example, the National Awakening Party (PKB) appointed the prominent Chinese businessman Rusdi Kirana as its new deputy even though he was an outsider. Since then, the party’s political advertisements have regularly appeared on national TV with, of course, Rusdi’s face all over them. PKB Chairman Muhaimin Iskandar admitted: “Many Islamic parties, including the PKB, had been unable to compete with larger parties as they had no money to run massive political advertising campaigns ahead of this year’s elections” (Khoirul 2014). Meanwhile, taking advantage of the official recognition of civil rights for Chinese, Rusdi claimed that he had decided to enter politics because he wanted to preserve equal business opportunities (for all Indonesian people) as he had enjoyed during the post-reform era (Saragih 2014). Like Rusdi, a number of other businesspeople have claimed that their involvement in politics is driven primarily by social rather than economic motives (Christine Franciska 2014). Among them is Indonesia’s current trade minister, Enggartiasto Lukita. Enggartiasto, a well-known Chinese property developer as well as the commissioner general of PT Unicora Agung, jumped ship in 2013 from Golkar to the NasDem party, one of Jokowi’s coalition parties, and has been the head of foreign relations for NasDem since. He claimed that his objective in joining NasDem was not to seek a legislative seat but rather to implement a transformation of the Indonesian economy through the party (Aditya 2014). Indeed, his ultimate position as Indonesian trade minister, instead of a mere lawmaker of the party, carries a warning against creating sharp dichotomies between business and politics.

Another approach in horse-and-jockey games is splitting political loyalties to accommodate diverse pairs of political-bureaucratic relationships emerging outside the national realm. Decentralization has undoubtedly changed the structure of the national political economy as a result of constant power struggles among local elites and levels of government over control of natural resources and policy making (Hadiz 2003; Aspinall and Klinken 2010). Actors with different backgrounds and interests are vying for political leverage, but no one knows who will ultimately win given the spirit of democracy. Relatedly, business groups—regardless of whether they are Chinese or pribumi–owned—particularly those that do not rent or own political parties, like Rusdi and Hary, tend to divide their political loyalties into all-encompassing political blocs. For example, Chua (2008) vividly elaborates the “political network sharing” between the family and relatives of “old players.” In the case of the Wanandi family (Gemala Group), Sofjan favored Golkar and Jusuf Kalla, while his brother, Jusuf Wanandi—the founder of CSIS—tended to secure relationships with Megawati. In the case of the Riady family (Lippo Group), James Riady courted the actual power holders while his father, Mochtar, sided with the opposition leaders (Chua 2008, 126). In another example, it is an open secret that Tomy Winata is close to Megawati through his business connections with her late husband, Taufik Kiemas (Wessel 2005, 81), while he maintains strong ties with former President Yudhoyono through T. B. Silalahi, one of Yudhoyono’s closest associates, his key adviser, and former president commissioner of his Bank Artha Graha (Chua 2008, 126). Prior to the upcoming presidential election, the tycoon’s outmaneuvering of political loyalties has been too dynamic to capture. Speculation was rife that Tony endorsed the Jokowi-Ma’ruf pair after a photograph of the tycoon, holding a white shirt that read “Jokowi Amin 01 Indonesia Forward,” went viral on November 25, 2018 (Jakarta Post, November 27, 2018). Nevertheless, it is useful to remember an offensive point raised by Winata in an interview with Chua (2008, 76):

Up to now businessmen don’t want to be seen as supporting just one party . . . It will be the end for many businessmen who supported the wrong person. You cannot put all money on one horse, because the uncertainty of winning is too high. Beside this the president now changes at least every 10 years.

Amidst the growing number of political parties in Indonesia, many Chinese businesses hold tight to long-standing parties such as PDI-P and Golkar while simultaneously engaging with relatively young parties. Thanks to the legacy of the New Order, despite Soeharto’s fall, Golkar and its affiliates have not yet been left in the dust and are still significantly represented in the legislature. PDI-P, which has strong elements of a mass-based party and Megawati Soekarnoputri as a major drawcard for voters, has been dominating internal decision-making processes (Tomsa 2013, 33). Both parties have strong political bases in peripheral regions, especially in East and West Kalimantan, Sulawesi, and the central belt of Sumatra, where extractive industry projects are mainly located (ibid.; Simanjuntak 2014).

Rich businessmen do not have an issue with the growing necessity to donate money for elections (Mietzner 2015). Even though the bulk of campaign funds are referred to as donations, in fact they are investments of social capital aimed at yielding a bigger slice of the economic pie in the future. An ethnic Chinese businessman once told me in an interview that when funds are granted, tycoons normally expect that the politicians or elites with whom they co-allied will reward them with big projects should they win the election and have a hand in resource distribution. However, an electoral loss of a tycoon-backed candidate is not a zero-sum game. Given the unpredictability of politics, the candidate might win in other regional elections and thereby give the tycoon a return on his investment. In addition, having employed a diverse network of political support, Chinese businesses have political backup at different levels of government and interests.

The important role of Chinese in the development of the Indonesian real estate sector is a case in point. Benefiting from the rise of the Indonesian urban upper middle class, Chinese conglomerates have had property as one of their core businesses over the past decade. Among others, Tomy Winata’s Artha Graha Group, which pioneered Sudirman Central Business District development in Jakarta through its subsidiary PT Danayasa Arhatama, recently listed an additional 19 subsidiaries focusing on property and infrastructure (Indonesia Investment 2015). Chinese businessmen have acquired not only economic capital but also political connections at the local level. As local governments have greater discretion in matters of urban development, the tycoons have rapidly expanded their real estate business into both niche markets and residential markets in smaller provincial cities (Dieleman 2011; Arai 2015). Along the way, this has led to bribes in exchange for permits or for bypassing regulations. As M. Dieleman (2011, 77) wrote, based on her interviews with a former minister, “Developers bankroll the local elections by sponsoring candidates . . . If you are a rich developer, you can buy all the candidates, so that you are sure whoever wins is your man.” The arrest of Lippo Group executive Billy Sindoro, along with a government official from Bekasi Regency, in connection with the development of the Meikarta project in October 2018 illustrates the intensified political support Chinese businesses have built and maintained on an ongoing basis. Sindoro, consultants, and an employee allegedly bribed West Java’s Bekasi Regent, Neneng Hasanah Yasin, a total of Rp 13 billion ($855,613) in exchange for property and other permits for the planned Rp 278 trillion Meikarta project7)—the largest undertaking in Lippo’s 68-year history (Tani 2018).

Aside from positioning their capital in political fragmentation, Chinese businesses also took different approaches to accommodate diverse pairs of political-bureaucratic interests. To some extent, this replicated the practice of amakudari in Japan8)—the way business groups recruited former politico-bureaucrats based on their specialization and vital knowledge of the rules of the game and put the latter in the highest levels of management. During the mid-2000s, the upper management of the Lippo Group consisted of former Minister of Domestic Affairs Suryadi Sudirja, former Minister of State-Owned Enterprises Tanri Abeng, and former IBRA Deputy Farid Haryanto, who were co-opted as directors. Ginanjar Kartasasmita serves as deputy chairman of the Lippo Group, and Theo L. Sambuaga, the parliament member and former minister of public works and public housing, is the president commissioner of Lippo Karawaci Tbk—one of Lippo’s key real estate subsidiaries (Berita Satu, December 14, 2015). Indofood, the mainstay of the Salim Group’s business in Indonesia, has Bambang Subianto, the former minister of finance, as an independent commissioner (Reuters Finance 2018a). Obviously, Tomy Winata, who had strong connections with the military, appointed Kiki Syahnakri, the former vice head of the Indonesian Army, as the president commissioner rather than himself (Reuters Finance 2018b). In sum, the relations between horses and jockeys can be like playing chess at different tables. Each table represents a different set of elements with varying political arrangements, and the businessmen are required to deal with those different arrangements by converting their capital. They are aware of the consequences that the various arrangements might generate and are keen to skillfully capitalize on them.

(3) Privatizing Globalization, Socializing Nationalism

Democratization and globalization have contributed to the transformation of the national state as well as capital acting through it, whether Chinese or pribumi. The conflicting nature of those two events is apparent. On the one hand, the traditional principle of public interest in a globalizing market is that economic policy should protect and preserve competition as the most appropriate means of ensuring the efficient allocation of resources and protection of local industries. State technocrats and political elites, needing to maintain legitimacy in a democratic system, therefore tend to adopt national rhetoric and locally geared policies (Warburton 2017). On the other hand, the liberalization of state policies along with the global flow of capital has, to some extent, led to increasingly globalized circuits of capital accumulation that extend beyond the state’s control (Burnham 2006). Globalized circuits of capital accumulation tend to oppose protectionism and favor a regime of global free trade and investment. As such, what tends to happen is that outward-oriented, pro-globalization coalitions between businesses, politico-bureaucrats, and political parties become pitted against inward-oriented groups devoted to maintaining the status quo. An integral job of Chinese business is to accommodate both outward- and inward-oriented forces, which yield a myriad of opportunities as well as challenges.

Facing new challenges under popular mobilization and electoral politics, the government introduced a range of nationalist policies in the extractive sector—ranging from export bans to forced foreign divestments—in a bid to attract voters. For example, the enactment of Law No. 4/2009 under the Yudhoyono presidency fundamentally restructured the industry and reinstated the state’s authority to force companies to pay more tax, increase loyalty rate, and require foreign companies to divest their shares.9) More tellingly, in 2013 the Ministry of Energy and Mineral Resources introduced a new regulation that compelled oil and gas companies to use more local providers of goods and services. The following year, Yudhoyono went ahead and put a large number of oil and gas service sectors, including onshore drilling and piping and construction services, on the Negative Investment List so as to limit foreign shareholdings (Negara 2015; Warburton 2017).

Unlike Soeharto’s risk-averse policies regarding the mineral, coal, and energy industries, which gave priority to foreign investors, this wave of economic nationalism gave opportunities to Chinese tycoons to diversify their business portfolio. The early 2000s was also a time of low global coal prices, which allowed local businesses—including Chinese businesses—to acquire assets from foreign miners. For example, the Adaro Group, which is considered an “Astra reunion,” gained prominence as Indonesia’s largest coal company through acquisitions and foreign divestment deals (Erwide Maulia 2017). Among other divestment decisions, in 2016 BHP Billiton sold its 75 percent stake in the IndoMet project in East and Central Kalimantan to Adaro, as Indonesia’s regulatory framework was difficult for international companies to negotiate. Adaro, which previously acted as BHP Billiton’s joint venture partner and owned a 25 percent stake from 2010, now fully owned the coal-mining project (Reuters, June 7, 2016). One of Soeharto’s cukong, Prajogo Pangestu, also diversified his company into the mining sector. In 2012 Prajogo’s Barito Pacific signed $393 million to PT Thiess Contractors to develop coal mining in Central Kalimantan, Muara Teweh (Thiess website 2012). Eka Tjipta Widjaja gained a foothold in 38,165 hectares of coal mines in Jambi, South Kalimantan, and Central Kalimantan through Sinar Mas’s subsidiary Golden Energy Mines. The subsidiary also acquired shares of the British-owned coal investment company Asia Resource Minerals, which ultimately made it the major owner of Berau Coal Energy in East Kalimantan (Neil 2015; Warden 2015). While scrupulously focusing on its mainstream business, the Salim Group mobilized its subsidiary PT Adidaya Tangguh to manage coal and tin mining in Maluku. In March 2016 the Djarum Group, collaborating with the Wilmar Group of Martua Sitorus—a prominent Chinese Indonesian businessman—took over 95 percent of shares in PT Agincourt Resources, a gold-mining company in Martabe, North Sumatra, that was previously owned by G-Resources of Hong Kong (Kompas, December 7, 2015). A new player, the MNC Group belonging to Hary Tanosoedibyo—who seamlessly diversified his media empire—also acquired PT Nuansacipta Coal Investment, which focused mainly on coal mining (Didik Purwanto 2013). Economic nationalism yielded important resources necessary to back up Chinese economic capital, particularly in the extractive sectors that were restricted during the Soeharto era.

Despite the buoyant economic capital of Chinese business gaining traction on lucrative extractive projects, practices on the ground often reflect a varying pace and nature of capital convertibility. As mentioned in the previous section, by figuratively riding many horses, wealthy businessmen were able to have more diversified entry points to access the state actors, and hence to access licenses and contracts, which enabled them to expand their business empires (Warburton 2017). However, as the state became fragmented, the interests of business and different levels of government were not always easily aligned. As decentralization led to the substantially expanded power of local business and political elites, the line between business and politics at the local level became increasingly hazy. The social capital possessed by Chinese conglomerates has its limits, and there was thus somewhat of an impasse when it came to dealing with the increasingly chaotic power relations at the local level. It was not uncommon for local companies, owned by either pribumi or ethnic Chinese, to cash in on the rise of economic nationalism and convert their strong connections with local elites into economic capital (Choi 2012; Chong 2015). This recent development trend led to the rise of local capture, a condition under which local business elites capture or influence local economic and/or political institutions that constrain Jakarta-based Chinese conglomerates’ business expansion (Schulze and Sjahrir 2014).

For example, in the mining sector the IUP, a general license to conduct mining business activities in a designated area, is not issued by the central government; instead, the issuing authority depends upon the location of the mine infrastructure. If the mine infrastructure is located across more than one province, the IUP is issued by ministers. If a project is based in a regency or city, the mayor holds the authority to issue a license (PWC Indonesia 2016). No one knows for sure whether licenses inked at the national level will be honored by provincial or district authorities. In other words, city mayors—many of whom rise to power through money politics—have the power to issue and expunge licenses over hugely lucrative concessions. What follows is local capture. Many local political candidates who have personal connections with local businessmen or established politicians need support from local businesses. Once elected as local leaders, they repay the business elites in the form of contracts, projects, and even local policies. The most recent case involving the Salim Group vividly epitomizes the dynamics as well as the limits of Salim’s social capital in a particular area. The SILO Group, which is reportedly affiliated with the Salim Group and Agung Sedayu Group through its CEO, Effendy Tios, has held coal concessions on Laut Island in South Kalimantan since 2010. However, according to a report published by Tempo magazine (2018), the operation was circumscribed as the South Kalimantan governor, Shabirin Noor, revoked the license with the intention of handing it to his closest ally, Andi Syamsuddin Arsyad (known as Haji Isam), who ran oil-palm estates in the region. Reportedly, the mining licenses were sold to Haji before the regional head election was held. The ownership dispute has become complex as Haji is an important figure who has control over bureaucratic politics in South Kalimantan and enjoys the support of police officers. While the Salim Group, through its subsidiary Aetra Air, recently returned to the Jakarta water concession scene after almost 20 years (Jakarta Post, August 31, 2017), it seems that its capital convertibility in South Kalimantan is out of kilter.

Despite struggles over capital conversion in the mining sector, Chinese businesses have been forging the internationalization of their economic capital in a more innovative way. Their activities are no longer tied to centralized political power. Instead, new business trends they promote entail a rearticulation of economy and polity that supersedes cross-border mobility of capital. Old players, such as the Salim and Sinar Mas Groups, while often demonized as using “shadow companies” to hide their links to deforestation and unfair methods of concession (see AidEnvironment 2018), do a complete about-face publicly when it comes to the recent trend of industrialization, namely, the digital revolution. The big conglomerates portray themselves simply as entrepreneurs who have attained affluence and therefore have a responsibility to help others march toward the promotion of liberalization and globalization. Many of Soeharto’s cukong have become active in funnelling their capital toward digital services and venture capital to fund start-ups and early-stage companies that are believed to have long-term growth potential. The Lippo Group has made a noteworthy move through its sponsorship of Venturra Capital, which has $150 million to invest in start-ups in Indonesia, and Southeast Asia in general (Dion Bisara 2015). In a similar vein, Sinar Mas has been a key investor in Ardent Capital, a venture capital firm that has built e-commerce companies worth over $350 million throughout Southeast Asia and globally (Horwitz 2014). The richest conglomerate in Indonesia, the Djarum Group, also has its tentacles in tech investments through Global Digital Prima. Global Digital Prima has put money into many notable tech start-ups, ranging from digital communities, media, and commerce to solution companies such as Blibli.com, Gojek, Kaskus, Kumparan, and Merah Putih (Aruna Harjani 2012). This trend does not merely imply that Chinese businesses have staked a claim in the development of digital services. Rather, it demonstrates how they have been able to simultaneously shelter the expansion of their economic capital under the guise of economic nationalism and liberalization.

In sum, despite local constraints, democracy has led to the rolling out of economic and political ventures through which Chinese businesses have carved out varying degrees of capital conversion to suit their interests. Under such a complex, contradictory, and antagonistic interaction of capital and interests in the country, these businesses have skillfully appropriated political dynamics driven by both market and non-market discourses and practices and ultimately restructured the state-business relationship.

V Summary: Toward a Dispersed Network

An important point, as mentioned earlier, is that the state-Chinese business relationship is not static; it is driven by the varying pace and nature of capital conversion at the regional, national, and even international levels. The form of capital itself is varied—ranging from economic resources to social and cultural capital—and has waxed and waned over the years to eventually create a unique pattern of state-business ties. As such, democracy is not an end in itself but rather a new political space in which capital values are restructured and subsequently converted by various actors to suit their interests. Consequently, changes in the composition of interests and bargaining power of actors with varying degrees of capital at their disposal have redefined the state-business relationship.

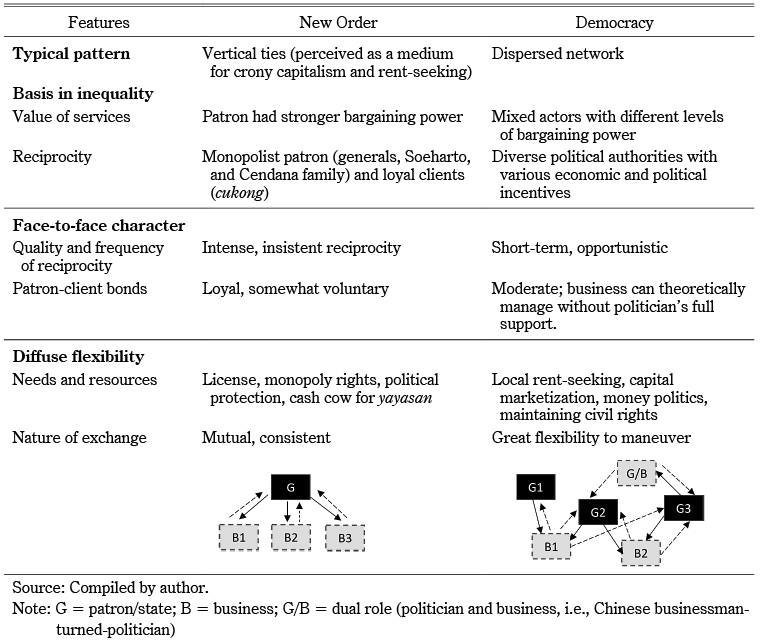

As summarized in Table 2, it is clear that three features of the state-business relationship have undergone a fundamental transformation. First, regarding the basis of equality, unlike during Soeharto’s administration, when Chinese businesses were more vulnerable than patronage-minded generals and politicians, democracy has strengthened the former’s bargaining power due to dramatic political shifts that have led to the dominance of the political sphere by business interests. A series of reforms, such as foreign divestment and restored civil rights, in turn, have created opportunities for Chinese business to harness an increased inflow of resources. Equally important, in terms of degree of reciprocity and value of services, the story is no more restricted only to monopolist patrons (prominent generals, Soeharto, and the Cendana family) that pledged monopoly rights and granted licenses to their well-connected cukong in return for favors in the form of company shares, funding for yayasan, or the bailing out of state-owned companies and helping Soeharto to accomplish certain unrealistic development plans. Democracy with the fragmentation of power has demonstrated that the president and military are not the nerve center of the state-business relationship; a wide range of “services” have been offered by mixed actors, including political parties, parliament members, and local authorities with bargaining power. To a greater extent, Chinese businesses even now can establish and manage their own political party.

Table 2 Mapping the State-Business Relationship

Second, in the realm of face-to-face character, it is apparent that the old patronage system has “higher qualities” of dependencies and loyalties than the recent one. Beyond the symbiotic relationship, somehow patronage brought a certain degree of volunteerism to the fore. The unbridled strong bond between Soeharto and his cukong showed that the roots of reciprocity were not simply limited to mutual advantage but were genuinely associated with a mutual devotion stemming from the enduring patron-client framework and shared values between both sides. In contrast, democracy downgraded the “qualities” of state-business ties. A series of unintended consequences deriving from democratic consolidation, such as liberalization, restored civil rights, and economic nationalism, have continuously created opportunities for cukong to gain a foothold in the political sphere. Thus, the bonds between Chinese business and the state seem more pragmatic and moderate. Additionally, given the capricious political environment, where nobody can predict who will be the next leader, the relationship lacks intensity as it is presumed to be short-term, dependent on how long the politician will be in office or how long a project will take.

The last feature of the relationship that has changed is flexibility. While a democratized Indonesia has witnessed a diversification of power, a decrease of military affiliations with politics, as well as the emergence of groups such as Islamic political parties and radical movements, Chinese businesses have skillfully managed to remain at the center of the diverse political constellation and minimize their political vulnerability. They wield influence in lucrative sectors of the economy and have significant shares in the media industry, which is a form of political capital required by politico-bureaucrats during their campaigns. As a result, they have greater space to maneuver in situations of either unpredictable political clout or contentious political choices.